Rising Inflation: What It Means for TIPS and Other Investments

Inflation is likely to rise in 2021—but will the rise be sustained? That seems to be the million-dollar question lately.

Given concerns that inflation will rise in the years to come, some investors may be looking for ways to protect their portfolios from its effects. Treasury Inflation-Protected Securities, or TIPS, are a straightforward investment that can help your portfolio keep pace with inflation, but today’s negative yields mean that total returns are likely to be low. Meanwhile, other types of investments have outperformed inflation over time, but often with a lot of volatility and more risk.

Below we’ll go over the recent inflation trends and provide a look into different inflationary environments to explore how various investments have performed over time.

Inflation and inflation expectations are on the rise

The Consumer Price Index (CPI) rose 2.6% in the 12 months ending in March, and the next few monthly readings are expected to be even higher. Given last year’s pandemic-driven drop in prices, inflation readings over the next few months are expected to be high due to the “base effect,” or the impact of having a very low rate at the beginning of the period being measured.

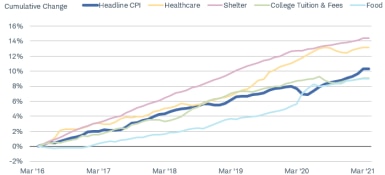

Inflation isn’t just a concern due to the base effect, however. Sometimes inflation measured by the CPI doesn’t accurately reflect every consumer’s experience. For instance, if more of your budget is focused on shelter or health-care costs, it’s possible that the rate of inflation on your basket of goods is higher than the headline index.

Inflation has risen faster on some items than on others

Source: Bloomberg, using monthly data as of 3/31/2021. US CPI Urban Consumers SA (CPI INDX Index), US CPI Urban Consumers Medical Care SA (CPUMTOT Index) (CPSCTOT Index), US CPI College Tuition & Fees SA (CPIQCTFS Index), US CPI Urban Consumers Shelter SA (CPSHSHLT Index), and US CPI Urban Consumers Food SA (CPSFFOOD Index).

According to economist forecasts, the CPI is expected to rise by 3.2% year-over-year in the second quarter of this year, before dropping modestly to 2.6% by year-end. Investors’ expectations for inflation are rising as well—according to the most recent poll by the University of Michigan, the one-year expected inflation rate jumped to 3.4% in April, its highest reading since 2014. Intermediate-term inflation expectations over the next five to 10 years are tamer, at 2.7%.

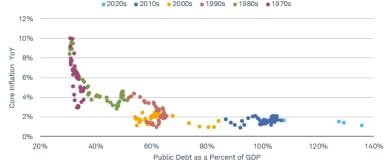

Some investors are concerned that the recent surge in government spending—the bulk of which likely will be financed by increased borrowing, as well as tax increases—will lead to a surge in inflation. However, over the past 50 years, more government borrowing generally hasn’t led to surging inflation (although relationships can always change over time). As the chart below illustrates, a high amount of debt relative to gross domestic product (GDP) hasn’t resulted in rising inflation, either.

In recent decades, high public debt vs. GDP has not led to surging inflation

Source: Bloomberg, using quarterly data as of 12/31/2020. Federal Debt Total Public Debt as Pct of GDP Quarterly Seasonally Adjusted (FDTGATPD Index) and US Personal Consumption Expenditure Core Price Index YoY SA (PCE CYOY Index).

TIPS tend to be attractive when inflation rises sharply

Before we look at the broad array of investment types, you should consider how TIPS can help protect your portfolio against a rise in inflation. TIPS are one of the most straightforward ways to buffer the effects of inflation because their principal value is indexed to the CPI. When inflation rises, TIPS’ value and coupon payments rise, as well.

However, TIPS today have negative “real,” or inflation-adjusted, yields. The yield on the 10-year TIPS is -0.8%, meaning an investor buying that security today would be locking in an inflation-adjusted loss over time. In other words, TIPS today will help you keep pace with inflation, but they won’t allow you to beat inflation, given their low-yield starting point.

While that might seem like a losing proposition, it’s important to compare TIPS to nominal (non-inflation-adjusted) Treasuries by looking at the “breakeven rate.” This is the rate that inflation would need to average over the life of the TIPS for it to outperform a nominal Treasury. For example, if the 10-year breakeven rate was 2.5%, then inflation would need to average over 2.5% for a 10-year TIPS to outperform the nominal Treasury. Even though TIPS offer negative real yields today, if inflation rises enough, they can still outperform a traditional Treasury. In other words, the higher inflation rises, the greater the likelihood that TIPS outperform traditional Treasuries.

Breakeven rates are at their highest level in years

Source: Bloomberg, using weekly data as of 4/30/2021. US Breakeven 10 Year (USGGBE10 Index) and US Breakeven 5 Year (USGGBE05 Index). Past performance is no guarantee of future results.

When considering TIPS, we believe it’s important to evaluate them relative to nominal Treasuries, as they have similar risk profiles (both are backed by the full faith and credit of the U.S. government) and both have low yields today. With breakeven rates so high, TIPS don’t appear very attractive unless inflations rises more than the current forecasts. According to Bloomberg, economists expect the CPI to fall to 2.2% in both 2022 and 2023, while median projections from Federal Reserve officials point to inflation dropping to the 2% to 2.1% area over the next two years. TIPS can help protect portfolios against a sharp and lasting rise in inflation, but if the rate of inflation remains modest going forward, their returns are likely to be held in check.

The inflation rate affects various asset classes differently

Looking beyond TIPS, we decided to evaluate how the returns of various asset classes have fluctuated depending on the rate of inflation. First, we created a composite inflation indicator composed of various inflation indexes (as there are many different inflation indicators).1 Then we examined the average total returns of various asset classes depending on the level of inflation based on the composite indicator:2

- Inflation below 2%

- Inflation between 2% and 4%

- Inflation above 4%

Keep in mind that the total returns illustrated below are averages, and the range of total returns depending on the inflationary environment can vary significantly.

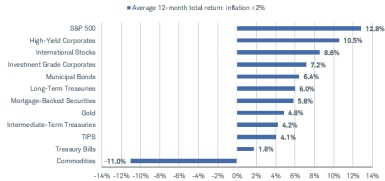

1. Inflation below 2%

During low-inflation environments, stocks and riskier bond investments have tended to generate the highest average total returns, while intermediate- and long-term Treasuries have generally outperformed Treasury bills.

When inflation is low, intermediate- and long-term Treasuries likely would provide higher yields than Treasury bills, as the Federal Reserve likely would keep its policy rate, the short-term federal funds rate, low. Meanwhile, easy monetary policies (which are likely during low- inflation periods) can support riskier investments like stocks or corporate bonds, because they help keep borrowing costs low and financial conditions easy.

TIPS generally underperformed other investments when inflation was low, but their average total returns were similar to those of intermediate-term Treasuries. Commodities, on average, generated negative total returns, which shouldn’t come as much of a surprise because commodity prices tend to influence inflation rates, meaning low or falling commodity prices could be a factor that keeps inflation low.

Average total returns when inflation was less than 2%

Source: Schwab Center for Financial Research with data from Bloomberg and Morningstar, using monthly data through March 2021. Each index has a different start date, so not all average total returns have the same amount of data points. Please see footnote 2 for start date for each index used. Indexes included are: S&P GSCI Index (Commodities), Gold United States Dollar Spot (Gold), ICE BofA U.S. Mortgage Backed Securities Index (MBS), S&P 500 Index (S&P 500), Ibbotson US 30-day Treasury Bill Index (1-month Treasury Bills), Bloomberg Barclays U.S. Corporate Bond Index (Investment Grade Corporates), MSCI EAFE Net Total Return USD Index (International Stocks), ICE BofA U.S. Municipal Securities Index (Municipal Bonds), Bloomberg Barclays U.S. Corporate High Yield Bond Index (High-Yield Corporates), Bloomberg Barclays U.S. TIPS Index (TIPS), Ibbotson US Intermediate-Term Government Bond Index (Intermediate-term Treasuries), and Ibbotson US Long-Term Government Bond Index (Long-term Treasuries). Total returns assume reinvestment of interest or dividends plus capital gains. Past performance is no guarantee of future results.

2. Inflation between 2% and 4%

With inflation between 2% and 4%, most investments have generated positive average total returns. Stocks and commodities outperformed most bond investments.

Long-term Treasuries even outperformed their intermediate- and short-term counterparts in these environments. Once again, note the average total returns of TIPS—they slightly underperformed intermediate-term Treasuries.

The average total return of Treasury bills in this environment was 3.8%, right in the 2%-to-4% inflation range. That’s likely the result of the Federal Reserve raising or lowering rates, depending on the rate of inflation, which helps drive Treasury bill performance.

Average total returns when inflation is between 2% and 4%

Source: Bloomberg, using monthly data through March 2021. Each index has a different start date, so not all average total returns have the same amount of data points. Please see footnote 2 for start date for each index used. Total returns assume reinvestment of interest or dividends plus capital gains. See source above for full list of indexes used and see disclosures for start dates for each data series. Past performance is no guarantee of future results.

3. Inflation above 4%

In high-inflation environments, the total return performance by asset class shifted noticeably.

Commodities generated the highest average total returns in this environment, while long-term Treasuries fell to the bottom of the list. When inflation rises sharply, bond yields generally rise to keep pace. Given their high sensitivity to rising yields, long-term Treasuries suffered in these environments.

Meanwhile, Treasury bills outperformed other bond investments. In high-inflation environments, the Fed historically has raised rates to “cool” economic growth. Treasury bills benefited in that scenario because their coupon rates can adjust quickly, and their very low durations means their prices don’t fall as much as intermediate- or long-term Treasury prices.

TIPS were introduced in 1997, and the most recent reading above 4% for our composite inflation indicator was 1991, so there’s no TIPS data for high-inflation environments.

Average total returns when inflation is greater than 4%

Source: Bloomberg, using monthly data through March 2021. Each index has a different start date, so not all average total returns have the same amount of data points. Please see footnote 2 for start date for each index used. Total returns assume reinvestment of interest or dividends plus capital gains. See source above for full list of indexes used and see disclosures for start dates for each data series. Past performance is no guarantee of future results.

Higher returns come with more risk

Simply looking at the highest average total returns doesn’t tell the whole story, as it doesn’t account for volatility or the potential for sharp declines in short periods of time.

The chart below illustrates the worst 12-month total returns for each of the investments included in the charts above. The investments that have generated the highest total returns tend to come with the largest drawdowns.

In other words, there are investments that can help protect against inflation, like TIPS or Treasury bills, or there are investments that can outperform inflation over the long haul, but with more risk and a lot of volatility along the way.

The worst 12-month return varies considerably by investment type

Source: Bloomberg, using monthly data through March 2021. Each index has a different start date, so not all average total returns have the same amount of data points. Please see footnote for start date for each index used. Total returns assume reinvestment of interest or dividends plus capital gains. See source above for full list of indexes used and see disclosures for start dates for each data series. Past performance is no guarantee of future results.

What to do now

No investments are perfect. Some investments can help protect your portfolio from the effects of inflation, but total returns might be relatively low. Conversely, some investments might not necessarily be correlated to inflation, but can help beat inflation over time due to higher total returns. Of course, those higher returns come with more risk and volatility. There’s a difference between beating inflation over time and being correlated with inflation.

- TIPS and Treasury bills tend to be highly correlated with inflation, but their total returns have been low over time.

- Commodities are also highly correlated with the rate of inflation, but their prices tend to be volatile regardless of the inflationary environment.

- Stocks tend to have high total returns regardless of the inflationary environment, but their prices are volatile.

There is no one-size-fits-all when it comes to which investment to choose if you are concerned about inflation. Consider the points above and your own goals, risk tolerance, and circumstances when determining which investment to hold to combat inflation. Also, a Schwab representative can help you find investments that fit your needs.

1The composite inflation indicator is an equally-weighted index using the following indexes: PCE Deflator, Core PCE Deflator, CPI, Core CPI, Federal Reserve Bank of Cleveland 16% Trimmed-Mean CPI Index, Atlanta Fed Sticky CPI 12 Month, Atlanta Fed Core Sticky CPI 12 Month, and the Federal Reserve Bank of Cleveland Median CPI YoY NSA.

2 Due to data limitations, not every investment type has readily available total return data going back to the same date. For this study, the start date for each investment type is as follows: S&P 500, International Stocks, Treasury Bills, Intermediate-Term Treasuries, and Long-Term Treasuries: January 1960; Gold: October 1970; Commodities: January 1971; Investment Grade Corporates: January 1974; MBS: September 1977; High-Yield Corporates: July 1984; Municipal Bonds: September 1990; TIPS: March 1998.

What You Can Do Next

- Follow the Schwab Center for Financial Research on Twitter: @SchwabResearch.

- Talk to us about the services that are right for you. Call a Schwab Fixed Income Specialist at 877-566-7982, visit a branch, find a consultant or open an account online.

- Explore Schwab’s views on additional fixed income topics in Bond Insights.

By

By