How to Structure Your Retirement Portfolio

Nowadays, it's reasonable to plan for a retirement that last 30 years or longer. In fact, creating a savings plan is the first step in our three-step program for generating income in retirement.

The next step is all about choosing the right mix of investments—also known as a portfolio allocation—to carry your portfolio through. (The third step is creating a plan for withdrawing your money.)

So, how should you structure your allocation? Here are some thoughts:

1. Set aside one year of cash

At the start of every year, make sure you have enough cash on hand to supplement your annual income from annuities, pensions, Social Security, rental properties, and other recurring sources. Hold the money in a relatively safe, liquid account, such as an interest-bearing bank account or money market fund.

With this cash on hand, you won't have to worry as much about the markets or a monthly paycheck. Spend from this account and replenish it periodically with funds from your investment portfolio.

2. Create a short-term reserve

Next, we recommend creating a short-term reserve in your investment portfolio equivalent to two to four years' worth of living expenses, again after accounting for other regular income sources. This money can be invested in high-quality, short-term bonds or other fixed income investments, such as short-term bonds or bond funds. Or, if you'd rather manage individual investments, you might want to create a short-term CD or bond ladder—a strategy in which you invest in CDs or bonds with staggered maturity dates so that the proceeds can be collected at regular intervals. When the CDs or bonds mature, you can use the money to replenish your bank account.

You can use interest income and other proceeds from this reserve to cover the portfolio withdrawals mentioned in section #1. This kind of reserve can also help you weather a prolonged market downturn because you can avoid having to tap more volatile investments—like stocks—to generate cash.

3. Invest the rest of your portfolio

With a year's worth of cash on hand and a short-term reserve in place, invest the remainder of your portfolio in investments that align with your goals and risk tolerance. Your overarching goal here should be to hold a mix of stock, bond, and cash investments that can generate growth, provide income, and preserve your capital.

What works best for you will depend on your age, income needs, financial goals, time horizon, and comfort with risk. And it's fine to change things up over time. For example, you might feel comfortable taking more risk in the early years of retirement in exchange for more growth. You could grow more conservative later on, with a focus on preserving your capital and generating income.

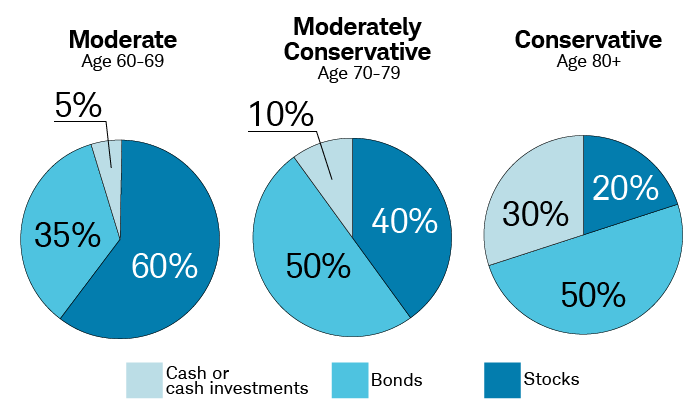

Here's how that might look. Notice how the share of more-volatile stocks shrinks relative to cash and bonds over 20-plus years:

Adapt your strategy over time

Source: Schwab Center for Financial Research. The example is hypothetical and provided for illustrative purposes only.

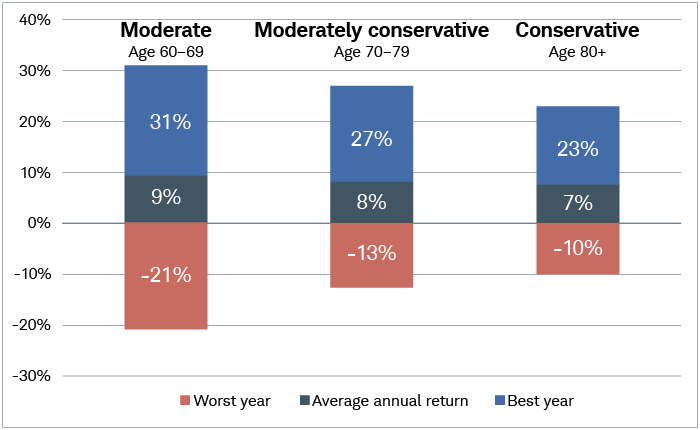

Retirees who adopted this plan would have seen the following results in their portfolios*:

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc.

*Based on data collected from 1970 through 2022.

The return figures represent the best and worst total returns, as well as the compound average annual total returns, for the hypothetical asset allocation plans. The asset allocation plans are weighted averages of the performance of the indexes used to represent each asset class in the plans and are rebalanced annually. Returns include reinvestment of dividends and interest. The indexes representing each asset class are S&P 500® Index (large-cap stocks), Russell 2000® Index (small-cap stocks), MSCI EAFE® Net of Taxes (international stocks), Bloomberg Barclays U.S. Aggregate Bond Index (bonds) and FTSE U.S. 3-month Treasury bills (cash investments). The conservative allocation is composed of 15% large-cap stocks, 5% international stocks, 50% bonds and 30% cash investments. The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds and 10% cash investments. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments. CRSP 6-8 was used for small-cap stocks prior to 1979, and Ibbotson U.S. 30-day Treasury Bill Index was used for cash investments prior to 1978. Past performance is no guarantee of future results.

Because stocks can be more volatile than other investments, you many wonder why you should have any allocation to them in retirement. The short answer is: Growth potential.

Gains from stocks have historically helped investors keep pace with inflation and taxes—doing a better job than bonds or cash.1 The key is having enough to keep your portfolio adequately inflated without exposing you to the risk of having to sell depressed assets during a downturn.

1Schwab Center for Financial Research.