The Appeal of Buyback Stocks

You don’t need to be a finance expert to understand the logic behind stock buybacks. When a company repurchases its shares from investors, it reduces the available supply, thereby increasing both the relative value of each share and the earnings per share.

Buybacks were one of the drivers of the remarkable 11-year bull run that followed the Great Recession, adding an estimated $4 trillion to the stock market between early 2009 and early 2020. Many companies suspended buybacks during the early months of the COVID-19 pandemic in order to conserve cash, but share repurchases in both the U.S. and Europe have been making a strong return in 2021 as the economic recovery accelerates.

Could buybacks offer the same kind of lift to the stock market that they did after the last recession? Let’s take a closer look at recent buyback performance in the U.S. and Europe, as well as what to watch out for when assessing investments for your portfolio.

The buyback boost

When companies repurchase their own shares, it may signal to investors a confidence in cash flow and strategic direction—and that often translates into stronger returns. From February 2010 through December 2014, for example, the stocks of U.S. companies that bought back their shares returned an impressive 149%, whereas the S&P 500® Index returned 93%. In Europe, the difference was even more staggering: Buyback stocks returned 120%, whereas the STOXX Europe 600 Index returned just 35%.

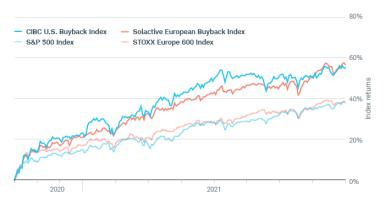

We’re seeing similar differentials during the current recovery. From November 2020 through August 2021, U.S. buyback stocks returned 55% versus the S&P 500’s 38%; in Europe, buyback stocks returned 56% versus the STOXX 600’s 38% (see “The buyback advantage,” below).

What’s more, companies on both sides of the Atlantic appear well positioned to maintain the current pace of buybacks well into next year—barring further setbacks in the fight against COVID-19 or a significant slowdown in economic activity—for three reasons:

- Companies are sitting on cash: Publicly traded companies in the U.S. and Europe were sitting on nearly $2.9 trillion earlier this year. As a result, businesses have plenty of leeway to buy back their shares even as they invest in their businesses to meet demand and address supply bottlenecks.

- Earnings are strong: S&P 500 companies grew their earnings 96% year over year through the second quarter of 2021. Companies fared even better in Europe, where earnings grew 153% during the same period.

- Stimulus is ongoing: There’s some government funding still in the pipelines in both the U.S. and Europe, which should provide further support for cash flows and earnings.

Before you buy

Whether a company you own recently announced a plan to repurchase shares or you’re looking to buy the buyback trend, consider some important questions:

- Does the company have strong fundamentals? Businesses should be investing in their futures at adequate levels—otherwise, they could be using buybacks to mask weakening fundamentals and keep their share prices afloat. For example, high-growth companies in the technology sector generally should be redeploying cash into operations, where they can earn a higher return and remain competitive. If they’re instead repurchasing shares, it could be cause for concern.

- Is the company likely to follow through? Companies sometimes announce a buyback but then fail to fulfill it, whether in whole or in part. Often this happens when new priorities arise or a crisis hits. Generally speaking, companies with a long-term history of share repurchases are more likely to follow through on them.

- Is the company issuing new shares? Companies can simultaneously repurchase their shares and issue new ones, which sometimes happens when executives exercise their stock options. This dilutes the benefit of the buyback program, since the shares outstanding may not decline at all, and could even rise depending on the pace of buying and issuing. You can check for net declines or increases in a company’s shares outstanding on its balance sheet at the close of each quarter.

If researching individual stocks feels daunting, or if you want to reduce the influence a single buyback stock has on your portfolio, you might consider buyback-focused exchange-traded funds or mutual funds. Adding a fund focused on U.S. buybacks and another focused abroad will help spread your risk and reduce your exposure to single sectors and markets.

What You Can Do Next

Schwab clients can screen for buyback-focused funds by logging in to the ETF screener or fund screener and selecting Basic Criteria, then Fund Name or Search By Name, and typing “buyback” in the search box.

By

By