Crude Up, Stocks Down: Broadcom, Jobs Data Mulled

Published as of: March 5, 2026, 9:11 a.m. ET

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,869.50 | +52.87 | +0.78% |

| Dow Jones Industrial Average® | 48,739.41 | +238.14 | +0.49% |

| Nasdaq Composite® | 22,807.48 | +290.79 | +1.29% |

| 10-year Treasury yield | 4.14% | +0.05 | -- |

| U.S. Dollar Index | 99.10 | +0.32 | +0.33% |

| Cboe Volatility Index® | 22.01 | +0.88 | +4.16% |

| WTI Crude Oil | $76.98 | +$2.32 | +3.11% |

| Bitcoin | $72,705 | -$740 | -1.01% |

(Thursday market open) Stocks came under fresh pressure early thanks to rebounding crude oil prices after a mid-week retreat. Hundreds of ships remain stuck in the Persian Gulf despite U.S. promises to escort oil tankers through the Strait of Hormuz, Reuters reported, and Iran has enough drones to create havoc in the Gulf for months. Domestic crude climbed 3% to nearly$77 per barrel and is up close to 14% from a week ago, raising inflation concerns and Treasury yields. Back home, investors mull today's February layoffs data and solid earnings from chip giant Broadcom (AVGO).

All this sets the stage for tomorrow morning's February nonfarm payrolls report, which could temporarily grab the spotlight in a week dominated by war news. The report, due at 8:30 a.m. ET Friday, is expected to show jobs growth last month sliced in half from January's 130,000, with consensus near 60,000. Unemployment is seen remaining at a low 4.3%. Yesterday's ADP jobs report received positive reviews, easily topping estimates. This morning's Challenger job cuts report for February fell to 48,300 from 108,000 in January, and weekly initial jobless claims stayed low at 213,000.

On Wednesday, major indexes finished moderately up, reversing course from Tuesday's dismal performance. Still, risk appetite appears fragmented. Markets are divided between "buy the dip"—notably for hobbled software shares—and "sell the rip" behavior in crowded areas like metals and memory chips. This tension could result in either a healthy rebalance or sharper risk-off moves if the conflict drags on. At the same time, market breadth remains constructive, though participation has cooled from recent peaks. Institutional hedging appears to remain heavy, with signs that investors are willing to pay up for protection.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

Digging into payrolls: When nonfarm payrolls bow early tomorrow, investors might consider focusing on where jobs were generated. Recent reports showed heavy increases in services-related employment like health care and social services. Federal government employment has dropped, but construction jobs gained in January. For stronger economic growth, it's helpful to see job gains in higher-paying sectors like professional and business services and financial activities. These numbers could also provide early hints about the possible impact of AI on white-collar job activity. Yesterday's ADP February jobs data suggests manufacturing continues to struggle, shedding 5,000 positions, with no net-increase in that category since March 2024. While a shift toward growth in highly compensated positions would often suggest higher spending followed by stronger gross domestic product, or GDP, increases, the current "no hire, no fire" environment is one force behind the current K-shaped economy that's pressed on consumer spending. People concerned they might lose their jobs conceivably aren't as likely to make big purchases. Earnings calls from Kroger (KR) this morning and Costco (COST) this afternoon might give investors insight into consumer spending trends heading into tomorrow's 8:30 a.m. ET report. Their observations can shed light.

The war and inflation: Rising oil has lifted U.S. gas prices to $3.25 a gallon on average, the highest since last September, according to AAA. U.S. offers to escort and insure tankers may not be enough to see a resumption of shipping, said Michelle Gibley, director of international equity research and strategy at the Schwab Center for Financial Research (SCFR). Though the core February Consumer Price Index (CPI) report due next week doesn't include energy costs, there's concern higher gas prices could eventually seep into so-called "core" inflation by raising costs for companies, which then pass those along to customers in the form of higher prices for goods. Sometimes this shows up first on the wholesale side, meaning coming Producer Price Index (PPI) reports might highlight early pressure on company margins. Airfare is a category to watch there for potential oil price impact. Neither February inflation report covers periods affected by the war, so the impact won't be measurable from those. War can raise inflation in other ways, too, for instance through heavier government spending on weapons, and as shipping firms pass along their rising logistics costs. That said, the U.S. uses far less crude per capita than it did 45 to 50 years ago, dampening the impact somewhat compared to what some of us remember from then, when Americans waited in gas lines after the 1979 Iranian revolution.

Fresh data puts spotlight on AI: Preliminary fourth-quarter productivity rose 2.8% on seasonally adjusted annual basis, compared with an upwardly revised 5.2% in the third quarter and the Briefing.com consensus of 4%. This metric saw its star glow brighter lately as economists parse whether AI-related efficiency gains aided the broader economy. Incidentally, tech-driven productivity gains sometimes go hand in hand with slower jobs growth because more productive companies can do more with less. Last month's news of Block (XYZ) cutting 40% of its workers as it grows more efficient with AI may have been an early wake-up call. Last year's soft U.S. jobs growth isn't proof of productivity's impact but might suggest it's happening at the margins, though it's far from clear if AI deserves any credit. "Productivity is difficult to measure in real time, let alone forecast," said Kathy Jones, chief fixed income strategist at SCFR. "It's especially hard in a service-oriented economy."

Crypto currents

What is crypto's role in an AI economy? A viral blog post that shook markets last week envisioned a future economy revolutionized by AI agents. In fact, some are starting to build that world, with blockchains and crypto coins as the financial infrastructure, as crypto and AI become increasingly intertwined. For every dollar that venture capital firms invested in a crypto company in 2025, $0.40 went to a company that's also developing AI in its product, according to Silicon Valley Bank. Last month, Coinbase said it was building the first crypto wallets specifically for AI agents, enabling them to hold funds and receive and make payments. MasterCard and Visa are also working quickly to accommodate AI agents for business clients. So is this bullish for crypto? An economy heavy on AI agents is likely bullish for the crypto ecosystem, if not necessarily any individual coin. Bitcoin supporters say bitcoin is the obvious choice as a payment currency. (For what it's worth, the Bitcoin Policy Institute surveyed 36 frontier AI models, and a plurality of 48% said they prefer to work with bitcoin, results no doubt influenced by their training data.) For now, dollar-pegged stablecoins seem favored by legacy financial institutions, but coins native to blockchains could benefit. In the past, more activity on the chain has meant greater demand for the native currency.

On the move

Broadcom surged 6% in early trading after reporting better-than-expected results and delivering upbeat guidance. Notably, semiconductor solutions revenue grew 52% year over year. AI revenue grew 106% year over year and topped the company's own forecast.

StubHub Holdings (STUB) cratered over 14% this morning after the ticketing company reported a quarterly loss in profit and lower revenue than a year earlier. JPMorgan Chase downgraded shares to neutral from overweight.

American Eagle Outfitters (AEO) slid more than 4% in trading ahead of the opening bell despite beating analysts' earnings and revenue expectations and delivering solid guidance. Concerns on Wall Street appeared to center around the impact of U.S. tariffs on the company's margins, Reuters reported.

Ciena (CIEN) slipped 4.5% in early trading despite beating consensus for earnings and revenue. It also guided for quarterly revenue above expectations. Shares had risen sharply so far this year, meaning today's action could reflect "buy the rumor, sell the fact" sentiment.

Nvidia (NVDA) fell 0.4% ahead of the open following a report by the Financial Times that the chip maker has stopped production of its second-most advanced AI chips, known as H200 chips, intended for the China market. Nvidia didn't include any data center business from China in its recent quarterly guidance, though it has approval to sell the H200 there. On another note, Barron's reported that billionaire IT entrepreneur Leo Koguan bought one million shares of Nvidia and plans to invest more.

Kroger dropped close to 1%. Earnings beat expectations and revenue came in just below consensus. Guidance was as expected. In its release, Kroger cited "improving market share trends."

BJ's Wholesale Club (BJ) dropped 4% in early action after perceived guidance weakness. The company's quarterly revenue and earnings topped expectations.

Penn Entertainment (PENN) climbed nearly 3% as Benchmark upgraded shares to buy from hold, suggesting possible strength from "meaningful" free cash flow expansion.

Rigetti Computing (RGTI) fell nearly 5% in early trading after quarterly earnings and revenue missed forecasts.

Overseas, Korean stocks rebounded today after a dramatic slump earlier this week that appeared to reflect war concerns that might affect its heavy natural gas imports, Barron's reported. Also, China set a 2026 GDP growth target of 4.5% to 5%, the lowest target since at least the 1990's, according to The Wall Street Journal. Anything below 5% would be the slowest growth in more than 30 years.

Crude-related inflation worries play into the market pricing in less than 3% odds of a Fed rate cut this month, according to the CME FedWatch Tool. Futures trading now anticipates the pause in rates likely lasting until September, penciling in only one in three chances of any rate cut by the Fed's June meeting. Inflation concerns also continue to weigh on Treasuries, keeping yields elevated, with the most pressure on short-term Treasuries yesterday.

Consumer-oriented stocks staged a rally Wednesday, burnished by strong results from Ross Stores (ROST) and strength from the largest discretionary shares, Amazon (AMZN) and Tesla (TSLA). Ford (F) shares rose despite February sales dropping more than 5% year over year. The buying wasn't universal. Home Depot (HD) fell, and home builder Lennar (LEN) also lost ground.

Tariff-sensitive consumer stocks might get a lift today from NBC News reporting a judge from the U.S. Court of International Trade ruled "all importers of record" were entitled to benefit from last month's Supreme Court ruling against a set of President Trump's tariffs. If the ruling stands, it could lead to possible refunds for affected companies.

Bitcoin (/BTC), an important barometer of risk sentiment, had its best day in a while on Wednesday, climbing 7% before shedding 0.3% early today. Bitcoin is near its highest level in a month, and strength in crypto has recently correlated positively with U.S. growth equities. Crypto-related shares including Strategy (MSTR) and Coinbase Global (COIN) also rallied Wednesday.

Silver and gold inched higher today. Gold—sometimes seen as a "safe haven" in troubled times—spiked above $5,400 an ounce Monday but has fallen back below $5,200. The all-time high of $5,600 occurred in early February.

More insights from Schwab

Iran FAQ: Our experts answer some of the most common questions about the Iran war's impact on markets in their latest post. One key takeaway: Investors should avoid over-reacting. Geopolitical shocks and crises rarely result in major sustained impacts to global economic growth or financial markets. They also discuss possible scenarios and potential outcomes.

Under the hood: Checking market internals, there's widening dispersion, falling correlations, and broader participation, write Liz Ann Sonders, chief investment strategist, SCFR, and Kevin Gordon, head of macro research and strategy, SCFR, in their latest analysis. Notably, equal-weight indexes, small caps, and international equities continue to outperform cap-weighted benchmarks. But markets continue to display resilience despite the war.

Target date funds primer: In the 401(k)-dominated retirement planning world, target-date funds have become popular ways to invest. Learn more about how they work and their historic performance in Schwab's new retirement feature.

What to know about restricted stock and taxes: With tax season here, investors can read Schwab's latest guide on how restricted stock or performance stock awards get taxed, along with an overview of the required documentation.

Resources for volatile markets: Turbulent market conditions can make anyone worried about their portfolio, and Schwab offers several perspectives that provide ideas to keep in mind at such times:

Market Volatility: What to Do During Turbulence

Bear Market: Now What?

Market Volatility in Retirement: Are You Prepared?

Navigating the Markets: Tariffs and Trade

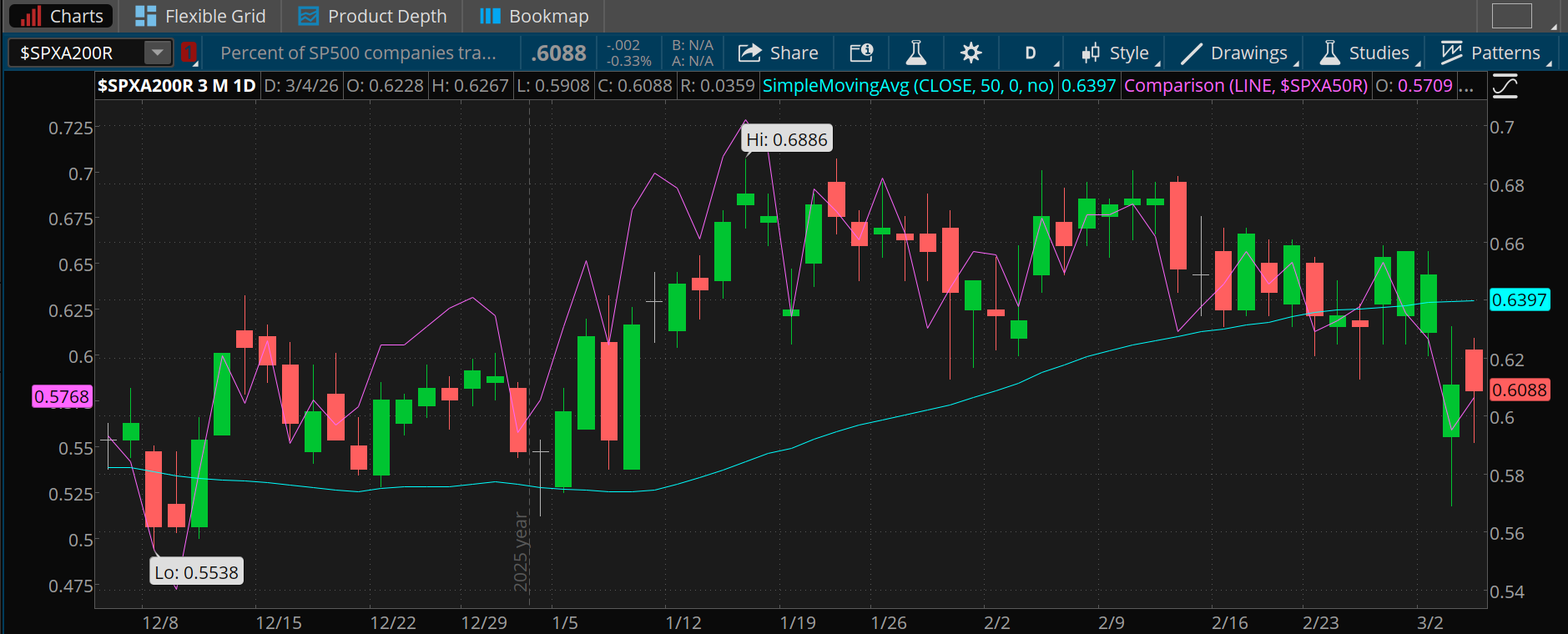

Chart of the day

Data source: S&P Dow Jones Indices. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Though market breadth as measured by how many S&P stocks trade above their 50-day moving average (purple line) and their 200-day moving average (candlesticks) fell slightly early this week, both remain historically robust above 60%. The 200-day moving average is around 64% in terms of stocks trading above their 200-day average, just above current levels near 61%.

The week ahead

Check out the investors' calendar for a summary of the top economic events and earnings reports on tap this week.

March 6: February nonfarm payrolls.

March 9: Expected earnings from Oracle (ORCL), Hewlett-Packard (HPE), and Casey's General Stores (CASY).

March 10: February existing home sales and expected earnings from BioNTech (BNTX).

March 11: February CPI and core CPI and expected earnings from Campbell's (CPB).

March 12: January factory orders, and expected earnings from Dollar General (DG), Dick's Sporting Goods (DKS), Adobe (ADBE), and Lennar (LEN).