How to Learn from Your Trading Losses

When you've made some losing trades, the urge to cut your losses and move on can be strong. Why focus on the past when new opportunities could be waiting? But spending some time studying your losers can teach you a lot about why some trades worked and some failed.

Here are some diagnostics you could consider running periodically to see what you can find.

Win/loss ratios

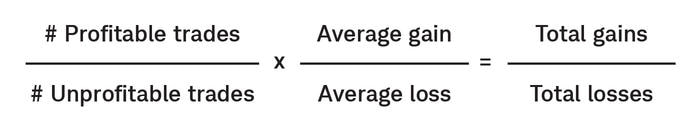

Start by compiling some basic gain and loss statistics, including your numbers of profitable and unprofitable trades, as well as your average gain or loss for each. You can use them to create a simple ratio like this:

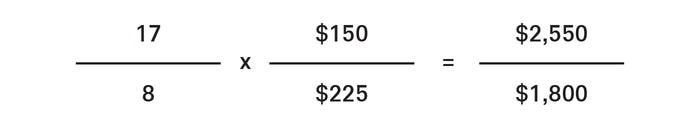

For example, let's say you had 17 profitable trades with an average $150 gain per trade and eight unprofitable trades with an average $225 loss per trade:

If you looked just at your total gains and losses, you might think you'd been doing pretty well: You've got $750 in net profit, and 17 of your 25 trades were profitable.

However, you can also see that your average loss of $225 was 1.5 times bigger than your average gain of $150. What's going on here?

Putting these numbers side-by-side gives you an opportunity to review how you're managing and exiting from your positions. For your winners, could it be that you're taking profit too soon? If so, you could consider looking at what factors are influencing your exit decisions.

And with your losers, is there any chance you're holding on too long in the hope of a recovery? Of course, there are also times when the market suddenly moves against otherwise reasonable positions. But if there are several such reversals, you could take a look at how long you allowed the positions to fall before you acted.

Questions like these underscore the need to draw up—and adhere to—a trade plan before entering a position. If you've already pre-committed to some risk parameters and an exit strategy, you might be less likely to jump out of a winning position too soon, or stick with a losing one too long.

In terms of next steps you could consider trying to exit future losing positions before they reached your average loss. Indeed, you can be wrong more than you're right and still come out ahead—so long as you keep your average loss to a minimum.

Trade expectancy

It's also good to know if you're improving as a trader. Again, this goes beyond your net profit. So, how do you do measure yourself against yourself?

One way is to use trade expectancy, which is the average dollar amount one might expect to gain or lose per trade based on previous performance.

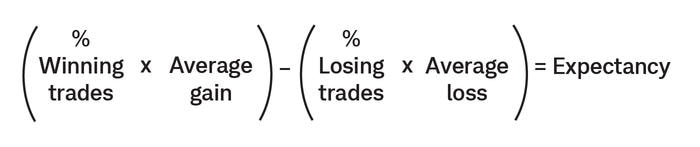

To calculate this, you multiply your percentage of profitable trades by your average gain per trade, then subtract your percentage of losing trades multiplied by your average loss per trade:

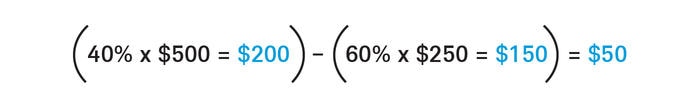

For example, let's say 40% of your trades in the past six months were profitable, with an average gain of $500 per trade, while 60% of your trades were unprofitable, with an average loss per trade of $250.

Now, of course, you can't predict future performance, but given these numbers, you could set a personal benchmark of an average gain of $50 per trade.

Then, you should aim to improve upon it with each trade. If the opposite is happening, it's time to revisit your strategy to see where the breakdowns might be occurring.

Patterns by type of trade

Finally, it can be helpful to organize trades by category. Here are some examples one could use:

- Fundamental versus technical analysis techniques

- Investment types

- Order types

- Time frames

- Trade size

Then you can look for patterns. Do you find less success with longer-term trades, for example? Or when you choose exchange-traded funds versus stocks? Breaking down your positions in this way can help identify which strategies have worked recently and which you may want to improve upon—or avoid altogether.

Taking control

Examining your trading performance on a regular basis can help you better understand any behavior or other factors that may be influencing your outcomes. Paying particular attention to losses is a great way to identify shortcomings.