How Overtrading Can Undercut After-Tax Returns

It can be tempting to switch out investments in your taxable portfolio in response to prevailing market conditions. However, our research has shown that most investors fail to properly account for the tax consequences of excessive turnover in their taxable accounts.

Here's a look at just how pernicious so-called tax drag can be—and what you can do to combat it.

The tax toll

Every time you sell an investment in a taxable brokerage account, you run the risk of incurring a tax bill. And the more often you trade, the greater the tax toll can be—especially to those in higher tax brackets, who are subject to higher taxes on both short- and long-term gains.

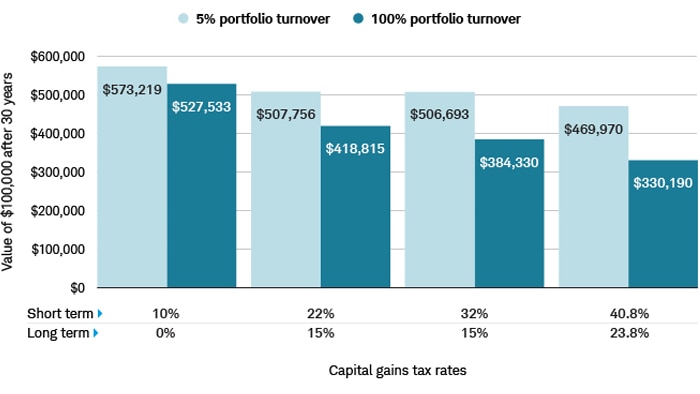

When more means less

Over time, tax drag can severely erode your returns—especially if you're in a higher tax bracket.

Source: Schwab Center for Financial Research.

This hypothetical example is only for illustrative purposes. Assumes 30-year investment horizon, 6% capital gains return, and 0% dividends with 2024 tax brackets. Realized capital gains are based on random portfolio turnover and assume turnover is distributed equally throughout the year, which directly translates to an average holding period. At 5% turnover, it's assumed that realized gains are 97.5% long term/2.5% short term; at 100% turnover, it's assumed that realized gains are 50% long term/50% short term.

For example, an individual in the highest tax bracket who sells and replaces just 5% of their investments each year could see their after-tax returns reduced by nearly three-quarters of a percentage point.

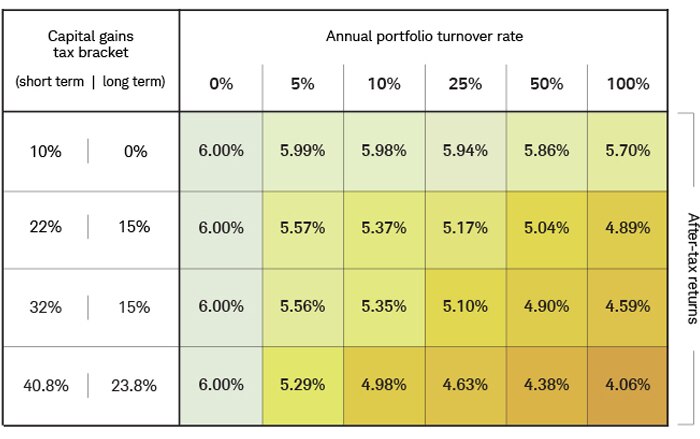

What a drag

The greater the percentage of investments you change out each year, the bigger the associated tax drag—regardless of tax bracket.

Source: Schwab Center for Financial Research.

This hypothetical example is only for illustrative purposes. Assumes 30-year investment horizon, 6% capital gains return, and 0% dividends with 2024 tax brackets. Realized capital gains are based on random portfolio turnover and assume turnover is distributed equally throughout the year, which directly translates to an average holding period. At 5% turnover, it's assumed that realized gains are 97.5% long term/2.5% short term; at 100% turnover, it's assumed that realized gains are 50% long term/50% short term.

That's not to say portfolio turnover is inherently bad. There are plenty of reasons to switch up your investment mix, such as to reduce fees or to replace an underperforming security. But if you regularly change out investments in an attempt to beat the market, the tax drag might not be worth it.

Tax-smart strategies

While investors in the highest tax brackets are most vulnerable to tax drag, the following strategies can help all investors shield more of their returns from taxes.

- Harvest losses: If switching out an investment will result in a capital gain, look for opportunities to offset the associated tax bill by selling an investment with an equivalent or greater loss (a.k.a. tax-loss harvesting).

- Keep high-turnover funds in tax-deferred accounts: Many mutual funds have turnover rates of more than 100%, and it's not uncommon to find funds with an annual turnover rate of more than 400%. These funds are more likely to incur capital gains, which are passed on to investors as taxable distributions. In contrast, most ETFs tend to produce fewer capital gains distributions, making them more tax-efficient investments overall. For example, in 2022, 76% of US Equity Mutual funds paid out capital gains distributions during the year, compared to only 4% of US Equity ETFs.1

- Consider broad-market passive funds: Broad-market index ETFs and mutual funds tend to have lower portfolio turnover because they change their holdings only when their underlying indexes do, which happens infrequently. For example, many ETFs can have an annual portfolio turnover rate of just 2% to 4%.

- Consider tax-managed funds: Certain fund managers make reducing tax drag a priority and use various techniques to reduce the impact of taxes, such as focusing on long-term asset appreciation and avoiding high-dividend-paying stocks. In addition, techniques such as tax-loss harvesting can be used to offset a portion of the gains the fund realizes.

- Think long term: The desire to fiddle with your holdings is often the result of short-term thinking. By creating and then following a sound investment plan, you can free yourself from overreacting to market turbulence—and from the temptation to overtrade.

Work with your Schwab consultant to craft an investment plan that's appropriate for your goals and risk tolerance.

- To view a fund's turnover rate, log in to schwab.com, search for the fund's ticker symbol, then scroll down to the Fund Profile section.

- To research index funds, log in to schwab.com/fundscreener, select Basic in the Choose Criteria menu, and under Fund Characteristics choose Index Fund.

- To research tax-managed funds, log in to schwab.com/fundscreener, select Search by Fund Name under Basic Criteria, then enter "tax-managed" into the search field.

1 "How to Maximize the Tax Efficiency of ETFs," Morningstar, morningstar.com