4 Ways to Maximize Charitable Giving Impact

One silver lining to come out of the pandemic has been the significant increase in giving to support those impacted the most. According to Giving USA, charitable giving in the U.S. reached a record $471.44 billion in 2020, up 5.1% from 2019.1 As of June 2021, charitable giving has nudged even higher with a 6.1% increase over the prior 12 months.2

As the giving season approaches, consider these four ways to maximize your giving power while potentially minimizing your tax liability.

1. Give appreciated non-cash assets instead of cash

Aside from generosity, the upward trend in charitable giving can be traced to economic factors, including growth of the S&P 500® index. With the S&P 500 roughly doubling between 2016 and 2021, many investors have highly appreciated non-cash assets—such as publicly traded securities, restricted stock, real estate investments, and private business interests—in their portfolios.

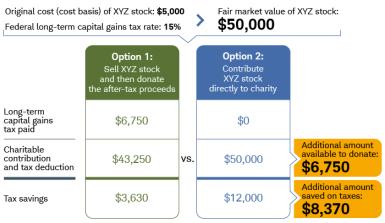

Before you sell appreciated non-cash assets to donate the proceeds, consider contributing the assets instead. If you’ve held the assets for more than one year, you could possibly increase your gift as well as your tax savings. Gifting the assets generally eliminates the capital gains tax you would incur from selling them—allowing you to potentially donate up to 20% more and, thereby, lowering your tax liability. Let’s take a look at how this strategy would work if you owned stock XYZ with a current value of $50,000.

Donating stock assets vs. after-tax sale proceeds

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (24% in this example), minus the long-term capital gains taxes paid.

If you decide to sell XYZ stock, with an original cost basis of $5,000 and a 15% capital gains tax rate, your charitable gift would be $43,250 after paying a long-term capital gains tax of $6,750 (($50,000 – $5,000) x 15%). Assuming your tax rate is 24%, your tax savings would be $3,630 (($43,250 x 24%) – $6,750).

By donating XYZ stock instead, you wouldn’t pay the long-term capital gains tax, allowing you to gift the full $50,000 value—a tax savings of $12,000 ($50,000 x 24%). With this strategy, the charity would receive the $6,750 that you would’ve owed on long-term capital gains tax—a win-win situation for both the charity and you.

2. Bunch charitable contributions

With 2022 standard deduction limits expected to increase from current levels,3 itemizing deductions may be more trouble than it's worth. If your total itemized deductions fall short of the standard deduction, you could benefit from consolidating two years’ worth of giving into one.

For instance, let’s say you decide to bunch, or combine, your 2021 and 2022 charitable contributions into one year (2021). You would then itemize deductions on your 2021 tax return and take the standard deduction in 2022. In addition to achieving a large charitable impact in 2021, this strategy could produce a larger two-year deduction compared to two separate years of itemized deductions, depending on your income level, tax filing status, and giving amounts each year.

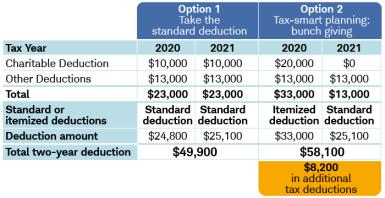

Here’s an example of how a married couple with no children could claim an additional $8,200 in tax deductions by bunching their annual contributions of $10,000 for both 2020 and 2021 on their 2020 tax return.

Taking the standard deduction vs. bunch giving

This hypothetical example is for illustrative purposes only.

In this scenario, the couple averages $10,000 in charitable deductions and $13,000 of other deductions (a total of $23,000) each year. With Option 1, the couple chooses to take the higher standard deduction amounts of $24,800 in 2020 and $25,100 in 2021—a two-year total of $49,900.

The alternative is to bunch their charitable giving for 2020 and 2021 so that they donate $20,000 in 2020 and nothing in 2021. They could then claim $33,000 in itemized deductions in 2020 and the standard deduction of $25,100 in 2021 for a two-year total of $58,100—$8,200 more than if they had taken the standard deduction both years.

If you had bunched two or more years of contributions for 2020 and plan to take the standard deduction for 2021, you may also consider taking the special CARES Act deduction ($300 for single filers and $600 for married couples) for cash donations made to operating charities4 in 2021.

Alternatively, if you itemize deductions and wish to achieve a large charitable impact in 2021, you may choose to give beyond your normal annual adjusted gross income (AGI) deduction limits. Then, you can carry over the excess amounts up to five tax years.5

Keep in mind that if you want a 2021 tax deduction, your gift must be received and processed by December 31, 2021, and some non-cash assets require additional processing time.

3. Give more by donating retirement assets

If you’re in or near retirement or are reviewing your estate plan, you might consider these three tax-smart tips to help maximize your charitable impact this year as part of your overall legacy planning.

- Make a Qualified Charitable Distribution (QCD) of individual retirement account (IRA) assets. If you’re age 70½ and older, you can direct up to $100,000 per year tax-free from your IRAs to operating charities through QCDs— regardless of whether you itemize deductions or claim the standard deduction. By decreasing the IRA balance, a QCD may also reduce your taxable income in future years, lower your taxable estate, and limit your IRA beneficiaries’ tax liability. QCD requests generally should be initiated by early December at the latest to ensure processing is complete before the end of the year.

- Use a charitable deduction to help offset the tax liability of a retirement account withdrawal. This strategy may be used if you are over age 59½ (to avoid an early withdrawal penalty) and will itemize deductions for 2021. As with the above strategy, a withdrawal offers the additional benefits of potentially reducing your taxable estate and limiting tax liability for account beneficiaries.

- Convert retirement accounts to Roth IRAs. If you itemize deductions and have tax-deferred retirement accounts, such as a traditional IRA, you can use charitable deductions to help offset the tax liability on the amount converted to a Roth IRA. The primary benefits of a Roth IRA are earnings can potentially grow tax free, qualified withdrawals are tax free if holding period and age requirements are met, you’ll have no annual required minimum distribution, and the tax liability for beneficiaries is eliminated (depending on the timing). Be sure to talk with a tax professional or financial advisor before deciding to do a Roth IRA conversion.

4. Recommend recurring grants for unrestricted use

Predictable and steady streams of revenue help charities solidify their finances and effectively plan and deliver their services, especially during difficult times. You can provide ongoing revenue through a series of recurring grants awarded indefinitely or over a defined period of time through a donor-advised fund.

A donor-advised fund is an investment account administered by a charitable sponsor that is used solely for charitable giving. You receive a tax deduction for the year that you contribute cash, appreciated assets, or investments to your account.6 However, the CARES Act incentives mentioned earlier won’t apply.

Fund assets may be invested in investment pools or managed by an investment advisor, and your earnings can potentially grow tax-free. Typically, you can grant any amount to an operating charity at any time. And you can direct your gift toward a specific purpose or wherever the charity needs funding to fulfill its mission.

As with other investment accounts, you might pay administrative or investment fees—such as operating expenses or commissions—depending on how your assets are invested and managed. Also, take note that a donor-advised fund is irrevocable, meaning you can’t withdraw funds for non-charitable giving purposes.

Upon your death, your survivors may use your account to continue your legacy of giving, close the account and distribute the assets to one or more charities, or roll over the assets into the fund sponsor’s endowment. It would be wise to state your wishes in your estate planning documents as soon as you open your account.

Sharing the wealth

Even as the economy and people’s financial situations recover from the effects of the pandemic, the need for charitable giving will always remain. Consider including a giving strategy as part of your financial plan. Your investment, tax, and legal advisors can help you determine the best strategies to amplify your generosity.

1“Charitable giving grew 5.1 percent in 2020, ‘Giving USA’ finds.” https://philanthropynewsdigest.org/news/charitable-giving-grew-5.1-percent-in-2020-giving-usa-finds.

2“The Blackbaud Institute Index, Your Source for Charitable Giving Trends.” https://institute.blackbaud.com/the-blackbaud-institute-index/.

3Standard deduction limits for 2021 are $25,100 for married couples filing jointly, $12,550 for single filers and married couples filing separately, and $18,800 for heads of households.

4Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.

5Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non-cash assets held more than one year and 60% of AGI for contributions of cash. Donation amounts in excess of these deduction limits may be carried over up to five tax years.

6A donor’s ability to claim itemized deductions is subject to a variety of limitations, depending on the donor’s specific tax situation. Donors should consult their tax advisors for more information.

What You Can Do Next

Read more about the basics of giving.

Learn how to give through a donor-advised fund with Schwab Charitable™.

By

By

By

By