Red Flag Day: Bond Yield Spike Denting Euphoric Sentiment

Key Points

Investor sentiment measures recently hit historic extremes of optimism and speculative excess; but until recently, strong market breadth served as an offset.

The fundamental catalyst for what has been a volatile “reset” of some valuation extremes was the recent spike in bond yields.

Some of the high-flying “low quality” baskets of speculators’ favorites this year have recently taken it on the chin.

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

-Investor and mutual fund manager Sir John Templeton

As illustrated so well in Templeton’s most famous quote, investor sentiment, at extremes, often corresponds to contrarian inflection points in the stock market. However, there is nothing precise, historically, in terms of timing. In general, periods of despair—as measured by both attitudinal and behavioral measures of sentiment—and typically occurring well into corrections and/or bear markets—tend to have shorter time spans. As such, they historically have tended to be more effective in signaling stock market inflection points.

Periods of optimism and/or euphoria often have persisted over longer time spans—a case in point would be the late 1990s. As many might recall, former Federal Reserve Chair Alan Greenspan uttered his now-famous “irrational exuberance” concerns in late-1996—more than three years before the market’s ultimate peak in March 2000.

Market peaks that are accompanied by euphoric sentiment extremes sometimes have a specific catalyst, but not always. Put another way, heightened optimism/euphoria suggests heightened risk of a contrarian market move. Historically, there have been catalyst-driven contrarian shifts in the market’s direction; but sometimes the market simply begins to fall under the weight of excess optimism or stretched valuations, without a specific catalyst. The peak of the dot-com bubble in March 2000 was an example of the latter (no specific catalyst), while the peak in stocks in February 2020 was triggered by the mother of all catalysts—the COVID-19 pandemic.

So, how does the sentiment environment look today? I keep track of a mix of behavioral (what investors are doing) and attitudinal (what investors are saying) sentiment measures. Below are examples of both; and as can be seen, sentiment has been quite frothy—both behaviorally and attitudinally. Typically, if market breadth remains healthy, it’s a positive offset to stretch sentiment. However, breadth has recently deteriorated; while we also got a catalyst in the form of rising bond yields—leading to very choppy market behavior and a recent near-correction in the formerly-high flying NASDAQ.

Behavioral Sentiment Indicators

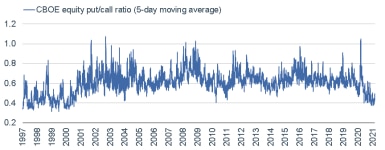

CBOE equity put/call ratio: Divides the number of traded put options (bets on falling prices) by the number of traded call options (bets on rising prices). As shown, recent levels have been hovering around late-1990s territory.

Source: Charles Schwab, Bloomberg, as of 3/5/2021.

Domestic equity ETF net new cash flow: After a descending trend between May and September last year, flows into equity exchange-traded funds started to surge last October—breaking monthly records twice since then.

Source: Charles Schwab, Investment Company Institute (ICI), as of 1/31/2021.

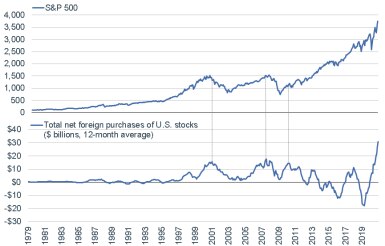

Total net foreign purchases of U.S. stocks: Spikes in foreign purchases of U.S. stocks have historically occurred around the same time U.S. stocks have taken a breather (bear markets in the case of 2001 and 2007, and a correction in the case of 2010).

Source: Charles Schwab, Department of the Treasury, as of 12/31/2020.For illustrative purposes only.

SentimenTrader’s Smart Money/Dumb Money Confidence: Using “real money gauges” (not opinions), SentimenTrader measures what the “good” market timers are doing compared to what “bad” market timers are doing. Examples of “good/smart” indicators include index put/call and open interest ratios and commercial hedger positions in equity index futures. Examples of “bad/dumb” indicators include the equity-only put/call ratio, flows in/out of the Rydex series of bull/bear index mutual funds, and small speculators in equity index futures contracts.

Caveat: Clearly, the so-called “dumb” money isn’t always wrong, and in fact, staying bullishly positioned over the past few months has been the right move (at least until mid-February). However, extreme spreads in these indicators do serve as possible warning signs (like was the case in early 2020, before the pandemic caused the February-March 2020 bear market swoon). Additional market weakness could bring more convergence between these two cohorts.

Source: Charles Schwab, SentimenTrader, as of 3/5/2021.

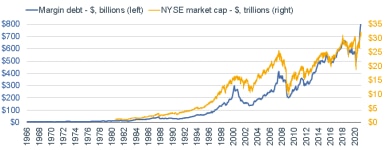

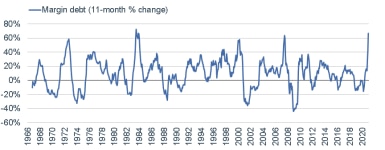

Margin debt: Investors have been ramping up leverage via margin accounts (borrowing money and using the value of stocks as collateral). The difference between credits (cash) in investors’ accounts and the amount of money they owe is currently $333 billion—a record low. Even accounting for the growth in market capitalization (yellow line in the first chart), margin debt is extreme. Since stocks bottomed nearly a year ago, margin debt has surged more than 67% (second chart), putting it in historically-rarified air—now exceeding the peaks in March 2000 and June 2007; but slightly below the all-time peak in July 1983.

Source: Charles Schwab, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, SentimenTrader, as of 1/31/2021. Past performance is no guarantee of future results.

Source: Charles Schwab, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, SentimenTrader, as of 1/31/2021. Past performance is no guarantee of future results.

Attitudinal Sentiment Indicators

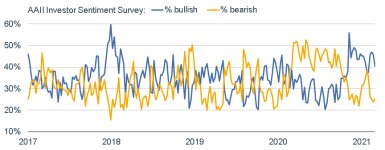

American Association of Individual Investors (AAII) Sentiment Survey: Recently hitting a high of 56% last November, bullish sentiment reversed and undercut bearish sentiment in early January this year. Since then, bullishness rose again, but has since rolled over; so this is presently an example of sentiment that has come off the boil a bit.

The last time the spread between bulls and bears hit an extreme was in early 2018 (when bullishness was extremely high relative to extremely low bearishness)—just prior to the “short vol” correction from late January to early February that year.

Source: Charles Schwab, Bloomberg, as of 3/4/2021.

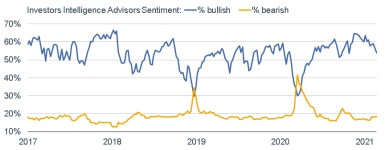

Investors Intelligence Advisors Sentiment: This is a study of more than 100 independent market newsletters with an assessment of each author’s stance on the market. Following a quick plunge in bullishness tied to the pandemic bear market last year, bullishness continues to be significantly higher than bearishness; although the spread has narrowed a bit (see “caveat” note above).

Source: Charles Schwab, FactSet, as of 2/26/2021.

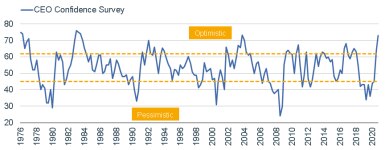

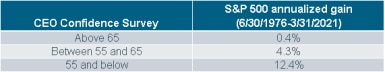

CEO Confidence: Although not a direct measure of stock market sentiment, rising CEO confidence tends to coincide with sharply rising corporate profits (although it’s a bit of a chicken-or-egg issue); while also typically leading to higher capital spending. However, it has historically been a sign of stock market excess. During spans when CEO confidence was above 65 historically (top yellow dotted line), stocks barely registered a positive return on an annualized basis (table).

Source: Charles Schwab, FactSet, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 3/31/2021. Past performance is no guarantee of future results.

Combination sentiment indicators

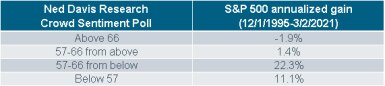

Ned Davis Research Crowd Sentiment Poll: As with the Smart Money/Dumb Money Confidence and Investors Intelligence measures, the crowd’s “extreme optimism” has been mostly rewarded in recent months. Historically though, sentiment remains in the zone during which annualized returns for the S&P 500 were slightly negative since 1995 (table).

Source: Charles Schwab, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 3/2/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

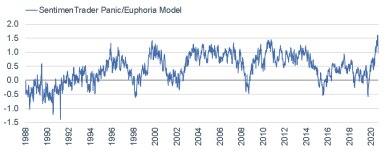

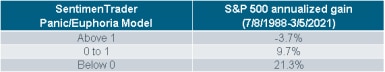

SentimenTrader’s Panic/Euphoria Model: This is ST’s take on Citi’s proprietary sentiment model of the same name, which has lately received a lot of attention due to the unprecedented height of euphoria reached recently. It’s historically rare for everything to agree at the same time. At the recent peak, there were more than 50% of the model’s core indicators showing optimistic extremes and 0% showing pessimistic extremes. The latest market weakness did finally put a dent in euphoria; with the latest reading moving down and out of the most negative zone historically as per stock market performance (table).

Source: Charles Schwab, SentimenTrader, as of 3/5/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

As noted at the beginning of this report, strong breadth conditions have historically been a positive offset to periods of euphoric sentiment. What now bears watching is that breadth has deteriorate throughout the latest consolidation phase; at least as measured by the percentage of major indexes’ stocks above their 50-day (top chart) and 200-day (bottom chart) moving averages.

Breadth souring

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Past performance is no guarantee of future results.

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Past performance is no guarantee of future results.

Low-quality takes a hit

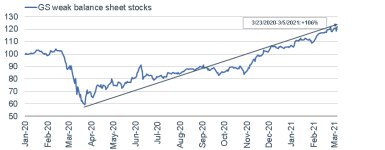

In addition to cautioning about sentiment risk since this year began, we have also been highlighting the related speculative fervor toward “low-quality” themes—notably among the “newly-minted day trader” crowd. The first three charts below are indexes created by Goldman Sachs, tracking stocks with a few of those factor characteristics. In the case of weak balance sheet companies (first chart); those stocks are up over 100% from the market’s trough in March 2020.

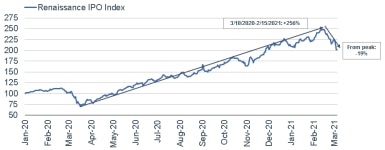

But not all hyped low-quality themed baskets remain near their highs. Non-profitable technology stocks (second chart) have suffered a bear market-level loss since their recent peak; while the most-heavily shorted stocks (third chart) are well into correction territory. Finally, the bloom has come off the initial public offering (IPO) rose to some degree, with a well-watched IPO index (fourth chart) also now near bear market territory from its recent high.

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Data indexed to 100 (base value = 12/31/2019). The Goldman Sachs (GS) weak balance sheet basket contains 50 S&P 500 companies across eight sectors with weak balance sheets. Past performance is no guarantee of future results.

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Data indexed to 100 (base value = 12/31/2019). The Goldman Sachs (GS) basket consists of non-profitable U.S.-listed companies in innovative industries. Technology is defined quite broadly to include new economy companies across GICS industry groupings. Past performance is no guarantee of future results.

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Data indexed to 100 (base value=12/31/2019). The Goldman Sachs (GS) most-shorted basket contains the 50 highest short interest names in the Russell 3000; names have a market cap greater than $1 billion. Past performance is no guarantee of future results.

Source: Charles Schwab, Bloomberg, as of 3/5/2021. Data indexed to 100 (base value = 12/31/2019). The Renaissance IPO Index tracks US-listed newly public companies that are weighted by float, capped at 10%, and removed after two years. Past performance is no guarantee of future results.

In sum

Especially during times of heightened speculation—particularly in segments of the market with either extremely stretched valuations or questionable fundamentals—it behooves investors to be mindful of the tried-and-true disciplines of diversification (across and within asset classes) and periodic rebalancing. With regard to the latter, we continue to recommend that investors consider portfolio/volatility-based rebalancing vs. calendar-based rebalancing. This allows investors to “stay in gear” during a volatile market environment by adding low and trimming high; which is likely to be a more successful strategy than trying to anticipate which indexes, sectors, factors or “stories” will drive leadership over the short-term.

What you can do next

- Follow Liz Ann Sonders on Twitter: @lizannsonders.

- Explore other topics on Insights & Ideas.

- Talk to us about the services that are right for you. Call us at 800-355-2162, visit a branch, find a consultant or open an account online.

By

By