War: Impact on Earnings

For the past month, investors have been focused on the war on Ukraine and the economic impact of sanctions. As the first quarter wraps up this week, we get to review the impact current developments around the world have had on the most important driver of stock prices over the long-term: earnings.

The corporate earnings outlook has been relatively stable despite the backdrop of war in Ukraine. Although the unofficial start of the earnings reporting season is still a couple of weeks away, there is the potential for market moving news ahead of these announcements. The weeks around the end of the quarter often see companies who expect to fall short of their earnings targets downwardly revise their guidance. So far, the changes in first quarters' earnings estimates have been modest.

Earnings-per-share growth in 2022 for companies around the world (as measured by the MSCI All Country World Index) is now expected by FactSet analysts' consensus to be up 6%. Prior to the invasion, the consensus was at 7%, a difference of only 1%. Higher post-invasion forecasts in the energy, materials and industrials sectors partially offset modest declines across other sectors.

Pre- and post-invasion 2022 EPS estimates

Source: Charles Schwab, FactSet data as of 3/25/2022. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Geographically, earnings per share estimates for 2022 show that the rising trends in the U.S., U.K., and Japan have not changed much this year. Despite Europe's proximity to the conflict and dependence upon Russian energy supplies, earnings growth is still expected to be higher than it was at the start of the year, though lower by about 1.5% from pre-invasion levels.

Percent change in 2022 EPS forecasts since start of year

Source: Charles Schwab, FactSet data as of 3/25/2022.

There are a couple notable pre- and post-invasion differences:

- Canada, a major commodity producer, has jumped higher since the start of the conflict, bolstered by higher prices.

- Emerging markets (EM), when measured in U.S. dollars, have dropped—tied to the earnings of Russian oil companies dropping out of the index and weakness due to EM currencies falling versus the U.S. dollar. Notably, China and other major emerging market earnings outlooks haven’t changed much.

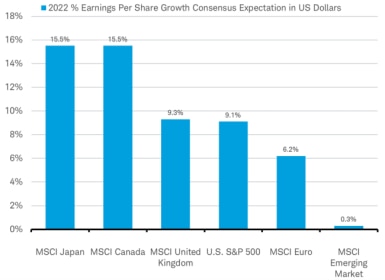

Reflecting the changes in estimates since the start of the year, analysts' forecasts for earnings growth in 2022 are still positive across countries and regions heading into the first quarter earnings reporting season, as you can see in the chart below.

2022 earnings growth still seen positive across countries and regions

Source: Charles Schwab, FactSet data as of 3/25/2022. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Although forecasts for the year are usually raised during the earnings season as companies typically exceed quarterly estimates, there is greater uncertainty this season given the Ukraine conflict, inflation, and lingering COVID-19 waves.

One of the best leading indicators of the trend in earnings expectations is the global manufacturing purchasing managers' index (PMI). This survey of business leaders from companies around the world is typically about three months ahead of analysts' forecasts for earnings over the coming 12 months, as you can see in the chart below of the past 20 years.

PMI leads earning trends

Source: Charles Schwab, Bloomberg (PMI) and Factset (MSCI) data as of 3/25/2022. Past performance is no guarantee of future results.

The level of 50 on the PMI is the threshold between expansion and contraction in manufacturing and tends to align with the division in the outlook between growth and decline in earnings for all companies over the coming year. We will get March's reading of the global manufacturing PMI on April 1. This month's preliminary PMI readings for major countries like the U.S., Germany, France, and Japan were resilient despite the war, reflecting only a small dip. If this trend is confirmed with the final global PMI reading on April Fools' Day, it suggests the outlook for earnings growth is likely to continue.

Of course, the future direction of the PMI and the outlook for earnings remains tied to the impact of the war and sanctions, among many other factors that include inflation and central bank actions. Further escalation of sanctions may have greater earnings impact; current sanctions have been cautiously implemented to avoid disruption of energy supplies. However, investors may take some comfort that the earnings impact so far has remained modest and global companies appear to be on a path for earnings growth this year.

Michelle Gibley, CFA®, Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.

By

By