Waiting to Save for Retirement Could Cost You

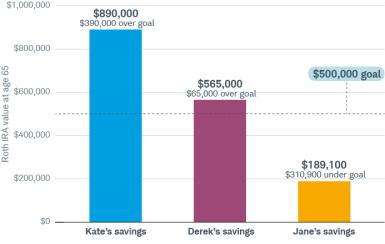

When it comes to saving for retirement, the clock is ticking. To illustrate the value of time, let’s consider three Roth IRA investors.

Kate, Derek, and Jane all decide to open Roth IRAs to supplement their other retirement accounts. Each investor hopes to build this account to $500,000 at the time of retirement, though they are starting to save for retirement at different ages. All plan to retire at age 65, and the investors maximize their contributions each year.

*People age 50 and older are allowed to include a $1,000 “catch-up” contribution.

By age 65, here’s how their savings could add up

The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. Assumes annual contribution of $6,000 until age 50, and $7,000 from age 50 to age 65; also assumes 6% average annual portfolio growth.

How you can best prepare for the future

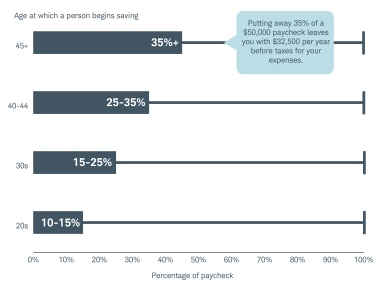

Here’s a retirement savings rule of thumb that you can use as a directional guideline to get you started.

If you start saving in your 20s, contributing 10%–15% of your paycheck including a savings match—if any—from an employer will likely allow you to meet your retirement savings goal. With every decade you delay, however, you’ll need to save a greater percentage of your paycheck.

Find additional ways to save

Here are some options for getting on the right track:

-

Maximize your workplace retirement plan. For 2021, the max 401(k) contribution for employees under age 50 is $19,500. Employees age 50 or over can make an additional catch-up contribution of $6,500. Be sure to take advantage of any match your company offers.

- Devote funds from a windfall, such as a bonus or inheritance, to an investment account geared toward your retirement.

- Set up a taxable brokerage account to supplement your retirement savings.

- Give your savings a boost. As your income increases, up your savings rate by 1%–3% each year. Before you know it, you’ll be savings a lot more than you thought you could.

- Start a Health Savings Account (HSA)—if you’re able—to help cover medical expenses, both now and later in life.1 If you don’t use the money, you won’t lose it. An HSA stays with you.

Better late than never

Invest in your future sooner rather than later. If you’re starting later in life, don’t get discouraged—there are other options that could help you reach your financial goals. All it takes is discipline and perseverance.

1You may only open and contribute to an HSA if you’re covered by a high deductible health plan. Contribution limits for 2021 are up to $3,600 for single coverage and $7,200 for family. In 2022, limits will increase to $3,650 for self-coverage and $7,300 for family. See HealthCare.gov for details.

What You Can Do Next

Consider using a robo-advisor to build a portfolio with your goals, time horizon, and risk tolerance in mind.

If you prefer more personalized guidance, a CERTIFIED FINANCIAL PLANNERTM professional can help you establish a sound plan for the future.

Call us at 800-355-2162 or visit your local branch to discuss all your options.