Investment Expenses: What’s Tax Deductible?

Key Points

Due to the Tax Cuts and Jobs Act (TCJA) of 2017, certain investment-related expenses are no longer deductible if you itemize.

If you borrowed money to purchase taxable investments, you may still be able to use the interest expenses from the loans to reduce your taxable investment income.

Up to $3,000 of capital losses can be used to offset your ordinary taxable income.

The IRS allows various tax deductions for investment-related expenses if those expenses are related to producing taxable investment income. With the Tax Cuts and Jobs Act (TCJA) of 2017, some of the rules related to the deductibility of investment expenses have changed.

Since maximizing your tax deductions has the potential to reduce your tax burden, let’s look at some of the most common deductible investment expenses and how they can reduce your taxable income.

No more deduction for miscellaneous investment-related expenses

Prior to the TCJA, taxpayers were allowed a tax deduction for certain expenses known as “miscellaneous itemized deductions.” Miscellaneous itemized deductions included expenses such as fees for investment advice, IRA custodial fees, and accounting costs necessary to produce or collect taxable income. For tax years 2018 to 2025, these deductions have been eliminated.

Despite concerns about the loss of these deductions, many investors may not have actually been receiving a tax benefit with the previous tax code. Prior to the TCJA, three main limitations caused people to lose a portion or all of their deductions:

- The 2% adjusted gross income (AGI) limitation on miscellaneous itemized deductions required your miscellaneous itemized deductions to be greater than 2% of your AGI before you could receive any benefit.

- The 3% Pease limitation could reduce your overall itemized deductions after you earned a certain amount of income.

- The alternative minimum tax (AMT) could kick in if your income and deductions were too large, resulting in a loss of all or a portion of your itemized deductions.

The net effect of these limitations resulted in quite a few taxpayers thinking that they had received a deduction, but in reality, they had lost the deduction or had seen only a limited benefit.

For many taxpayers the combination of all the changes within the TCJA (such as the new tax rates and brackets) may have offset the loss of miscellaneous itemized deductions.

Investment interest expense

If you itemize your deductions, you may be able to claim a deduction for your investment interest expenses. Investment interest expense is the interest paid on money borrowed to purchase taxable investments. This includes margin loans for buying stock in your brokerage account. In these cases, you may be able to deduct the interest on the margin loan. (This wouldn’t apply if you used the loan to buy tax-advantaged investments such as municipal bonds.)

The amount that you can deduct is capped at your net taxable investment income for the year. Any leftover interest expense gets carried forward to the next year and potentially can be used to reduce taxes in the future.

To calculate your deductible investment interest expense, you need to know the following:

- Your total investment income for investments taxed at your ordinary income rate

- Your total investment interest expenses (for loans used to purchase taxable investments)

To calculate your deductible investment interest expense, you first need to determine net investment income. This normally includes ordinary dividends and interest income, but does not include investment income taxed at the lower capital gains tax rates, like qualified dividends, or municipal bond interest, which is not taxed.

Now, compare your net investment income to your investment interest expenses. If your expenses are less than your net investment income, the entire investment interest expense is deductible. If the interest expenses are more than the net investment income, you can deduct the expenses up to the net investment income amount. The rest of the expenses are carried forward to next year.

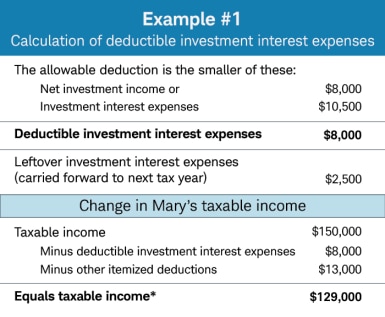

For example, let’s say Mary has $150,000 of total income, $8,000 of investment income (from ordinary dividends and interest income), $10,500 of investment interest expenses from a margin loan, and $13,000 of other itemized deductions (such as mortgage interest and state taxes).

*Example assumes that Mary itemizes deductions.

The example is hypothetical and provided for illustrative purposes only.

Because of the investment interest expense deduction and other itemized deductions, Mary’s taxable income has been reduced from $150,000 to $129,000.

Qualified dividends

Qualified dividends that receive preferential tax treatment aren’t considered investment income for purposes of the investment interest expense deduction. However, you can opt to have your qualified dividends treated as ordinary income.

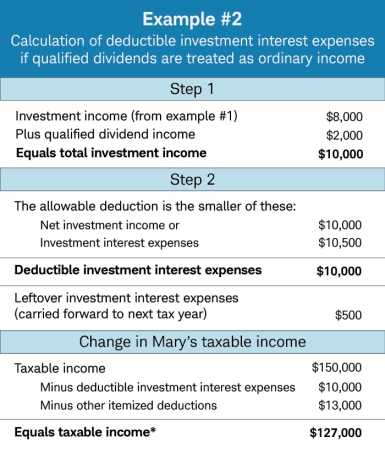

In the right circumstances, electing to treat qualified dividends as ordinary dividends can increase your investment interest expense deduction, which could allow you to pay 0% tax on the dividends instead of the 15% or 20% tax that qualified dividends normally receive. Here’s an example of how it might work.

In addition to the information in the first example, let’s say Mary has $2,000 of qualified dividends, on which she would normally pay $300 in tax ($2,000 x 15% tax rate). If Mary elected to treat the qualified dividends as ordinary income, she could boost her net investment income from $8,000 to $10,000. As a result, she would be able to deduct more of her investment interest expense in the current year —and pay no tax on the qualified dividends.

*Example assumes that Mary itemizes deductions.

The example is hypothetical and provided for illustrative purposes only.

Because Mary is a tax-savvy investor, she was able to reduce her taxable income from the original $150,000 to $127,000. That $10,000 investment interest expenses deduction resulted in $2,220 of tax savings (assuming an ordinary tax rate of 24% and a long-term capital gains tax rate of 15%).

Note: The election to treat qualified dividends as ordinary dividends should not be taken lightly. Once made, the election can only be revoked with IRS consent. Consult with your tax professional before implementing this tax strategy.

Capital losses

Losing money is never fun, but there is a silver lining. Capital losses can be used to offset your capital gains. If your capital losses exceed your capital gains, up to $3,000 of those losses (or $1,500 each for married filing separately) can be used to offset ordinary income and lower your tax bill. Net losses of more than $3,000 can be carried forward to offset gains in future tax years.

For more information about maximizing the tax benefit of capital losses and understanding strategies like tax loss harvesting, see Reap the Benefits of Tax-Loss Harvesting to Lower Your Tax Bill.

Don’t forget about the cost basis of your investment

To make the most effective use of capital losses, keep track of your investment cost basis. The cost basis is generally equal to an investment’s purchase price plus any expenses necessary to acquire that asset, such as commissions and transaction fees.

When you sell your investment, the cost basis is used to reduce the taxable gain. For more on cost basis, see Save on Taxes: Know Your Cost Basis.

Where to get help

The IRS also has some resources that provide examples and detailed explanations of the topics included in this article, including: Publication 550, Publication 529, and the instructions for Form 1040, Schedule A, Schedule D, and Form 4952.

In addition, be sure to consult your tax professional (CPA, lawyer, or enrolled agent) about your situation, preferably well before the end of the year. No matter the time of year, it’s also a good idea to check with your tax advisor before you enter into any transaction that might have significant tax consequences.

What You Can Do Next

Make sure that you’re considering the potential tax implications of your investments. Learn more about investment advice at Schwab.

Talk to a financial professional. Find a Schwab Financial Consultant or visit a branch near you.

By

By