Weekly Trader's Outlook

Follow me on Twitter @RandyAFrederick. I'll tweet interesting observations about volatility, put/call ratios, technical signals, economics, option block trades and other unusual activity.

Weekly Market Review

Earnings Summary

The regular Q4 earnings season is over and Q1 earnings season won't begin for about another 4 weeks. However, since not all companies follow a regular calendar quarter, this week 4 S&P 500 companies reported earnings and 2 of them beat consensus EPS expectations. A detailed earnings calendar can be found by logging into Schwab.com and selecting Research>Calendar>Earnings.

Overall, 0 (0%) of companies in the S&P 500 have reported Q1 results so far. Below are the aggregate beat rates relative to the final results from recent quarters. I'll begin reporting this data as soon as Q1 is over.

|

Quarter |

EPS beats |

Rev beats |

|

Q1 '23 |

0% |

0% |

|

Q4 '22 |

70% |

58% |

|

Q3 '22 |

69% |

59% |

|

Q2 '22 |

75% |

63% |

|

Q1 '22 |

76% |

67% |

|

Q4 '21 |

76% |

69% |

|

Q3 '21 |

82% |

68% |

|

Q2 '21 |

86% |

83% |

|

Q1 '21 |

87% |

72% |

|

Q4 '20 |

78% |

69% |

|

Q3 '20 |

84% |

74% |

|

Q2 '20 |

85% |

65% |

|

Q1 '20 |

65% |

59% |

|

Average |

80% |

70% |

From a growth standpoint, Q4 earnings were -2.9% y/o/y versus a -4.1% estimate when Q4 ended. Q4 revenues were +5.6% y/o/y versus a +3.8% estimate when Q4 ended. This compares to final growth rates of +3.8% and +11.5% respectively in Q3.

Economics Recap

Better (or higher) than expected

- NFIB Small Business Optimism Index for Feb: 90.9 vs. 90.3 est

- NAHB Housing Market Index for Mar: 44 vs. 40 est

- Producer Price Index (PPI) for Feb: -0.1% vs. +0.3% est

- Core PPI for Feb: 0.0% vs. +0.4% est

- Initial (weekly) Jobless Claims: 192k vs. 205k est

- Export Prices for Feb: +0.2% vs. -0.3% est

- Housing Starts for Feb: 1,450k vs. 1,310k est

- Building Permits for Feb: 1,524k vs. 1,343k est

- Leading Economic Indicators for Feb: -0.3% vs. -0.4% est

On Target

- Consumer Price Index (CPI) for Feb: +0.4% vs. +0.4% est

- Retail Sales for Feb: -0.4% vs. -0.4% est

Worse (or lower) than expected

- Core CPI for Feb: +0.5% vs. +0.4% est

- Business Inventories for Jan: -0.1% vs. 0.0% est

- Import Prices for Feb: -0.1% vs. -0.2% est

- Industrial Production for Feb: 0.0% vs. +0.2% est

- Capacity Utilization for Feb: 78.0% vs. 78.4% est

- University of Michigan Consumer Sentiment (Prelim) for Mar: 63.4 vs. 66.0 est

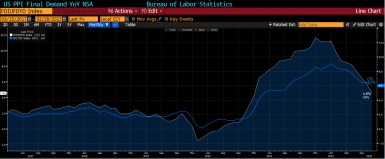

This was a heavy week for economic data and it included two key inflation reports; the Consumer Price Index (CPI) and the Producer Price Index (PPI). At +6.0%, the headline February y/o/y change in the CPI eased from +6.4% in January, and it came in exactly as expected.

At +4.6%, the headline February y/o/y PPI also eased from +6.0% in January, and it came in well below the +5.4% estimate. While historically the CPI tends to move markets more than the PPI, this time both of them have been overshadowed by investor anxiety over the banking sector, so it's likely that neither had much influence. As you can see below, while still above the Fed's 2% target, the y/o/y CPI (blue line) and the y/o/y PPI (white line) have both been steadily falling since June of last year.

Source: Bloomberg L.P.

Past performance is no guarantee of future results.

Market Performance YTD

While 2022 was very defensive, with the exception of the Financial sector, 2023 continues to be quite cyclical in nature. Here is the 2023 YTD (versus 2022 full-year) performance of the market broken down by the 11 market sectors (as of the close on 3/16/22):

|

|

2023 YTD |

2022 Final |

Category |

|

1. Info Tech |

+15.3% |

-28.9% |

Cyclical |

|

2. Communications Svc |

+15.1% |

-40.4% |

Cyclical |

|

3. Consumer Disc |

+10.5% |

-37.6% |

Cyclical |

|

4. Industrials |

-0.3% |

-7.1% |

Cyclical |

|

5. Real Estate |

-0.4% |

-28.5% |

Cyclical |

|

6. Materials |

-1.7% |

-14.1% |

Cyclical |

|

7. Cons Staples |

-3.1% |

-3.2% |

Defensive |

|

8. Utilities |

-4.8% |

-1.4% |

Defensive |

|

9. Healthcare |

-6.7% |

-3.6% |

Defensive |

|

10. Financials |

-7.0% |

-12.4% |

Cyclical |

|

11. Energy |

-11.7% |

+59.0% |

Defensive |

Source: Bloomberg L.P.

Past performance is no guarantee of future results.

Here is the 2023 YTD (versus 2022 full-year) performance of the major U.S. equity indices (as of the close on 3/16/22):

|

|

2023 YTD |

2022 Final |

Forward P/E Ratio / ∆ |

|

S&P 500 (SPX) |

+3.1% |

-19.4% |

18.0 / +0.4 |

|

Nasdaq Composite (COMPX) |

+11.9% |

-33.1% |

26.1 / +1.1 |

|

Dow Industrials (DJI) |

-2.7% |

-8.8% |

16.5 / +0.1 |

|

Russell 2000 (RUT) |

+0.6% |

-21.6% |

22.9 / -0.0 |

Source: Bloomberg L.P.

Past performance is no guarantee of future results.

Technicals

With all the turmoil in the banking sector and the resulting treasury market volatility, it did not feel like a strong week for equity markets. However, with the SPX +98.69 points (+2.6%) through Thursday (3/16) it was. And even with the SPX down more than 35 points as I'm writing this (mid-day Friday 3/17), it seems likely to remain positive for the week.

As you can see below, the SPX remains below the 50-day SMA (currently 4,007) and is struggling to get back above the 100-day SMA (currently 3,955) and the 200-day SMA (currently 3,936). The current bear market low (3,577) from last October is about 9% below, and the start of a new bull market (4,292) is about 9% above current SPX levels.

Source: StreetSmart Edge®

Past performance is no guarantee of future results.

Option Volumes

At mid-month, March option volumes are averaging a potentially record-setting 48.0M contracts per day. That is above the final February level of 46.7M, and far above the March 2022 level of 41.0M. As a reminder, last month (February 2023) set a new all-time monthly record at 46.7M contracts per day.

Open Interest (OI) Change

The following data comes from the Chicago Board Options Exchange (Cboe) where about 98% of all index options, about 20% of all Exchange Traded Product (ETP) options, and about 15% of all equity options are traded:

In reviewing the VIX OI Change for the past week I observed the following:

- VIX call OI was +2.3%

- VIX put OI was +19.4%

Historically, the daily change in the VIX and the SPX have been opposite each other about 80% of the time. These changes reflect a sharp bias toward the put side, so I see the VIX OI Change as bullish for the market in the near-term.

In reviewing the SPX OI Change for the past week I observed the following:

- SPX call OI was +8.0%

- SPX put OI was +4.3%

While SPX volume tends to be mostly institutional hedging, these changes reflect a small bias toward the call side, so I see the SPX OI Change as moderately bullish for the market in the near-term.

In reviewing the ETP OI change (which includes SPY, QQQ, DIA, IWM, etc.) for the past week I observed the following:

- ETP call OI was +6.2%

- ETP put OI was +4.3%

The aggregate changes in Exchange Traded Products options reflect a small bias toward the call side, so I see the ETP OI Change as moderately bullish for the market in the near-term.

In reviewing the Equity OI Change for the past week I observed the following:

- Equity call OI was +3.3%

- Equity put OI was +3.4%

Equity volume tends to have a large retail component to it. These changes reflect an insignificant bias toward the put side, so I see the Equity OI Change as neutral for the market in the near-term.

Open Interest Participation

Index OI Participation is +28.0% versus 2022 levels, so I see it as bullish in the long-term.

Equity/ETF OI Participation is +3.7% versus 2022 levels, so I see it as neutral in the long-term.

Open Interest Put/Call Ratios (OIPCR)

The VIX OIPCR is up 6 ticks to 0.35 versus 0.29 last week. Since this ratio tends to move in the same direction as the VIX index, this sizable uptick is rather inconsistent with the VIX which was -1.81 points (-7.3%) over the last 4 sessions. Thus, it probably implies that traders feel the VIX is likely to tick down in the near-term. Therefore, I see the VIX OIPCR as bullish in the very near-term for the markets. This ratio is still little changed YTD, and it is now equal to the 200-day SMA of 0.35. Therefore, I see it as neutral in the long-term for the markets.

The SPX OIPCR is up 1 tick to 1.85 versus 1.84 last week. This ratio tends to move in the same direction as the SPX, so this increase is consistent with the SPX which was +98.69 points (+2.6%) over the last 4 sessions. As a result, it implies that SPX option traders (who are almost entirely institutional) have slightly increased their hedges this week and probably believe the SPX has little upside potential in the near-term. Therefore, I see the SPX OIPCR as neutral in the near-term for the market. This ratio has risen for the past 2 weeks now, and it remains well above the 200-day SMA of 1.73. I see it as moderately bearish in the long-term.

The normally very stable Equity OIPCR is unchanged at 0.92 versus 0.92 last week. This ratio remains well above the yearly low of 0.76 reached in mid-December, and it is only one tick below the 2-year high it reached in February. At this level it implies that equity option traders (which includes a lot of retail traders) remain very cautious (or even bearish) in the near-term. However, retail investors tend to be wrong in the short-term, and this particular ratio does have a contrarian history in the short-term. Therefore, I see the Equity OIPCR as moderately bullish in the near-term for the market. This ratio remains well above the 200-day SMA (currently 0.84), so I see it as moderately bearish in the long-term.

Cboe Volume Put/Call Ratios (VPCR)

The Cboe VIX VPCR has been neutral (0.90>0.40) all week. The 0.73 level on Thursday (3/16) was neutral and the current reading of 0.82 as I'm writing this (mid-day Friday 3/17) is neutral. Therefore, I see the Cboe VIX VPCR as neutral in the very near-term.

The Cboe SPX VPCR has moved from neutral (1.60>1.30) to moderately bullish (<1.30) this week. The 1.24 reading on Thursday (3/16) was moderately bullish, but the current reading of 1.59 as I'm writing this (mid-day Friday 3/17) is neutral. While intraday levels tend to decline as the day goes on, I see it as neutral in the very near-term. With a 5-day moving average of 1.49 versus 1.47 last week, it is neutral in the long-term.

The Cboe Equity VPCR has moved from moderately bearish (>0.73) to neutral (0.73>0.60) this week. The 0.66 reading on Thursday (3/16) was neutral but the current reading of 0.76 as I'm writing this (mid-day Friday 3/17) is moderately bearish. While intraday levels tend to decline as the day goes on, I see it as moderately bearish in the very near-term. With a 5-day moving average of 0.82 versus 0.81 last week, it is still moderately bearish in the long-term.

Since volume based put/call ratios are very reactive and very short-term in nature, near-term usually means just a day or two, while long-term is more like a week or two.

OCC Volume Put/Call Ratios (VPCR)

The OCC Index VPCR has been mostly moderately bearish (>1.10) this week. As a result, I see it as moderately bearish in the near-term. However, it has been more neutral than anything over the past 3 weeks, so I see it as neutral in the long-term.

The OCC Equity VPCR has moved from a bearish extreme (>1.00); which is bullish, to moderately bearish (0.95>0.85). As a result, I see it as moderately bearish in the very near-term. With a 5-day average of 1.11 versus 1.11 last week and with readings >1.00 for 7 consecutive sessions, I see it as still volatile in the long-term.

Volatility

Cboe Volatility Index (VIX)

After studying and analyzing the VIX for the past 30 years, I have found that it generally falls into the following 4 zones:

- Above 40 – Panic Zone

- 30 to 40 – High Anxiety Zone

- 20 to 30 – Elevated Uncertainty Zone

- Below 20 – Normal Zone

This is still the only bear market in which the VIX has not (yet) touched or closed in Zone 4.

At the time of this writing (mid-day Friday 3/17), the VIX is +1.56 to 24.55. That is in the middle of Zone 2 and it illustrates that worries over the stability of the banking sector continue to cause a fair amount of uncertainty in the markets.

At its current level, the VIX is implying intraday moves in the SPX of about 50 points per day (this was 51 last week). The 20-day historical volatility is 127% this week versus 107% last week. The VIX is now back at levels not seen since November of last year. It is above its long-term average (19.74) and well above its long-term mode (12.42) which is the most common level of volatility.

With a top-to-bottom range this week of 8.54 points, day-to-day volatility has been substantial. At this level I see the VIX as volatile in the very near-term for the equity markets. At the time of this writing (mid-day Friday 3/17) the VIX is about 6 points below its weekly high, but still well above any level reached in the first two months of this year. I see it as moderately bearish in the long-term.

On a week-over-week basis, VIX call prices have risen modestly while VIX put prices have held steady. As a result, at -58 versus -75 last week, the VIX IV Gap (the average IV of VIX calls less the average IV of VIX puts) is lower, and when the gap is negative it has historically been bullish in the very near-term. Over the past 3 weeks, VIX call prices and VIX put prices have both trended modestly higher. At the moment I see the VIX IV Gap as volatile in the long-term.

Keep in mind, this is not only a contrarian indicator most of the time, it tends to be one of the earliest and shortest-term indicators I discuss in this report, so it can also change directions very quickly.

VIX Futures

At the time of this writing (mid-day Friday 3/17) the nearest VIX futures contract (which expires on 3/22) was trading at 24.80; only a quarter point above the spot VIX level of 24.55. Adjusting this price for the risk premium factor (which takes into account the time until expiration), the Risk Premium Adjusted Price (RPAP) is 24.40; just below the spot price.

With an adjusted level that is very close to the spot price, futures traders are indicating that they believe the VIX is likely to remain about where it is over the next few days. Therefore, I see VIX futures as neutral in the near-term for the market. The RPAPs of the next two closest monthly futures contracts are 23.21 and 22.03 respectively. With the RPAPs of the further-dated contracts both more than a point below the spot VIX, I see VIX futures as moderately bullish in the long-term for the SPX.

Since VIX futures are typically much less reactive to current market conditions than the VIX index, near-term for VIX futures usually means a few days, while long-term means a couple of weeks.

As the VIX itself has been highly volatile this week, the VIX Hedging Effectiveness has been Very Good in the near-term. At the moment, this means that options on the VIX (and possibly other volatility-related products) are showing strong sensitivity to market volatility, and should be effective as hedging tools in the very near-term. VIX Hedging Effectiveness is Good in the long-term.

VIX Hedging Effectiveness is a manner of measuring the magnitude of VIX moves relative to the magnitude of SPX moves in the opposite direction. When the VIX is highly reactive, VIX related products can serve as potentially effective hedging tools, when the VIX is not very reactive, traditional hedging techniques may be a better choice.

Cryptocurrencies

Silvergate Capital (SI), which was one of the largest crypto-focused lenders, voluntarily ceased operations on Wednesday (3/8) but debate over the reasons for its ultimate demise continue. As I reported here two weeks ago, Silvergate lost over $1B in Q4 when its customers quickly pulled out nearly two thirds of total deposits following the FTX implosion. Now, some experts are saying its downfall was not because of any problems with the cryptocurrency industry directly, rather due to most of its customers being too concentrated in one industry (crypto) and being forced to sell (mostly low-risk treasury) assets at a loss to meet withdrawal demands.

If you've been following the more recent implosion of Silicon Valley Bank (SIVB) most experts are saying the same thing. The only difference is that most of SIVB's customers were in the technology industry. Similar to SI, while there weren't any real problems in the technology industry directly, when a crisis of confidence was sparked by a few venture capital firms, too many customers tried to withdraw too much money, too fast, forcing SIVB to sell (mostly low-risk treasury) assets at a loss. It wasn't the specific industry these banks delt in, it was that their client base wasn't diversified enough.

For Schwab's perspective on cryptocurrencies, please visit: www.schwab.com/cryptocurrency

Economic reports for next week

Mon 3/20

None

Tue 3/21

Existing Home Sales for Feb – This is a good measure of overall demand in the housing market, because it aggregates completed closings on all single-family dwellings, which comprise the largest portion of the housing market. Home buying can imply economic stability, since it is often the largest single investment for any family. It can also lead trends in future durable goods purchases.

Wed 3/22

FOMC Rate Decision – Regularly scheduled Federal Open Market Committee meeting, after which interest rate changes are usually announced. The meetings are usually followed by a press conference with the Chairman of the Federal Reserve.

Thu 3/23

Initial Jobless Claims - For the week ending 3/11/23, claims were down 20k after being up 22k the prior week. The 4-week moving average now stands at 197k, unchanged from 197k the prior week.

New Home Sales for Feb – This report measures sales activity of newly constructed homes and other single-family dwellings, and is generally considered less important than building permits since it is more of a trailing report.

Fri 3/24

Durable Goods Orders for Feb – This is a key measure of consumer and industrial spending trends and it may cause market swings if it misses estimates.

Interest Rates

This has been a very volatile week in the Treasury markets. After hitting 4.09% earlier this month, the interest rate on the 10-year U.S. treasury ($TNX) began the week around 3.50% increased to 3.68% by mid-week, and is currently around 3.38% at the time of this writing (mid-day Friday 3/17); very close to a 30-day low.

This has also been a volatile week with regard to the probability of the next interest rate hike. As you can see below, as recently as last week Thursday (3/9) there was a 75% chance that the interest rate hike on 3/22 would be +0.50%. By Wednesday (3/15) there was only a 37% chance of any rate hike at all. As I'm writing this (mid-day Friday 3/17) there is now a 78% chance of a +0.25% hike.

As I've mentioned many times, for the 8 years in which this data is available, whenever the probability has exceeded 65% just before a Fed meeting, a rate hike (or cut) has occurred.

Source: Bloomberg L.P.

Past performance is no guarantee of future results.

Outlook

Banking sector uncertainties and interest rate changes imply more volatility to come, even though markets may continue to trend very modestly higher overall.

Bottom Line

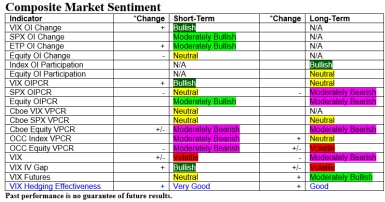

With Q1 earnings season still about a month away and a relatively light economic calendar next week, market movements are likely to remain driven by banking sector uncertainties, treasury markets and Fed policy, especially with a rate hike likely on Wednesday (3/22). As you can see below, there were slightly more upgrades than downgrades this week but there is also a lot of disagreement and a few volatile indications. With all of these factors in mind, the indicators seem to be pointing to a possible Moderately Bullish move in the early part of the week, while also implying that markets will remain Volatile overall.

Key:

OI = Open Interest

OIPCR = Open Interest Put/Call Ratio

VPCR = Volume Put/Call Ratio

IV = Implied Volatility

+ means this indicator has changed in a bullish direction from the prior posting.

– means this indicator has changed in a bearish direction from the prior posting.

+/ – means this indicator has changed bi-directionally; i.e. last week was either Volatile, N/A or Breakout.

^ means this indicator is at a historical extreme that has often (though not always) preceded a market reversal.

Except as noted in certain sections, Short-Term implies about a week, and Long-Term implies about a month.

Issue Number: 682

By

By