8 Questions on the Bond Market and Rate Hikes

The bond market was hit hard this year as surging inflation and the prospect of Federal Reserve rate hikes sent yields up and prices sharply lower. Although the Fed has only raised rates once by 0.25%, Fed officials have signaled their intention to tighten monetary policy significantly by raising short-term interest rates and shrinking its balance sheet.

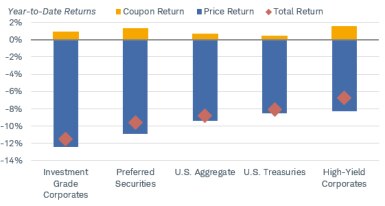

Nowhere to hide in the bond markets this year

Source: Bloomberg. Total returns from 12/31/2021 through 4/18/2022. Indexes representing the investment types are: Bloomberg U.S. Aggregate Bond Index (LBUSTRUU Index), Bloomberg U.S. Treasury Index (LUATTRUU Index), Bloomberg U.S. Treasury Inflation-Protected Bond Index (LBUTTRUU Index), Bloomberg U.S. Corporate Bond Index (LUACTRUU Index), Bloomberg U.S. Municipal Bond Index (LMBITR Index), Bloomberg U.S. Corporate High-Yield Bond Index (LF98TRUU Index), Bloomberg Global Aggregate ex-USD Bond Index (LG38TRUU Index), Bloomberg Emerging Markets USD Aggregate Bond Index (EMUSTRUU Index), ICE BofA Fixed Rate Preferred Securities Index (P0P1 Index), Bloomberg U.S. Floating-Rate Notes Index (BFRNTRUU Index), S&P/LSTA Leveraged Loan Index (SPBDLL Index), and the Bloomberg U.S. Securitized Index (LD19TRUU Index). Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly Past performance is no guarantee of future results.

Given this backdrop, investors are naturally concerned about their fixed income investments. In our view, there are still risks in the market, but rising interest rates may also provide opportunities for income investors.

The following are some of the most frequently asked questions we’ve received this year.

1. Why were bond returns so bad at the start of 2022?

Bond prices and yields move in opposite directions, so rising bond yields sent prices lower. High inflation and the Federal Reserve’s pivot to a more aggressive approach to rate hikes were the main culprits for the surge in yields.

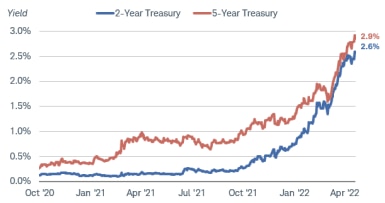

The two-year Treasury yield rose more than 180 basis points this year through April 19th, with the five-year Treasury yield up 160 basis points.

Treasury yields are up sharply this year

Source: Bloomberg, using daily data as of 4/19/2022.US Generic Govt 2 Yr (USGG2YR Index) and US Generic Govt 5 Yr (USGG5YR Index). Past performance is no guarantee of future results.

The performance of short-term bonds might have caught investors off guard. While short-term bonds are less sensitive to rising rates than long-term bonds, the magnitude of the rise in yields resulted in poor performance across the board, including short-term bond investments, whose prices have historically been more stable. The Bloomberg U.S. Aggregate Bond Index suffered its worst quarterly decline since 1980. Nearly every domestic bond index we track suffered a loss in the first quarter of the year.

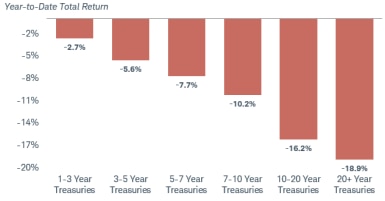

Consider the one- to three-year Treasury index total return. As illustrated below, it is down 2.5% this year. For this index to continue to deliver such a low return over the next three and a half months, the two-year Treasury yield would need to rise as much as it has already, which is unlikely in our view.

Even short-term Treasuries are down this year

Source: Bloomberg. Total returns from 12/31/2021 through 4/18/2022. Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Indexes representing the investment types are: Bloomberg U.S. Treasury 1.3 Year Index (LT01TRUU Index), Bloomberg U.S. Treasury 3-5 Year Index (LT02TRUU Index), Bloomberg U.S. Treasury 5-7 Year Index (LT03TRUU Index), Bloomberg U.S. Treasury 7-10 Year Index (LT09TRUU Index), Bloomberg U.S. Treasury 10-20 Year Index (I00059US Index), and the Bloomberg U.S. Treasury 20+ Year Index (LT11TRUU Index. Past performance is no guarantee of future results.

2. If the Federal Reserve keeps hiking rates, won’t prices keep falling?

Possibly, but we believe the magnitude will be significantly less than the price declines already experienced this year.

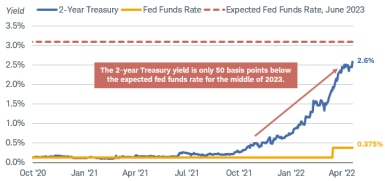

The bond market is forward-looking and yields tend to rise in anticipation of changes to the federal funds rate. We’ve already seen that happen, especially with two-year Treasury rates. If the markets are right and the Fed does hike rates to the 3.1% area, there’s not much more upside with short-term Treasury yields, especially compared with the recent rise.

The two-year Treasury yield is approaching the mid-2023 expected fed funds rate

Source: Bloomberg, using daily data as of 4/19/2022.US Generic Govt 2 Yr (USGG2YR Index) and Federal Funds Target Rate Mid Point of Range FDTRMID Index). The 3.1% expected fed funds rate for June 2023 is based on the fed funds futures market, as of 4/19/2022. Past performance is no guarantee of future results.

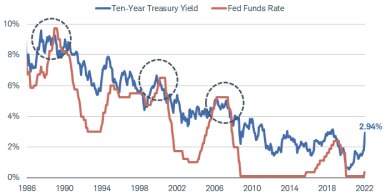

The relationship is slightly different for long-term bonds. While short-term Treasury yields tend to be driven directly by changes in the fed funds rate, long-term Treasury yields have a more indirect relationship. Since 10 years is a long period of time, the 10-year Treasury yield doesn’t necessarily move along with each hike (or cut) to the fed funds rate. Rather, the 10-year Treasury yield tends to adjust based many factors, such as where the fed funds rate is expected to be in the future and how long it will stay there, as well as expectations for inflation and economic growth.

Historically, the 10-year Treasury yield has often peaked near a cycle’s peak fed funds rate. Although the market is pricing in a steep rise in the fed funds rate (to more than 3% by mid-2023), it is also discounting rate cuts in late 2023 and 2024. With the 10-year Treasury yield approaching 3%, there doesn’t appear to be much upside with 10-year Treasury yields, either.

There are risks, of course. If our outlook is wrong, and the Fed tries to fight inflation by hiking rates more than markets expect, there may be more upside with long-term yields. The yield increases would be accompanied by price declines.

The 10-year Treasury yield tends to peak near the peak fed funds rate

Source: Bloomberg, using daily data as of 4/19/2022. US Generic Govt 10 Yr (USGG10YR Index) and Federal Funds Target Rate Mid Point of Range FDTRMID Index). Past performance is no guarantee of future results.

3. Are bond mutual funds or ETFs a good investment in this environment?

For certain investors, bond mutual funds or ETFs are an appropriate investment even though rates are rising. A fund is simply a portfolio of individual bonds. Unlike an individual bond, bond funds generally don’t have a maturity date, so investors don’t know the value they’ll receive in the future.

Unfortunately, income returns have not been enough to offset the decline in prices of most bond investments this year. But if we are correct in saying that much of the bad news has been priced into the market at current yields, then prices may begin to stabilize or improve going forward. Meanwhile, income payments will continue; they may even rise for bond funds as fund managers rebalance in a rising-rate environment.

Total return breakdown: price vs. income returns

Source: Bloomberg. Total returns from 12/31/2021 through 4/13/2022. Indexes represented are the Bloomberg U.S. Corporate Bond Index (Investment Grade Corporates), Bloomberg U.S. Corporate High-Yield Bond Index (High-Yield Corporates), ICE BofA Fixed Rate Preferred Securities Index (Preferred Securities), Bloomberg U.S. Aggregate Bond Index (U.S. Aggregate), and the Bloomberg U.S. Treasury Bond Index (U.S. Treasuries). Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no indication of future results.

When looking at the gain or loss of a bond fund, keep in mind that it usually only considers the change in price, not any income received or reinvested. To get a more accurate measure of what the total return is, consider income as well.

4. Shouldn’t I wait until the Fed hits its peak rate before I invest?

It may be tempting to sit in very short-term investments while the Fed is hiking rates, but that could mean missing out on today’s higher-income opportunities. For example, consider a money market fund that yields roughly 0.25%. That yield should continue to rise as the Fed hikes rates, but a five-year Treasury yield already offers a yield of 2.6%. To match that Treasury’s average yield, the hypothetical money market fund yield would have to rise by roughly 120 basis points a year, each year (for example, from 0.25% today to 1.45% in year two, and then a similar increase over the next three years) for the incomes to match over a five-year period.

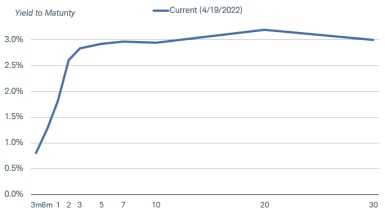

5. What part of the yield curve is the most attractive?

The Treasury yield curve is the line that plots the yields of Treasuries of all maturities, starting with very short-term maturities and ending at 30 years. As the chart below illustrates, the yield curve is steep from three months through two years, but then it’s very flat from two years through 30 years.

Yield curve snapshot

Source: Bloomberg, as of 4/19/2022. Past performance is no guarantee of future results.

We suggest investors gradually extend the duration of their bond holdings to benefit from the increase in yields. Duration is a measure of how prices will change relative to changes in interest rates. How far to extend will depend on the investor’s objectives and risk tolerance.

To do this, consider a bond ladder. Bond ladders can be another way to take advantage of rising rates while not trying to time the market. Schwab clients can use the CD & Treasury Ladder Tool to build your own bond ladder online.

6. The yield curve is very flat and inverted in some places —should I be worried?

Historically, inverted yield curves have preceded recessions, so any time the curve flattens as much as it has this year, recessions warnings begin to make headlines.

The time between when the yield curve inverts and the next recession has varied. More importantly, the fixed income and equity market performance during those periods has varied, meaning it’s not a reliable investment signal.

Inverted yield curves don’t necessarily cause recessions—rather, they are symptoms of tight financial conditions that can slow growth. For example, the yield curve last inverted in August 2019—months before the COVID-19 pandemic began. Fast-forward to February 2020 and the U.S. economy experienced the shortest recession on record due to the COVID crisis—not because the yield curve inverted the year before.

The slope of the yield curve represents what the markets expect short-term rates to average over time. The yields on maturities of two-year Treasuries and beyond have converged between 2.5% and 3%, consistent with the market estimate of the Fed’s “neutral rate.” The good news is that the short-term slope, a key indicator for Federal Reserve officials, is still steep. While risks to economic growth are rising, we’ll be more concerned when we see the short-term slope flatten or invert.

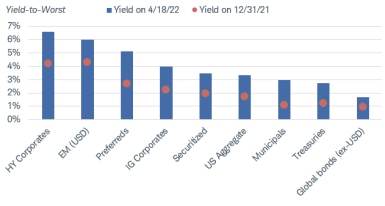

7. What are potential opportunities in the bond market today?

Given our outlook that yields are near their peak, investors should consider locking in those yields now by considering intermediate- or modestly longer-term bonds, in moderation.

For those who prefer to stay in cash, consider moving out to two- or three-year Treasuries. It’s not our preferred strategy, but we know a lot of investors likely don’t want to come off the sidelines until they feel more confident about inflation declining. Instead of waiting for cash or money market fund rates to rise, investors can potentially earn 2.5% or more and get paid to wait.

For those willing to take a little extra risk, intermediate-term investment-grade corporates appear attractive—the average yield of the intermediate-term corporate bond index is now 3.7%. With an average duration of 4.4 years, the index is still subject to price declines if yields rise, but the duration is well below the average duration of 7.8 years of the broad corporate bond market, meaning less interest rate risk.

For investors in higher tax brackets, yields on municipal bonds look especially attractive. The Bloomberg Municipal Bond Index offers a yield of nearly 2.9%, which is the equivalent of a roughly 5.9% taxable yield for an investor in the top tax brackets. In addition, we believe credit risk in the muni market is low due to the multiple rounds of fiscal aid Washington gave state and local governments in an effort to support the economic recovery during the pandemic.

For those willing to take a bit more risk to earn higher yields, preferred securities appear attractive. Prices have been hit hard by the double whammy of surging long-term Treasury yields and stock market volatility. However, aside from the pandemic-driven plunge in March 2020, average prices have rarely been lower, and the price plunge provides a relatively attractive entry point.

The sharp rise in yields has created opportunities for income-oriented investors

Source: Bloomberg. As of 4/18/22. Indexes representing the investment types are: Bloomberg U.S. Aggregate Bond Index (LBUSYW Index), Bloomberg U.S. Treasury Index (LUACYW Index), Bloomberg U.S. Corporate Bond Index (LUACYW Index), Bloomberg U.S. Municipal Bond Index (LMBIYW Index), Bloomberg U.S. Corporate High-Yield Bond Index (LF98YW Index), Bloomberg Global Aggregate ex-USD Bond Index (LG38YW Index), Bloomberg Emerging Markets USD Aggregate Bond Index (EMUSYW Index), ICE BofA Fixed Rate Preferred Securities Index (P0P1 Index), and the Bloomberg U.S. Securitized Index (LD19TRUU Index). Past performance is no guarantee of future results.

8. I’m worried about inflation, what can I do?

Consider Treasury-Inflation Protected Securities, or TIPS. TIPS are indexed to the consumer price index, so their principal values and coupon payments rise and fall with the level of inflation. There are a few considerations for TIPS investors:

- TIPS yields are negative. That shouldn’t be too much of a surprise since nominal Treasury yields are negative after adjusting for the level of inflation today. If you invest in a TIPS with a negative yield and hold to maturity, you lock in a “real” or inflation-adjusted loss. Nominal returns can be positive, however, depending on the rate of inflation.

- TIPS can offer inflation protection over the long run, but not necessarily over the short run. TIPS prices and yields move in opposite directions, just like traditional bonds. Over the short run, price movements in the secondary market may offset the inflation adjustment. For example, the consumer price index rose sharply in the first three months of this year, but the Bloomberg U.S. TIPS Index still lost 3.5%, since the rise in yields/drop in price offset that inflation adjustment. As the chart below illustrates, TIPS prices are down sharply this year—enough to offset the inflation adjustment.

TIPS prices have declined, offsetting the CPI adjustments

Source: Bloomberg, using daily data as of 4/18/2022. Past performance is no guarantee of future results.

- Breakeven rates are high. A breakeven inflation rate is the difference between the yield of a TIPS and the yield of a nominal Treasury with a similar maturity. That rate is what inflation would need to average over the life of the TIPS for its total return to break even with the total return of the nominal Treasury. Breakeven rates are near all-time highs, which isn’t too surprising given the current rate of inflation. But if you think that inflation will remain elevated for years—and higher than the breakeven rates shown above—then TIPS can still make sense.

What to do now?

We don’t believe the performance of the fixed income markets in the first part of the year is a reason to abandon fixed income. The move up in yields has created opportunities we haven’t seen in many years. For help selecting the solutions for your situation, consider reaching out to a Schwab representative.

By

By

By

By