5 Tips for Weathering a Recession

Recessions are an inevitable, albeit painful, part of the business cycle. Since 1948, the U.S. has experienced 12 recessions, or an average of one every six years. To put that in perspective, an individual who begins investing at age 25 could expect to experience between six and seven recessions by the time they reach retirement.

Recessions—generally defined as a contraction of economic activity lasting at least six months—are a relatively regular and even natural part of the economic cycle, so it's important to have a plan for when they occur. You may not be able to make your portfolio recession-proof, but you can make it recession-resistant.

Here are five steps you can take before and during recessions to mute the impact on your savings—and perhaps even capitalize on the opportunities that recessions can usher in.

1. Batten down the hatches

Recessions often coincide with bear markets, or market declines of 20% or more—although bear markets often come first, with investors anticipating an economic slowdown. However, while the average recession lasts just 11 months, it generally takes the market more than two years to bounce back to its pre-bear peak.

So, the first thing you should do to make your portfolio more recession-resistant is shore up your cash reserves. Otherwise, you may be forced to sell stocks during a market decline, thereby locking in losses and undercutting your portfolio's capacity to recover.

For nonretirees, that means setting aside three to six months' worth of living expenses in a relatively safe, liquid account—such as an interest-bearing checking account, money market savings account, money market fund, or short-term CD—plus enough cash to cover any upcoming sizable expenses, such as tuition payments.

For retirees, cash reserves should be much larger—ideally covering two to four years' worth of expenses. Most retirees can't afford to wait for their investments to rebound. If you don't have enough cash on hand, taking a big withdrawal in a down market can seriously increase your longevity risk, or the risk that you'll outlive your savings.

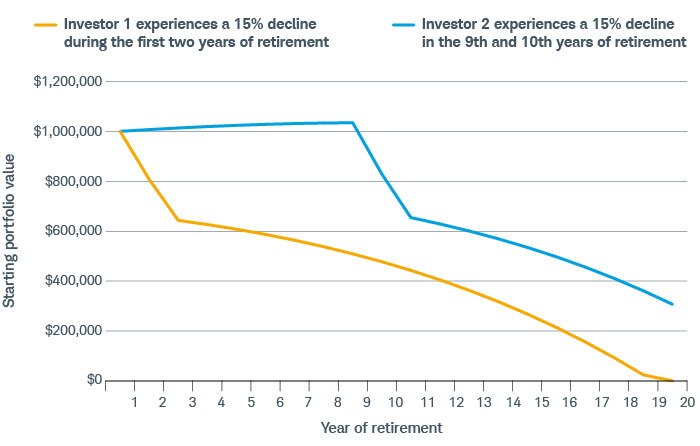

Double dip

Making a large withdrawal from your savings during a downturn—especially if the decline occurs in the first few years of retirement—can seriously erode your portfolio's longevity.

Source: Schwab Center for Financial Research.

This hypothetical example is only for illustrative purposes. Both hypothetical investors had a starting balance of $1 million, took an initial withdrawal of $50,000, and increased withdrawals 2% annually to account for inflation. Investor 1's portfolio assumes a negative 15% return for the first two years and a 6% return for years three through 19. Investor 2's portfolio assumes a 6% return for the first eight years, a negative 15% return for years nine and 10, and a 6% return for years 11 through 19. These scenarios do not reflect expenses, fees, or taxes.

2. Hold firm

If you're tempted to bail on the market when the going gets tough—don't. There's a reason those in the know describe investing as a marathon, not a sprint.

In fact, trying to time the market can set you back significantly. Some of the best days in the market have occurred right on the heels of some of the worst. For example, moving your portfolio into cash for just one month following a market decline of 20% or more would cut your returns almost in half one year later.

As long as you have sufficient time and money—whether from wages, retirement income, or cash reserves—it's important to stay the course so you can potentially benefit from the eventual recovery.

That said, it generally makes sense to sell some investments and buy others as part of your regular portfolio maintenance. Paring back on those investments that have become overweight and reinvesting those funds in assets that have become underweight help you maintain your target asset allocation and take advantage of the relatively low prices a down market often affords.

3. Double down

When the market is falling, it's natural to want to wait until it recovers to put more money in, but you should really be doing the opposite if you can afford it. As famed investor Warren Buffett once put it: Bad news is an investor's best friend. It lets you buy a slice of America's future at a marked-down price.

Still, there are a couple of caveats:

- Don't use your emergency funds for new investments. You might be tempted to dip into that pool for especially tempting opportunities, but they're called emergency funds for a reason.

- Don't hoard cash hoping to land a bargain. The sooner your money is in the market, the sooner it can benefit from the effects of compounding, whereas we know that trying to pinpoint the perfect time to get in is notoriously difficult.

- Don't use funds that you need soon. The average steep downturn in the market, and potentially your diversified portfolio, can last for several years. Make sure you have the time horizon to weather any losses, or hold your cash in stable assets like an interest-bearing savings or checking account, money market fund, or CD—especially if you're expecting a large expense or purchase in the short-term.

4. Consider tactical tweaks

Beyond buying shares at a discount, a downturn offers the opportunity to make strategic adjustments to your portfolio. Tactical tweaks should be refinements rather than wholesale changes. One rule of thumb is never deviate from your target asset allocation by more than five percentage points.

In particular, you might consider:

- High-quality stocks: Companies with low debt, positive earnings, strong cash flow, and low volatility tend to outperform when recessions hit and investors turn to businesses with ample financial cushions.

- Lower-volatility sectors: Defensive sectors—including Consumer Staples, Health Care, and Utilities—tend to be less volatile than the broader market and therefore have greater potential to outperform when returns go negative.

- Fundamental index funds: These index funds weight holdings by fundamental factors such as adjusted revenue, dividend yields, and earnings, and, as such, they favor value relative to market-cap-weighted index funds.

- Longer-maturity bonds: When interest rates rise, consider shifting your long-term fixed income allocation to longer-maturity bonds. The Federal Reserve typically cuts rates once economic conditions deteriorate, so you'll want to lock in today's higher coupons before they fall.

Schwab clients can log into their account to use our research tools:

- For high-quality stocks: Use the Stock Screener and select one or more of the following:

- For low debt: Under Financial Strength, select Debt to Equity (MRQ), then <1.

- For positive earnings: Under Valuation, select Price/Earnings (TTM), then <10 and 10–20.

- For strong cash flow: Under Financial Strength dropdown, select Cash Flow Per Share (TTM), then 10–15, 15–20, and >20.

- For low volatility: Under Analyst Ratings, select SER Volatility Outlook, then Low.

- For lower-volatility sectors: Use the Stock Screener and under Basic, select Sectors and Industries.

- For fundamental index funds:

- Research fundamental exchange-traded funds using the ETF Screener. Under Portfolio, select Weighting Scheme dropdown, then Fundamental.

- Research fundamental mutual funds using the Fund Screener. Under Basic and then Search By, select Fund Name and type "fundamental" in the search field.

- For longer-maturity bonds: Use the Bonds & Fixed Income tool to select a range of maturity dates under Maturity/Yield.

5. Reach out

While there's a lot you can do to make your portfolio more recession-resistant, you may not think you have the expertise or time to do so effectively—or you may simply want a second opinion before responding to prevailing market conditions. Working with a financial planner can help align your investments with your spending needs and goals, as well as prioritize which—if any—of the steps we've listed make the most sense for your situation.

Financial planners can help with not only the mechanics of investing but also the emotions that come with it. Sometimes it takes an outsider to help you set aside your fears and focus on your future, and a financial consultant can assist you with creating a plan that includes a personalized mix of asset classes and investments based on your goals and time horizon. Planning is one of the surest ways to be prepared—mentally and financially—to manage a downturn.