What is a Micro E-Mini Future?

Index-tracking Micro E-mini Futures aim to make an advantage of smallness.

What are they? Micro E-mini Futures are basically smaller versions of the CME Group’s popular E-mini stock index futures contracts, checking in at just 1/10th the size. The CME Group created them because the classic E-minis had become too expensive for many traders, effectively shutting them out of the liquid futures market. The smaller Micro contracts also give traders more flexibility and allows them to be more precise in how they manage their risks.

Since their launch in 2019, Micro E-minis have allowed traders to take positions on the big four U.S. indexes—the Dow Jones Industrial Average, S&P 500, Nasdaq 100, and Russell 2000—without having to commit nearly as much capital as the regular contracts. For example, where the regular E-mini S&P 500 futures contract represents $50 times the price of the S&P 500 Index, the Micro E-mini S&P 500 represents $5 times the price of the S&P 500 Index.

Let’s take a closer look at some of the potential benefits and risks associated with these contracts.

What are the benefits?

The Micro E-mini’s small size brings a variety of potential benefits to retail traders:

- Portfolio diversification for less: With futures, you can take on long or short exposure to an entire index of stocks for far less money than it would take to buy or short the same stocks or even the associated index-tracking funds.

- Capital efficiency. One of the key concepts of futures trading is that, as leveraged investments, a relatively small initial amount of capital is used to control a much larger contract amount. With Micro E-minis, a trader’s performance bond, or margin—a financial guarantee required of both buyers and sellers of futures contracts to ensure fulfillment of the contract—could run from just 5%–7% of the notional value of the contract. (The notional value is calculated by multiplying the size of the contract by the current price. For example, the Micro E-mini S&P 500 contract is $5 times the price of the index. If the index is trading at 4,255, the notional value of the Micro E-mini contract would be $21,275.)

- Flexible risk management: Selling Micro E-mini futures can help investors manage some of the risk associated with the stock allocation in their portfolios without actually disturbing their stock portfolios.

- Around the clock access: With trading available nearly 24 hours a day, six days a week, traders can respond to market moving events as they occur around the globe.

What are the risks?

As with any futures trading, if a trade goes against you, you may lose more money than you initially invested. (With a stock or bond, your potential loss is limited to the amount you invested.) In fact, any significant move against your position before expiry could lead to a margin call for you to settle.

Under certain (rare) market conditions, you may also find it difficult—or impossible—to close out a position. This situation can occur, for example, when a market reaches a daily price fluctuation limit (limit-up or limit-down) or market circuit breaker.

In addition, stop and market orders may not execute at or near your desired price during times of high volatility or low volume.

Finally, while the nearly 24-hour trading in some products can be an advantage, it could also tempt traders and investors into making more trades than they can reasonably handle, creating the potential for larger losses. Futures trading is hard work and requires a substantial investment of time and energy. Studying charts, reading market commentary, staying on top of the news—it can be a lot for even the most seasoned trader.

How do they work?

The size of the contract refers to a contract multiplier. As noted above, Micro E-minis are one-tenth the size of an equivalent E-mini contract. For example, the S&P 500 Micro E-mini has a $5 multiplier, while the E-mini version has a $50 multiplier. This means traders will gain or lose $5 per point change in the Micro contract versus $50 per point with the regular mini contract.

| Index | Micro E-mini Contract | E-mini Contract Size | Micro E-mini Contract Size |

|---|---|---|---|

|

S&P 500 |

Micro E-mini S&P 500 futures (MES) |

$50 x S&P 500 Index | $5 X S&P 500 Index |

|

Nasdaq-100 |

Micro E-mini Nasdaq-100 futures (MNQ) |

$20 x Nasdaq-100 Index | $2 X Nasdaqu-100 Index |

|

Dow Jones |

Micro E-mini Dow futures (MYM) |

$5 x DJIA Index | $.50 X DJIA Index |

|

Russell 2000 |

Micro E-mini Russell 2000 futures (M2K) |

$50 x Russell 2000 Index | $5 X Russell 2000 Index |

|

Russell 2000 |

Micro E-mini Russell 2000 futures (M2K) |

$50 x Russell 2000 Index | $5 X Russell 2000 Index |

Source: cmegroup.com

Like their E-mini counterparts, Micro E-mini futures trade on a March quarterly expiration cycle (third Friday of March, June, September and December). The tick increments follow their E-mini counterparts as follows:

| Index Futures Contract Specs | Outright | Calendar Spread |

|---|---|---|

| Micro E-mini S&P 500 futures | 0.25 Index points= $1.25 | 0.05 index points= $0.25 |

| Micro E-mini Nasdaq-100 futures | 0.25 Index points= $0.50 | 0.05 index points= $0.10 |

| Micro E-mini Dow futures | 1.00 Index points= $0.50 | 1.00 index points= $0.50 |

| Micro E-mini Russell 2000 futures | 0.10 Index points= $0.50 | 0.05 index points= $0.25 |

Source: cmegroup.com

Here are the contract specifications:

| CONTRACT | Micro E-mini S&P 500 | Micro E-mini Nasdaq-100 | Micro E-mini Russell 2000 | Micro E-mini Dow |

| CONTRACT SIZE | $5 x S&P 500 Index | $2 x Nasdaq-100 Index | $5 x Russell 2000 Index | $0.50 x DJIA In |

| TRADING HOURS |

CME Globex: Sunday through Friday, 5:00 p.m. CT to 4:00 p.m. CT |

|||

|---|---|---|---|---|

| TICK SIZE | 0.25 Index points | 0.25 Index points | 0.10 Index points | 1.00 Index points |

| DOLLAR VALUE/TICK | $1.25 per contract | $0.50 per contract | $0.50 per contract | $0.50 per contract |

| PRODUCT CODE | MES | MNQ | M2K | MYM |

| CONTRACT MONTHS | March, June, September, December | |||

| DELIVERY | Cash settlement to Final Settlement Price | |||

| TERMINATION OF TRADING | 9:30 a.m. ET on 3rd Friday of contract delivery month | |||

Source: cmegroup.com

How do I trade Micro E-mini futures at Schwab?

Micro E-mini contracts trade on the CME GLOBEX trading platform Sunday through Friday between 6:00 p.m. and 5:00 p.m. Eastern.

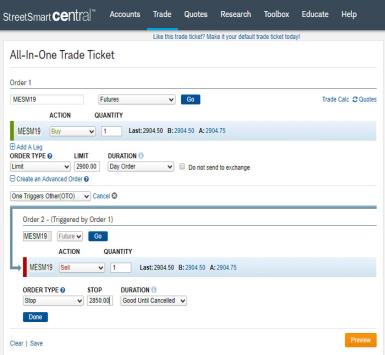

Micro E-mini stock index futures are available on Schwab’s StreetSmartCentral and StreetSmart mobile trading platforms.

Source: schwab.com

For additional details, visit the CME Group’s FAQs page.

What You Can Do Next

- Read and watch educational content about futures.

- Learn more about futures trading at Schwab.

- Call 877-807-9240 to speak with a Schwab futures trading specialist.

- Ready to trade futures at Schwab? Open an account.

- Schwab clients: Interested in trading futures? Login to apply for futures trading approval.

By

By