Bank Loans vs. High-Yield Bonds: How They Stack Up

Bank loans and high-yield bonds both offer some of the highest yields in the fixed income market today. Both are worth consideration for those investors who are willing to take additional risks to earn higher yields, but bank loans are starting to look a bit more attractive than high-yield bonds today.

Bank loans are a type of corporate debt that offer some unique characteristics, but most importantly, they have sub-investment-grade, or “junk,” ratings, which usually means more volatility and greater potential for price declines. With those junk ratings, we consider bank loans to be “aggressive income” investments, alongside other risky assets like high-yield bonds, and they should always be considered aggressive investments.

Below we’ll provide some details on how bank loans work, and what investors should consider when comparing them with high-yield corporate bonds.

Bank loans background

Bank loans—also called “leveraged loans” or “senior loans”—are a type of corporate debt with three distinct characteristics:

- Sub-investment-grade credit ratings. Bank loans tend to have sub-investment-grade credit ratings, meaning those rated BB+ or below by Standard and Poor’s, or Ba1 or below by Moody’s Investors Service. A sub-investment-grade rating means that the issuer generally has a greater risk of default.

- Floating coupon rates. Bank loan coupon rates are usually based on a short-term reference rate plus a spread. The short-term reference rate is usually the three-month London Interbank Offered Rate, or LIBOR, although that will likely change in the future as LIBOR is set to be retired in a few years. The spread above LIBOR is meant as compensation for the lenders.

- Secured by the issuer’s assets. Bank loans are secured, or collateralized, by the issuer’s assets, like inventory, plant, property, and/or equipment. They are senior in a company’s capital structure, meaning they rank above an issuer’s traditional unsecured bonds. Secured doesn’t mean “safe,” however, as bank loans can still default.

One final consideration for bank loan investors is that they can generally only be held by institutional investors, meaning most individual investors can only access the market through a bank loan mutual fund or exchange-traded fund (ETF).

How do bank loans stack up against high-yield bonds?

There a few things investors considering bank loans or high-yield bonds should know:

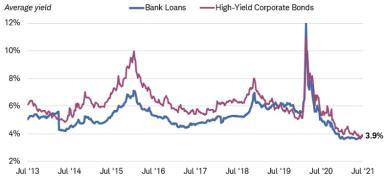

1. Bank loan yields are the same as high-yield bond yields today. The average yields of both the bank loan index and the high-yield bond index are 3.9%, much closer to each other than they’ve been over time. Usually, bank loans offer lower yields due to those senior and secured characteristics, as the chart below illustrates.

Because bank loans rank higher than traditional high-yield bonds, investors generally accept lower yields, as the perceived risk of credit losses is lower. That’s not the case today, as yields of almost all types of investments have plunged to all-time lows.

Bank loan investors can earn very similar yields to high-yield bonds, while being higher in the capital structure. Meanwhile, the floating coupon rates means that their prices should be less sensitive to interest rate fluctuations.

Bank loan yields are the same as high-yield bond yields today

Source: Bloomberg, using weekly data as of 7/30/2021. S&P/LSTA U.S. Leveraged Loan 100 Index (SPBDLLY Index) and Bloomberg Barclays U.S. Corporate High-Yield Bond Index (LF98TRUU Index). Note that the yield for bank loans is the weighted average yield and the yield for high-yield corporate bonds is the average yield-to-worst. Past performance is no guarantee of future results.

2. The bank loan default rate is usually lower than high-yield bond default rate. Bank loans can, and do, still default, despite their “senior” and “secured” characteristics, but they tend to default at a lower rate than traditional high-yield corporate bonds.

The good news is that the default rate for both the loan market and the traditional high-yield bond market likely peaked already, as both rates have dropped considerably over the last few months, and both Moody’s and S&P expect the default rates to continue falling, given such a strong economic backdrop.

It’s not just the default rate that matters for bank loans or high-yield bonds, but how much the bond or loan-holders receive after default, known as the recovery rate. Over time, loans tend to have significantly higher recovery rates—due to their collateralized nature—than high-yield bonds. In the 12 months ending June 2021, the average recovery rate for loans was $55, compared to just $41.1 for traditional bonds.1 The difference is even wider over the last five years, with the loan recovery rate coming in at $63.4, compared with just $41.6 for bonds.1 This means that when markets take a turn for the worse and defaults start to pick up, loan investors should be better off than traditional high-yield bond investors.

Bank loans tend to default at a lower rate than high-yield bonds

Source: Moody’s. “Default Trends—Global, June 2021 Default Report,” July 11, 2021.The trailing 12-month speculative grade loan default rate represents the percent of speculative grade loans that have defaulted as a percent of the rated loan universe.

3. Bank loans generally have less upside and less downside than high-yield bonds, but keep in mind that the price swings can still be wide. Over time, high-yield bonds do provide more upside than bank loans, but during market downturns high-yield bonds tend to see greater price declines.

Bank loans versus high-yield bonds: best and worst three-month total returns

Source: Schwab Center for Financial Research with data from Bloomberg. Indexes represented are the S&P/LSTA Leveraged Loan 100 Index (SPBDLL Index) and the Bloomberg Barclays U.S. Corporate High-Yield Bond Index (LF98TRUU Index). Best and worst 3-month returns using monthly data from January 2002 through June 2021. Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no indication of future results.

Investors should consider a more defensive position when taking additional risks today. While the economic backdrop is very strong, the low yields that bank loans and high-yield bonds offer means there’s very little wiggle room if the economic outlook deteriorates. The higher yields that risky investments offer is meant to compensate for the risk of credit losses, but that compensation is very low today. Investors can cautiously consider bank loans and high-yield investments in moderation, but we believe an investment in bank loans is a bit more defensive. Bank loan prices can still fall, but they may fall less than high-yield bond prices.

What to consider now

Investors looking for higher yields—but willing to take additional risks—can consider both bank loans and high-yield bonds, but bank loans are a bit more defensive in nature given their senior and secured status, but still offer very similar yields. Bank loans’ floating coupon rates help limit their interest rate sensitivity as well, but keep in mind that the coupons float off short-term yields, not long-term yields. It’s unlikely that bank loan coupon rates will rise until the Federal Reserve starts hiking short-term rates.

Schwab clients considering bank loan funds can explore Schwab’s Mutual Fund OneSource Select List or explore bank loan ETFs through the Exchange-Traded Fund Screener. When searching for bank loan funds, first start in the “Taxable Bond” category, and then search for “Bank Loan” under the Morningstar Category.

1Moody’s Investors Service, “June 2021 Default Report,” July 11, 2021. The recovery rates quoted assume a $100 par value, but bonds and loans usually have $1,000 par values. An average $55 recovery for a $100 par bond would translate to $550 per $1,000 par bond, or 55% of the par value.

What You Can Do Next

Follow the Schwab Center for Financial Research on Twitter: @SchwabResearch.

Talk to us about the services that are right for you. Call a Schwab Fixed Income Specialist at 877-566-7982, visit a branch, find a consultant or open an account online.

Explore Schwab’s views on additional fixed income topics in Bond Insights.

By

By