Stock Settlement: Why You Need to Understand the T+2 Timeline

Key Points

Stock settlement violations can occur when new trades are not properly covered by settled funds.

Although settlement violations generally occur in cash accounts, they can also occur in margin accounts, particularly when trading non-marginable securities.

We discuss the main types of settlement violations and how to avoid them.

Stock settlement violations can occur when new trades are not properly covered by settled funds. Here we discuss the main types of settlement violations and how to avoid them.

What is settlement?

Settlement marks the official transfer of securities to the buyer's account and cash to the seller's account.

When does settlement occur?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

What counts as settled funds?

- Incoming cash (such as a check deposit or wire)

- The available margin borrowing value in a margin account (doesn't apply to a cash account)

- Settled sale proceeds of fully paid-for securities

How can I view settlement information on Schwab.com?

You can view the settlement date for a particular transaction in your account History page, or you can see your account's total available settled funds in your account Balances page.

To view History:

- Log into Schwab.com.

- Select Accounts.

- Click History.

- Click on the Transactions tab.

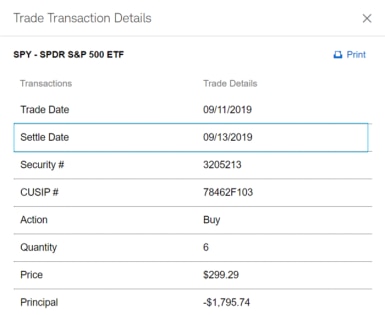

- To view the Trade Transactions Details window, click the Trade Details link. (See below.)

Source: Schwab.com

To view Balances:

- Log into Schwab.com.

- From the Accounts dropdown, select Balances.

- Navigate to the right-hand side of the page to Funds Available.

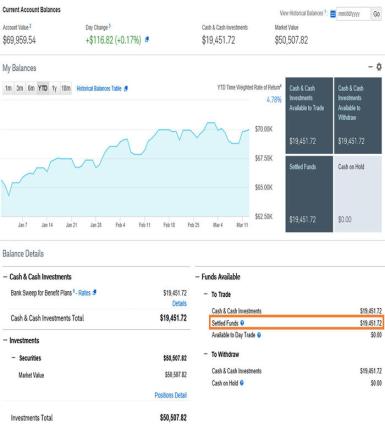

- Under To Trade, you'll see the Settled Funds total. (See below.)

Source: Schwab.com

What are settlement violations?

Stock settlement violations occur when new trades to buy are not properly covered by settled funds. Although settlement violations generally occur in cash accounts, they can also occur in margin accounts, particularly when trading non-marginable securities.

The main types of violation are good faith, freeriding, and liquidation.

Good faith violations occur when you buy a stock with unsettled funds, and then sell it before the funds you bought it with have settled.

- The situation:

- Ms. Jones sells 100 shares of XYZ stock for $2,000, the proceeds from which will settle two business days later (T+2). Ms. Jones immediately invests $1,000 of the unsettled proceeds in UVW stock.

- The next day, Ms. Jones sells her UVW stock for $1,500—a day before the XYZ trade settles.

- The violation: Ms. Jones bought UVW stock using unsettled proceeds from her sale of XYZ stock, and then sold the UVW stock before the XYZ proceeds settled on T+2.

- The consequence:

- The first instance of a good-faith violation in an account generally leads to a notification, but no restrictions. (Note that Schwab may at its discretion impose permanent restrictions or account closures.)

- The second through fourth violations in a rolling 12-month period can lead to a 90-day settled-cash restriction, meaning trading is limited to the amount of settled funds available in your account. At Schwab, clients can use a one-time exception—i.e., once in the life of the account—to remove such a restriction.

- The fifth violation of any kind generally results in a permanent settled-cash restriction.

Freeriding violations occur when you buy a security in a cash account that lacks sufficient settled funds and then sell the same security before depositing funds to pay for its purchase. This violation can occur whether the purchase and sale occur on the same day or on different days.

- The situation:

- Mr. Smith starts the day with $100 of settled cash in his account, and buys $1,000 of XYZ stock. The remaining $900 needed to cover the trade is due by the settlement date on T+2.

- The next day, Mr. Smith still hasn't deposited the outstanding $900 he owes, but sells his XYZ shares for $1,500.

- The violation: Mr. Smith sold stock before paying for its purchase.

- The consequence: Industry regulations require the brokerage firm to freeze the account for 90 days, during which time trading is restricted to the amount of settled funds available. (At its discretion, Schwab may impose permanent restrictions or account closures.)

- Schwab cannot waive this restriction. However, if funds are deposited within the payment period to cover the entire purchase—generally four business days after the trade date—the violation may be downgraded to a good faith violation

Liquidation violations are based on trade dates rather than settlement dates. There are two types of liquidation violations: cash liquidation violations and margin liquidation violations.

A cash liquidation violation occurs when you sell a security and use the proceeds to cover the purchase of a different security you bought on a prior trade date. Although similar to a freeriding violation, the primary difference between a liquidation violation and a freeriding violation is that you are selling a security other than the one you purchased and using its proceeds to cover the other trade.

- The situation:

- Mr. Lee starts with settled shares of XYZ stock and $100 in settled cash, and buys UVW stock for $1,000. The remaining $900 in settled funds needed to fully pay for the UVW purchase is due by the settlement date on T+2.

- On T+2, Mr. Lee places an order to sell some of his XYZ stock instead of depositing the $900 he still owes for the UVW stock.

- The violation: In deciding to initiate a sell order for XYZ stock on the settlement date for his UVW purchase instead of providing the cash he still owed, Mr. Lee committed a liquidation violation. If he had sold enough settled, fully paid for XYZ stock on the same day the bought the UVW stock, that transaction would have settled in time to cover his obligation.

- The consequence:

- The first liquidation violation in an account generally results in a notification, but no restrictions. (Note that Schwab may at its discretion impose permanent restrictions or account closures.)

- The second through fourth non-freeride violations in a rolling 12-month period can lead to a 90-day settled-cash restriction, meaning trading is limited to the amount of settled funds available in your account. At Schwab, clients can use a one-time exception—i.e., once in the life of the account—to remove such a restriction.

- The fifth violation of any kind generally results in a permanent settled-cash restriction.

A margin liquidation violation occurs when your margin account has both a Fed call and a regulatory maintenance call, and you sell securities in the account to cover the calls.

- A Fed call represents the deposit amount needed to meet the Federal Reserve Board's Regulation T requirement (Reg T) for trades in a margin account. According to Reg T, you may borrow up to 50% of the total purchase price of a margin security, and fund the remaining 50% with cash.

- A maintenance call occurs when a brokerage account falls below the brokerage firm's established minimum equity requirement. Schwab's maintenance requirement for equity securities is generally 30% of current market value, though this amount may vary depending on the type of security. A regulatory maintenance call occurs when the account falls below the regulatory minimum requirement, which is 25% for equity securities.

Extensions

At Schwab, if you fail to make payment on a purchase of stock or deliver shares for a sale of stock within the designated time frame, you will receive a notification asking that you take action.

If you fail to act upon notification, industry regulations require that Schwab either request an extension, or buy back or sell out the position, as well as mark your account with a freeriding violation. Your account may also be placed on a 90-day settled-cash restriction, or incur more severe penalties, including account closure or removal of electronic access. Again, Schwab clients can request a one-time exception (i.e., once in the life of the account) to remove the restriction.

Schwab doesn't grant extensions for trades in retirement accounts (IRAs, SEPs, Keoghs, etc.), or accounts with existing trading restrictions. There are different practices for extensions on purchases and sales. You can contact a Schwab trading specialist at 800-435-9050 for more information about extensions.

What are some common situations that can lead to settlement violations?

I accidentally placed the trade in the wrong account.

It can happen to the most careful of investors. You think you're placing a trade in your margin account, only to find you've accidentally placed it in your IRA. If you place a trade in the wrong account, contact a Schwab trading specialist immediately at

800-435-9050. Closing out the position yourself may cause a violation. In many cases, Schwab can request a "cancel and rebill" to move the trade to the intended account.

I traded a non-marginable security in my margin account.

If you buy a security that's not marginable then settled funds are required for full payment. Consequently, a settlement violation can occur in a margin account if you buy and then sell a non-marginable security before settled funds have covered the purchase. The order verification screen will alert you if a stock is not marginable. If you're not confident that you can commit to holding a non-marginable security for at least three trading days, consider limiting your purchase to settled funds only.

I placed a day trade in my cash account.

When a stock trade is completed in a cash account, the funds will not settle for two full trading days. Since a trade held less than two days in a cash account requires settled funds to avoid a good faith violation, it may become necessary to wait at least two days between trades so that the day trades or short-term trades may be executed using settled funds only. Limiting very short-term trades to settled funds will help reduce the risk of violating settlement rules.

A bracket or alert fired in my cash account during the settlement period.

When a bracket or alert is attached to a security you bought with unsettled funds in a cash account, there's a possibility that the exit trigger (e.g., sell stop, trailing stop, profit exit, etc.) will fire, closing the position and causing a settlement violation. If you need immediate protection on the position via an alert or bracket, consider using settled funds for the purchase, in case the exit is triggered during the settlement period.

Alternatively, you could delay activating the alert until the first day the position can be sold without incurring a violation—either the settlement day for the purchase or the settlement day for the funds used to make the purchase. If you decide to simultaneously place the purchase with unsettled funds and immediately attach a bracket or alert, consider giving an additional cushion to the exit parameter(s) to lower the risk of execution within the settlement period. You can always update your exit parameters when the cushion is no longer necessary.

What You Can Do Next

- Call 877-435-9050 to speak with a Schwab trading specialist.

- Ready to bring your trading to Schwab? Get started today.

By

By