Earnings Season May Bring Changes

The surge in the so-called "Magnificent Seven" or Mag7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) accounted for the catch up in performance of U.S. stocks relative to international stocks since the current bull market began. But now the performance of these Mag7 stocks may be waning, leaving international stocks unchallenged as the leaders this market cycle.

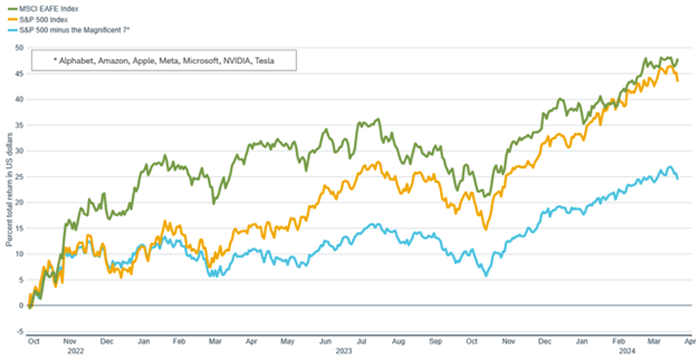

Performance since current bull market began on October 12, 2022

Source: Charles Schwab, Macrobond, S&P Global, MSCI as of 4/5/2024.

Past performance is no guarantee of future results. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Supporting documentation for any claims or statistical information is available upon request. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly.

The bear market ended on October 12, 2022, when stocks began to rebound from the 25-30% decline in U.S. and international stocks that began at the start of 2022. Since the bear ended and the new bull market began, international stocks represented by the MSCI EAFE Index (in green) have outperformed U.S. stocks represented by the S&P 500 Index (in orange), as we had forecast, even when measured in U.S. dollars as it is in the above chart. But the performance gap narrowed over the past four quarters to only a very small margin. While enthusiasm for artificial intelligence stocks began when ChatGPT was launched on November 30, 2022, by OpenAI, the outperformance gap between the Mag7-heavy S&P 500 (in orange) and the S&P 500 excluding the Mag7 stocks (in blue) only began to widen at the start of the second quarter of 2023. The reason may be tied to earnings growth.

Earnings

History shows that growth of earnings has been the main driver of stock market performance over the long-term. Beginning in the second quarter of 2023, the Mag7 stocks began to grow earnings rapidly, while the rest of the world's earnings saw declines. That trend continued through the end of the first quarter of 2024. Rising Mag7 valuations, supported by soaring earnings growth, combined to lift the entire S&P 500 up toward the MSCI EAFE Index even as the rest of the stocks in the S&P 500 Index continued the wide gap in performance.

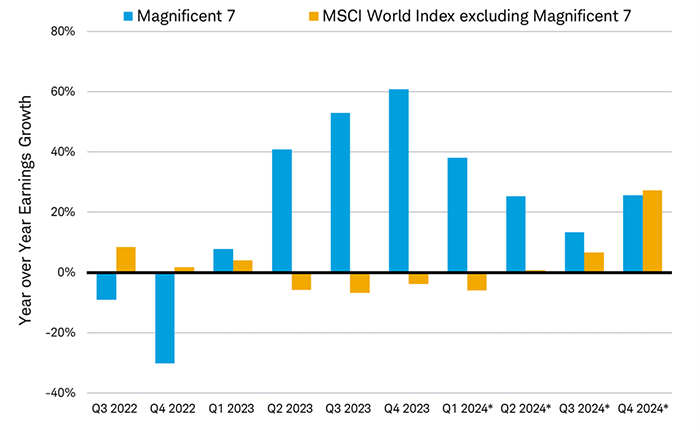

Earnings gap supporting Mag7 may reverse by year-end

*FactSet-tracked analyst consensus earnings growth estimates as of 4/1/2024.

Magnificent 7 includes: Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla.

Source: Charles Schwab, FactSet data as of 4/1/2024. Past performance is no guarantee of future results. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Supporting documentation for any claims or statistical information is available upon request.

That appears poised to change as the second quarter gets underway and the gap in earnings growth is expected to begin to close. Over the rest of the year, the FactSet-tracked consensus of analysts' earnings estimates shows that the growth of Mag7 earnings is set to slow relative to those of the rest of the global stock market, and by the fourth quarter is expected to be below that of the rest of the market. Already some of the Mag7 stocks have started to stumble, with Apple and Tesla suffering losses so far this year.

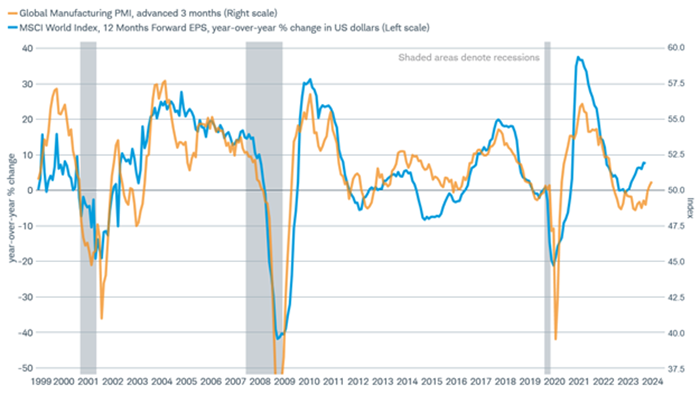

Analysts' outlook for broadening earnings growth beyond the Mag7 is supported by the Global Manufacturing Purchasing Managers' Index (PMI) rising to 50.6 in March. That release marked the second month in a row above 50.0, the dividing line between growth and recession, after spending 18 months below 50—the longest stretch since the data began nearly 30 years ago. Historically, when the global manufacturing PMI is below 50, analyst's earnings estimates for the next 12 months are typically falling and when it is above 50 they are rising, as you can see in the chart below.

Manufacturing recovery signals earnings rebound

Source: Charles Schwab, Macrobond, S&P Global, as of 4/5/2024.

Global Manufacturing PMI level advanced three months to illustrate correlation. Past performance is no guarantee of future results.

Concentration

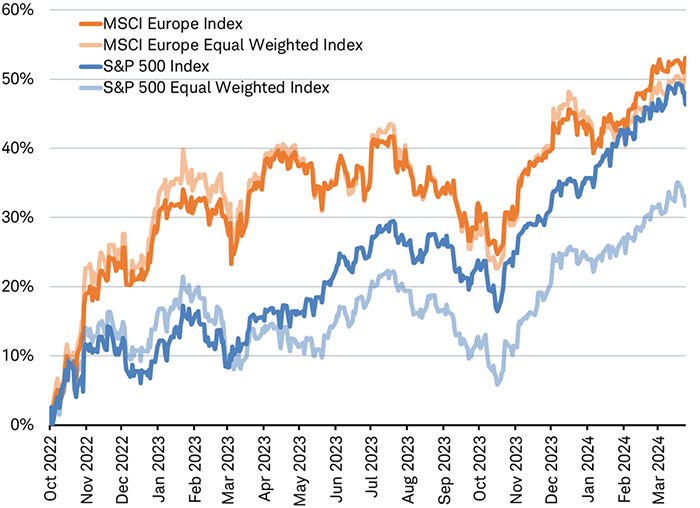

Concentration risk is sometimes illustrated by how much of an index is concentrated in just a handful of stocks. But this view can be misleading since some markets have fewer stocks than others. For example, unlike the 500 stocks that make up the S&P 500 Index, the MSCI Germany index has just 53 stocks. Therefore, it is not surprising to see more of the weight of the index in the top seven stocks in Germany (49.5%) than in the United States (29.9%). We believe that a better way to look at concentration risk for investors is by how much of the performance of an index is coming from just a handful of stocks. We can see from the capitalization and equal-weighted indexes that Europe's stock market, where more of the index is concentrated in the top stocks, isn't concentrating its performance only in the top stocks since the capitalization-weighted and equal-weighted indexes are performing similarly, as you can see in the chart below. In contrast, in the U.S. the gap between the capitalization- and equal-weighted performance is wide, illustrating how performance has been largely concentrated in just a handful of the top U.S. stocks.

Concentration risk

Percent total return measured from October 12, 2022 through April 4, 2024.

Source: Charles Schwab, Bloomberg data as of 4/5/2024. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

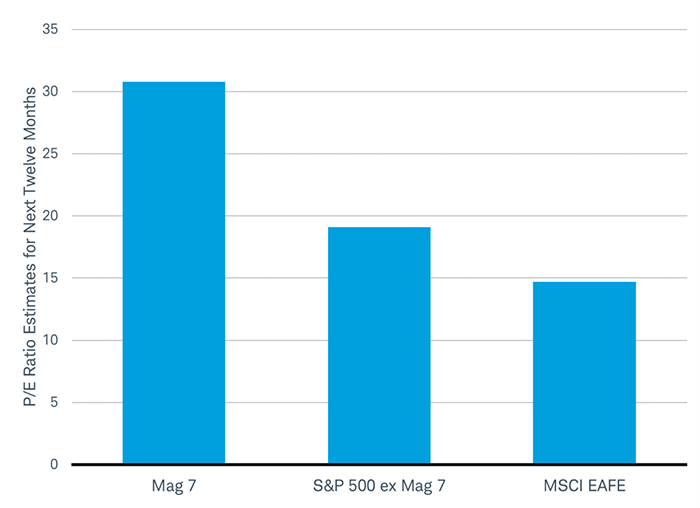

Valuations

When discussing valuation, we typically focus on the price divided by analysts' expectations for earnings over the next 12 months because stocks tend to be forward-looking and react to the outlook for earnings rather than those of recent past. The exceptional relative earnings growth that helped support high and rising valuations for the Mag7 stocks relative to the rest of the market may be fading. That suggests the Mag7 stocks' stronger relative price appreciation over the past year may also begin to fade.

Valuation gap may begin to close

Source: Charles Schwab, FactSet data as of 4/5/2024.

The price-earnings ratio, also known as P/E ratio, is the ratio of a company's share price to the company's earnings per share and is a measure of valuation. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Supporting documentation for any claims or statistical information is available upon request.

Will this earnings season bring a change as investors begin to focus on a reversal in relative earnings growth supporting broader market performance? If so, this may help to maintain the outperformance by international stocks since the bull market began.