5 Elements of a Smart Trade Plan

The decision to buy a stock usually comes down to a hunch that you can turn a profit. But markets are unpredictable, and a lot can happen on the journey from inspiration to success, which is why seasoned traders draft trade plans before putting any money on the line.

In short, a trade plan means setting parameters for getting into and out of trades, how much money you’re putting at risk, and a profit strategy. Think of it as tool for keeping a cool head as you build and reshape positions when markets are on the move.

It starts with a quick self-evaluation:

- What is the basis of your hunch? Are you looking at fundamental factors focused on company performance, or technical factors based on market trends and patterns in stock charts?

- Which investing style do you prefer? For example, are you looking for fast-moving growth stocks or underpriced value stocks? Are you trading a trend or a countertrend?

- What’s your view of market sentiment? Is momentum generally tilted up or down?

Once you have your bearings, and you’ve identified a list of stocks or exchange-traded funds (ETFs) suited to your preferred method of research—fundamental, technical, or both—you’re ready to draft a plan. Here are the five key elements to include:

Element 1: Your time horizon

How long do you plan to hold a stock? This will depend on your trading strategy. Generally, traders fit into one of three categories:

- Single-session traders are very active and look to gain from small price variations over very short time periods (minutes or hours) throughout the trading day.

- Swing traders target trades that can be completed in a few days to a few weeks.

- Position traders seek larger gains and recognize that it often takes longer than a few weeks to achieve them.

Element 2: Your entry strategy

Look for entry signals—for instance, divergences from trend lines and support levels—to help you place your trades. The signals you employ and the orders you use to make good on them hinge on your trading style and preferences.

Here’s an example of one moving outside a support or resistance level with increasing volume, also known as a breakout.

Is this stock poised for a breakout?

Source: StreetSmart Edge®

In the chart above, XYZ has just broken through a resistance level—the price where selling might be strong enough to prevent further price increases. With breakouts, consider limiting trades to stocks that have broken through resistance areas and where trading volume is above average, not just for the trading day but for the specific time of day.

A trader looking for an entry point could consider buying XYZ at slightly above the resistance level, in this case that could mean buying at $123. To help manage their risks in the event of a reversal, the trader could also place a stop order at $120. If the stock drops below $120, the stop order would become a market order to sell the stock. However, there’s no guarantee that execution of a stop order will be at or near the stop price, so risk is not entirely eliminated.

Here’s another example with a stock that is experiencing a pullback, meaning it has fallen from a recent peak. What we’re looking for here is a possible entry should the stock just be taking a temporary breather before rising again.

Has this stock pulled back?

Source: StreetSmart Edge®

Examples are hypothetical and for illustrative purposes only.

Start by looking for some area of support—a price level at which demand might be strong enough to prevent further declines—such as the stock pulling back to a moving average or an old low. Some traders even wait until the stock moves above the high of the previous day—a sign that the pullback might be over. In this case, XYZ is still trading above the support level of $30.50, so entering at $31 could make sense.

Element 3: Your exit plan

When it comes to an exit strategy, plan for two types of trades: those that go in your favor and those that don’t. You might be tempted to let favorable trades run, but don’t ignore opportunities to take some profits. For example, when a trade is going your way, you could consider selling part of your position at your initial target price and letting the rest of your position run.

To prepare for when a trade moves against you, you can set a stop order at a price below a support level to help manage your risk if the stock breaks below that level.

Element 4: Your position size

Trading is risky. A good trade plan establishes ground rules for how much you’re willing to risk on any single trade. Say, for example, you don’t want to risk losing more than 2%–3% of your account on a single trade. You could consider exercising portion control, or sizing positions, to fit your budget.

Here’s a scenario: A trader with $150,000 in total capital is interested in a stock trading at $67 a share. The trader could set a maximum budget per trade of 10% of the account, or $15,000. That means the maximum number of shares the trader can buy is 223 ($15,000 ÷ $67).

Let’s also imagine the trader doesn’t want to lose more than $3,000 of their $150,000 on this trade. If we divide that amount by 223 shares, that means the trader can tolerate a drop of $13.45 per share ($3,000 ÷ 223). Subtracting that amount from the stock’s current price, gives the trader a target stop price of $53.55 ($67 – $13.45). The trader may never have to use this stop order, but at least it’s in place if the trade moves the wrong way.

Element 5: Your trade performance

Are you making or losing money with your trades? And, most importantly, do you understand why?

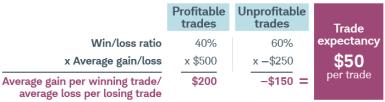

Look over your trading history to calculate your theoretical trade expectancy, meaning your average gain (or loss) per trade. You start by determining the percentage of your trades that have been profitable versus those that haven’t. This is known as your win/loss ratio. Next, compute your average gain for profitable trades and average loss for unprofitable trades. Then, you multiply them. That gives you average gain per winning trade and average loss per loser. Subtract the latter from the former to determine your trade expectancy. Here’s an example of how that might look:

How profitable are your trades?

A positive trade expectancy indicates that, overall, your trading was profitable. If your trade expectancy is negative, it’s probably time to review your exit criteria for trades.

The final step is to look at your individual trades and try to identify trends. Technical traders can review moving averages, for example, and see whether some were more profitable than others when used for setting stop orders (e.g., 20-day versus 50-day).

Sticking to it

Even with a solid trade plan, emotions can knock you off course. This is particularly true when a trade goes your way. Being on the winning side of a single trade is great, but far better is to score a series of them. Understanding what goes into a smart trade plan is the first step to prepare you for your next trade.

What You Can Do Next

Learn more trading strategies from our experts.

Find out more about fractional shares.

By

By