Structuring Your Retirement Portfolio

According to the Social Security Administration, the average 65-year-old retiree can expect to live roughly 18–20½ years after leaving the workforce.1 However, with advances in health care leading to increasing longevity, it’s widely recommended that you plan for a retirement of 30 years or longer. Therefore, how you invest your savings in retirement is crucial.

The first aspect of our three-pronged approach to generating retirement income is creating a plan. After you’ve completed the planning stage, your next step should be to determine your portfolio allocation. Lastly, you’ll make a plan for withdrawing from your portfolio in retirement.

The portfolio allocation step is all about choosing the right mix of investments. Here’s a guide for how to approach it.

The key is staying invested—and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments.

1. Set aside one year of cash

Try to set aside enough cash—minus any regular income from rental properties, annuities, pensions, Social Security, investment income etc.—to cover a year’s worth of retirement expenses. Ideally, this money would be held in a relatively safe, liquid account, such as an interest-bearing bank account, money market fund or short-term certificate of deposit (CD).

With this cash on hand, you won’t have to worry as much about the markets or a monthly paycheck. Spend from this account and replenish it periodically with funds from your invested portfolio. Then invest the rest of your portfolio sensibly.

2. Create a short-term reserve

Within your main portfolio, starting with accounts that you may need to tap soon, create a short-term reserve to cover withdrawals from your portfolio and help weather a prolonged market downturn—we recommend two to four years’ worth of living expenses, again after accounting for other regular income sources, if you can. This short-term reserve will help prevent you from having to sell more volatile investments, like stocks, in a down market.

This money can be invested in high-quality, short-term bonds or other fixed income investments, such as short-term bonds or bond funds. Or, if you’d rather manage individual investments, you might want to create a short-term CD or bond ladder—a strategy in which you invest in CDs or bonds with staggered maturity dates so that the proceeds can be collected at regular intervals. When the CDs or bonds mature, you can use the money to replenish your bank account.

3. Invest the rest of your portfolio

When it comes to the rest of your portfolio, remember that your overarching goal is to create a mix of investments that work together to preserve capital, generate income and grow. Your specific mix of stock, bond and cash investments should be appropriate for your age, income needs, financial goals, time horizon and comfort with risk.

With a year’s worth of cash on hand and a short-term reserve in place, invest the remainder of your portfolio in investments that align with your goals and risk tolerance. For example, it’s perfectly acceptable to focus on growth in the early years of retirement in order to take advantage of potential compounding to continue to grow savings for expenses later in retirement or a legacy, depending on goals and time horizon. As you move through retirement, you may want to shift to a more conservative investing approach that seeks to preserve capital and generate income.

What to do if you have an annuity

Many retirees use annuities to provide a steady paycheck that they won’t outlive, and to help protect part of their portfolios from market risk. If you have predictable income from any type of annuity, you may be comfortable reducing the balance in your cash account and short-term reserve, as well as investing the rest of your portfolio in stocks and bonds for growth potential.

With this in mind, consider lowering the amount you set aside in cash and the short-term reserve by the income, if any, generated from an annuity. The annuity income can be seen as a baseline of income, in addition to Social Security and other sources, before you withdraw from your portfolio.

Annuity guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company.

Adapt your strategy over time

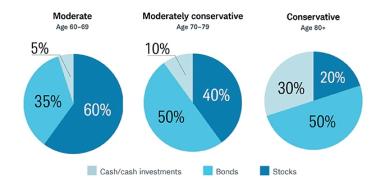

Here’s an example of how you might adjust your asset allocation throughout retirement, if you plan to use your portfolio including principal, to support spending, rather than spending only your investment earnings and leaving your nest egg to your heirs.

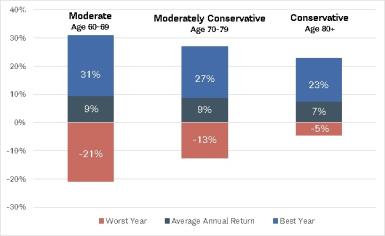

Retirees who adopted this plan would have seen the following results in their portfolios*:

*Based on data collected from 1970 through 2020.

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc. The return figures represent the best and worst total returns, as well as the compound average annual total returns, for the hypothetical asset allocation plans. The asset allocation plans are weighted averages of the performance of the indexes used to represent each asset class in the plans and are rebalanced annually. Returns include reinvestment of dividends and interest. The indexes representing each asset class are S&P 500® Index (large-cap stocks), Russell 2000® Index (small-cap stocks), MSCI EAFE® Net of Taxes (international stocks), Bloomberg Barclays U.S. Aggregate Bond Index (bonds) and FTSE U.S. 3-month Treasury bills (cash investments). The conservative allocation is composed of 15% large-cap stocks, 5% international stocks, 50% bonds and 30% cash investments. The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds and 10% cash investments. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments. CRSP 6-8 was used for small-cap stocks prior to 1979, and Ibbotson U.S. 30-day Treasury Bill Index was used for cash investments prior to 1978. Past performance is no guarantee of future results.

The key is staying invested—and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments. Why? Over time, equities historically have been an adequate defense against inflation and taxes—even better than bonds and cash.2 However, limit your exposure to stocks based on how much you’ll need from your portfolio soon, because there will be less time to recover from a bad year in the market. The key is determine the right mix for you, based on your age, needs, and time horizon.

1. Social Security Administration, Actuarial Life Table, 2017. The average life expectancy for a person age 65 is 17.89 years for males and 20.45 years for females.

2. Schwab Center for Financial Research.

What You Can Do Next

Explore additional steps for retirement planning in these related articles about planning for retirement and withdrawing from your savings in retirement.

If you’d like to talk about your retirement plan, call a Schwab investment professional at 800-355-2162 or visit a branch near you.

By

By