Making Sense of Your Tax Refund

Some taxpayers’ refunds may look a little different this year due to federal relief efforts included in the American Rescue Plan Act of 2021.

We’ll address some of those changes here and explain how they could affect your filing.

Tax refunds (or bills) depend on your withholding

Uncle Sam withholds a portion of every paycheck to cover your tax obligation for the year. In a perfect world, you’d know exactly what that obligation was and could withhold accordingly. As a result, you’d never be owed a refund or receive a surprise bill after preparing your tax return.

In the real world, however, calculating your tax obligation in advance is difficult because your income might change or you may want to claim certain deductions. That’s why most people either receive a refund or have to pay a bit extra when they file.

Neither is a judgment about your finances. A refund just means you withheld too much from your paycheck, while an addition tax liability means you didn’t withhold enough.

What’s in a refund?

As exciting as refunds are, they’re really just the federal government returning the extra amount you paid. While some people prefer to receive a large refund at tax time, there may be better ways to save money. In fact, when you withhold too much, you’re effectively giving the government an interest-free loan: The government gets to use your money, and then returns it to you without any compensation—not a great investment.

We generally recommend doing a bit of advance tax planning and then finetuning your withholding so you’re paying just enough to cover your tax bill. (If you don’t withhold enough, you may face penalties.) The upshot would be having more money that you could invest for a return or spend as needed, without having to wait for a refund the following spring.

What’s your actual tax liability?

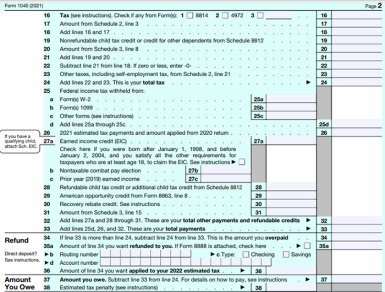

The following information from the Form 1040, which you use to file your taxes each year, will help you determine your tax liability—and whether you’ll get a refund or end up owing more:

- Line 24: The total tax due is what you owe in taxes for the year

- Line 25d: Income tax withheld is the total amount withheld from your income

Is the number on Line 25d larger than the number on Line 24? If so, that means you withheld too much. Go to:

- Line 34: This is your refund

Or is Line 24 larger? If so, you didn’t withhold enough. Go to:

- Line 37: This is the amount you owe

Image of Form 1040 for 2021

Source: IRS Form 1040 for 2021.

Why did my refund (or tax due) change so much this year?

If any of the numbers above differ significantly from what you’ve come to expect from previous years’ filings, there may be good reasons. As mentioned above, the American Rescue Plan Act introduced a few potential wrinkles.

In 2021, Congress increased the child tax credit to $3,600 for each child under age 6 and $3,000 per qualifying child between the ages of 6 to 17 years old, from $2,000 the year before. In addition, Congress authorized advance monthly payments for up to 50% of the credit from July through December last year. Eligibility for these payments was based on taxpayers’ 2020 or 2019 filings and started to phase out at incomes above $150,000 for married couples filing jointly (or $75,000 for single filers).

This change could affect your filing in a few ways. For example, if you’re accustomed to claiming the full child tax credit when you file but received advance payments in 2021, it’s possible your refund will be smaller than in previous years (or the amount you owe higher) simply because you received part of the credit in advance, despite Congress having raised the size of the credit.

Also, if you received advance payments, the IRS would have recorded the amount in Letter 6419, which you should have received in January. You will need this information when you file your taxes. If you’re eligible for the full child tax credit, you will receive the remaining amount when you file your return. If you were eligible for the increased child tax credit based on your prior tax return but didn’t get the advance payments, you can claim the full amount when you file your taxes.

However, if your income in 2021 was significantly higher than in your prior tax return, it’s possible you might have received advance payments for which you were no longer eligible. Depending on your income, you could end up having to repay some or all the advance credit you received.

How to prepare for next year

If you want a larger refund next year (again, not recommended, in our opinion), you can update your Form W-4 to change how much is withheld from your paychecks. We recommend checking how much is being withheld from your paycheck once or twice a year to make sure you’re on target. For help determining the amount that should be withheld, use the IRS’s calculator or meet with a tax professional.

What You Can Do Next

Learn about tax-smart strategies. Go to our tax planning guide.

By

By