Geopolitical Risk Update: Russia-Ukraine

In an apparent desire to create a weakened border state unable to join NATO, Russia supported separatists in eastern Ukraine by recognizing the independence of two regions: Donetsk and Luhansk. In support, Russia ordered “peacekeeping” troops to the areas, prompting sanctions by world powers. This was a risk we cited in our Top Global Risks of 2022 published late last year and elaborated on in January’s Guide to Geopolitical Risk: Russia-Ukraine. We wrote that the market response may be muted and cautioned investors against overreacting in their portfolios.

In textbook fashion, stocks declined modestly—about 1%—in the U.S., Europe and emerging markets on Tuesday. Sanctions announced so far by Germany, the U.K. and the U.S., have been as expected and are likely to have a limited impact on the global economy and inflation. Russia seems to be bearing the brunt of the costs of its actions. These events are not likely to impact central bank policies—a key driver of markets this year—unless energy prices spike and exacerbate inflation pressures or economic momentum slows due to uncertainty around further developments.

A history of mild market reactions

While Russian military confrontations can be unsettling, markets tend to take them in stride, as the impact on global economic and earnings growth tends to be small. Prior Russian geopolitical events include:

- August 8, 2008: Russia accused Georgia of attacking pro-Russian separatists and launched an invasion of Georgia, which Russia called a "peace enforcement" operation, recognizing the independence of Abkhazia and South Ossetia from Georgia. Stocks ended higher that day in the U.S., international developed and emerging markets.

- August 3, 2014: Unmarked Russian troops invaded Ukraine to support pro-Russia separatists and annex Crimea. The Russian air force engaged NATO members as the U.S. and allies began military exercises on Russia's border. Stocks fell less than 2% that day in the U.S., international developed and emerging markets. They shortly began to rebound from those losses.

Historical geopolitical events involving Russia

*Turkey is a member of NATO, now and at the time of the event.

Source: Charles Schwab & Co., Inc. and FactSet. Data retrieved 1/28/2022. All price performance is in USD. Past performance is no guarantee of future results.

This mild market reaction to geopolitical events is not limited to those involving Russia. A long history of geopolitical developments has seen a similarly muted reaction in markets.

Sanctions impacts

Sanctions announced have been limited in scope, leaving room for more if additional actions warrant:

- Germany: Chancellor Scholz announced on Tuesday that he would continue to delay approval of the Nord Stream 2 pipeline of natural gas to Germany (construction was finished in September). German regulators have yet to issue the final legal permission Russia needs to begin operations. Natural gas prices in Europe rose on Tuesday but remain well below recent highs. Some countries in Europe have preemptively placed a cap on consumer prices for gas this winter so consumers might not feel any further rise immediately.

European natural gas prices for March delivery well off December highs

Source: Charles Schwab, Bloomberg data as of 2/22/2022.

- U.K.: Prime Minister Johnson announced sanctions on five Russian banks (Rossiya, IS Bank, General Bank, Promsvyazbank, and Black Sea Bank) and three Russian oligarchs (Gennady Timchenko, Boris Rotenberg and Igor Rotenberg). These are likely to have a very limited impact on the U.K. economy or inflation.

- U.S.: Thus far, a U.S. executive order by President Biden bans investment, trade and financing by U.S. entities in Donetsk and Luhansk and will prohibit American financial institutions from processing transactions for Russian bank VEB and its military bank. The U.S. also maintains sanctions from past events. The 2014 sanctions imposed by the Obama administration on Russia, after its invasion of Crimea, remain in effect. Additional sanctions imposed by the Trump administration after Russian meddling in the 2016 U.S. election remain in place. And further sanctions were applied by the Biden administration in 2021 after the SolarWinds cyberattack, which exposed data from both the U.S. government as well as hundreds of American companies. Any further sanctions imposed are unlikely to have meaningful economic impact on the U.S., due to limited economic exposure.

Were the U.S. to follow through on its threat to restrict Russian banks from the SWIFT global payments network, it would be much harder for Russia to export oil. This would hurt Russia’s main source of direct revenue but may also risk pushing energy prices higher for the rest of the world at a time when inflation is well above average. A U.S.-led nuclear deal with Iran in the next few weeks could come at a critical time to offset an oil supply crunch. In normal times, central banks tend to look past an energy-led rise in inflation. But with the current elevated pace of inflation, and the potential for a further rise in energy prices to stoke higher inflation expectations, it’s possible policymakers may feel more pressure to raise interest rates.

The potential stock market impact of an energy shock in Europe is difficult to assess from historical data. Whenever the European Union’s energy component of the consumer price index (CPI) exceeded a 10% year-over-year gain (which is approximately one standard deviation above the 25-year average), the impact on European stocks (measured in euros) was mixed.

Energy price spikes in Europe and stock market performance

| Begin Spike | End Spike | MSCI EU Price Performance (USD) | MSCI EU Price Performance (Euro) |

|---|---|---|---|

| 12/1/1999 | 12/1/2000 | -1.9% | 5.2% |

| 4/1/2005 | 6/1/2006 | 18.0% | 20.3% |

| 1/1/2008 | 9/1/2008 | -33.6% | -29.1% |

| 12/1/2010 | 11/1/2021 | -5.8% | -8.1% |

| 4/1/2021 | 1.8% | 6.9% |

Source: Charles Schwab, Data from Factset as of 2/2/2022. Past performance is no guarantee of future results.

But this historical data may not be useful since:

- the spike in 1999 preceded the unrelated dot-com recession and bear market,

- the 2008 price spike preceded the unrelated global financial crisis, and

- the 2011 price spike preceded the unrelated European debt crisis.

This makes it hard to say what the impact of these prices spikes on the market would have been had unrelated recessions and bear markets not taken place shortly thereafter.

But, perhaps most importantly, one exception to these examples occurred in 2005–2006 when there was no recession or financial crisis, the Fed was hiking rates, and Russia was in a long-running conflict in Chechnya. This is in some ways similar to the current environment. This period was the most positive for the market, with double-digit gains.

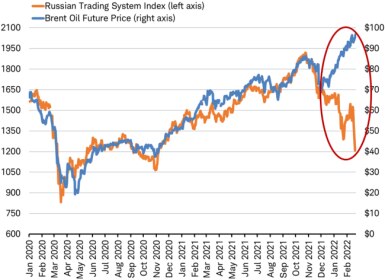

Russia bearing the brunt

Russia’s stock market usually trades in sync with oil prices. But recently, as oil hits new highs, Russian stocks have fallen into a bear market. What could have been a 20% rally in Russian stocks has turned into a 40% crash due to geopolitical tensions.

Stocks and oil prices

Source: Charles Schwab, Bloomberg data as of 2/22/2022. Past performance is no guarantee of future results.

To put these moves in perspective, Russia has very small equity exposure in the global indexes, making up only 3% of the MSCI Emerging Markets Index and just 0.4% of the global stock market as measured by the MSCI AC World Index.

Russia may see a recession as a result of its own actions. The ruble, Russia’s currency, has plunged, making Russia’s imports more expensive. With the U.S. leading a renewed Iranian nuclear deal in the next few weeks, an oil supply crunch could be avoided, prices may stabilize, and market share could be taken from Russia, worsening its export picture.

Takeaway

We don’t believe that diversified investors need to take actions to protect portfolios from the market risks tied to events in Ukraine, with market and economic trends unlikely to be significantly altered.

What You Can Do Next

Read more about Schwab’s perspective on current markets.

Talk to us about the services that are right for you. Call us at 800-355-2162, visit a branch, find a consultant or open an account online.

By

By