Looking to the Futures

Cows Silent in Cash Trade

Live Cattle futures traded lower in Wednesday's session as USDA reports showed a decline in boxed beef and non-existent cash market. Live Cattle Futures for June delivery, /LEM24, settled at 176.475, down 1.15 from previous settlement.

According to the United States Department of Agriculture (USDA), daily cattle summary, all regions reported the cash trade was at a standstill for Tuesday. Choice cutouts were down $1.82 at $296.67, and Select cutouts were down $4.09 at 288.25. The five-area weekly accumulated weighted average cattle price showed $184 for Live steer at 35 head with an average weight of 1,450 lbs., Live heifer showed $185 at 1,925 head with an average weight of 1,275 lbs., Dressed heifer showed $295 at 90 head with an average weight at 888 lbs.

Wednesday's slaughter report shows 123,000 head were slaughtered bringing week to date up to 367,000. Week over week the slaughter count is up 7,000 but year over year, down 11,722.

Avian flu is still impacting cattle across nine states in the lower forty-nine but mainly in dairy cattle. The CDC first reported the multi-state outbreak on March 25, 2024, across Texas, Kansas, and New Mexico. Currently, the virus has also been detected in Colorado, Idaho, South Dakota, Michigan, Ohio, and North Carolina across thirty-six herds.

The Federal and State governments have been working to mitigate the spread of bird flu by testing an animal before it is transported across state lines. These tests also include taking samples from milk in processing and taken from store shelves. The Food and Drug Administration (FDA) has asked farmers to discard any milk produced from infected animals.

The Center for Disease Control (CDC) has indicated the spread to humans remains low but people that have a job-related exposure are at greater risk to contracting the virus.

Technicals

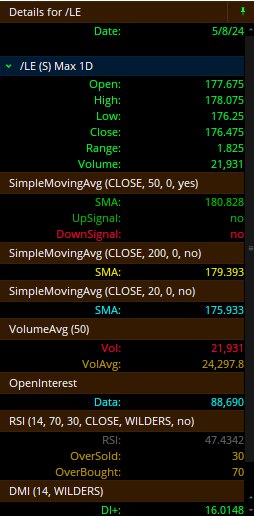

Live Cattle Futures for June delivery, /LEM24, settled at 176.475, down 1.15 from previous settlement.

Cattle the 20-day simple moving average (SMA) has moved beneath the 50- and 200-day SMAs. The 50-day SMA is not far behind in crossing the 200-day as the trend is reflected as bearish. The 20-day SMA is at $175.93; the 50-day SMA is at $180.82 and t he 200-day SMA is at 179.39.

The 14-day RSI is at 47.434% and pointing down, indicating a bearish move.

The Directional Movement Index is showing negative. The ADX is high giving a positive trend direction. The positive directional index is low and pointing down, giving an indication that a move up is less likely. The negative directional index is elevated and pointing up, indicating that a move down is more likely.

Looking at the chart below, cattle is off its highs from March and has been trading within a channel since the beginning of April near the levels of 170 and 180. The contract attempted to break out on 4/22 but was rejected and traded to a new weekly low of $172.70 on 5/1. In order for cattle to start a new bull trend it would need to hold above the $180 level, otherwise, it may be posting a flag chart pattern which would continue the bearish trend.

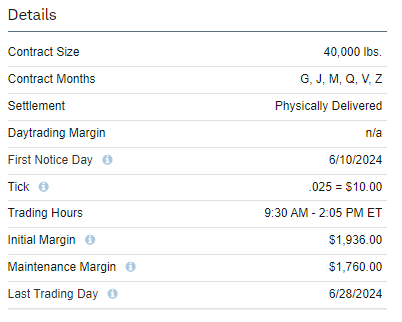

Contract Specifications

Live Cattle June 2024 (/LEM24)

Trading Calendar

Continuing Claims 8:30 AM ET

EIA Natural Gas Inventories 10:30 AM ET

Initial Claims 8:30 AM ET