2022 Muni Outlook: Near-Term Pain, Longer-Term Opportunity

Current low yields and tight spreads in the municipal bond market have made it difficult for investors to find opportunities to earn attractive interest income on their investments. We expect that to change in 2022.

Our outlook for 2022 is that both spreads and yields should modestly increase. This may result in near-term price declines, but we expect there will be opportunities for higher yields. Portfolios that are appropriately positioned should benefit from the rise in spreads and yields over time (a spread is the difference in yield between two bonds of comparable maturity, and reflects the additional compensation investors require to own a security relative to a highly rated alternative, such as a U.S. Treasury bond).

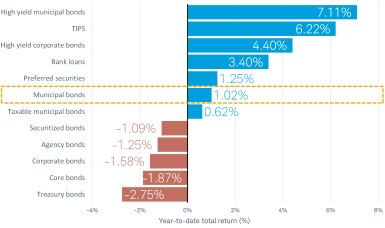

Early in 2021, there were concerns that the ongoing pandemic would create waves for the finances of some municipal issuers and lead to downgrades. That didn’t happen. Instead, Washington threw a life raft to the muni market. The economy also recovered much quicker and stronger than expected. As a result, credit concerns ebbed and prices on muni bonds didn’t fall as much as other fixed income sectors, resulting in munis outperforming most other highly rated fixed income sectors.

Munis have performed relatively well so far in 2021

Source: Bloomberg, as of 11/17/21. Bloomberg High Yield Municipal Bond Index ("High yield municipal bonds"), Bloomberg US Treasury Inflation Notes Index (“TIPS”), Bloomberg U.S. Corporate High-Yield Bond Index (“High-yield corporate bonds”), S&P/LSTA Leveraged Loan Index (“Bank loans”), ICE BofA Fixed Rate Preferred Securities Index (“Preferred securities”), Bloomberg Municipal Bond Index (“Municipal bonds”), Bloomberg Municipal Index Taxable Bonds ("Taxable municipal bonds"), Bloomberg U.S. Securitized: MBS/ABS/CMBS and Covered Index (“ Securitized bonds”), Bloomberg US Corporate Bond Index ("Corporate bonds"), Bloomberg US Agg Agency Index (“Agency bonds”), Bloomberg US Aggregate Bond Index ("Core bonds"), Bloomberg US Treasury Index ("Treasury bonds”). Past performance is no guarantee of future results.

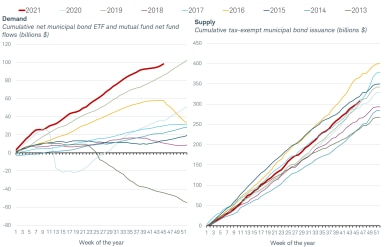

We expect the supply-and-demand imbalance to ease in 2022

An imbalance between supply and demand is one of the reasons that munis have outperformed other fixed income asset classes this year.1 It is also a contributing factor to tight spreads and the riskier portions of the muni market outperforming those with less risk. As of November 17, flows into muni mutual funds and ETFs have been positive for 78 of the past 80 weeks according to the Investment Company Institute, signaling strong demand. Meanwhile, the supply of tax-exempt munis over the same period wasn’t nearly enough to meet the strong demand. This led to higher prices and tighter spreads.

Demand for munis has been strong yet supply hasn’t kept pace

Sources: Bloomberg and ICI, as of 11/17/21

The imbalance may ease because of a slowdown in demand. If interest rates rise, as we expect, the pace of fund flows should slow and may even turn negative. We’ve found that when returns are negative, historically fund flows turn negative shortly afterward. In other words, fund investors experience price declines and then begin to withdraw money from those funds.

We expect interest rates to move higher next year as economic growth remains above its long-term trend and inflation remains elevated. We believe the 10-year Treasury yield could reach as high as 1.75% to 2.0% in 2022. Yields and prices move opposite one another, so if our expectation of higher rates comes to fruition, it could lead to near-term price declines.

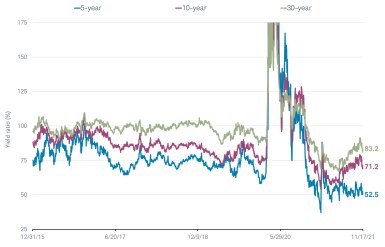

A glass half full

A common metric to evaluate the relative attractiveness of the muni market is the municipals-over-bonds (MOB) spread. The MOB spread is a ratio of the yield on a AAA-rated muni relative to a Treasury bond of equal maturity before accounting for taxes. The MOB spreads for most maturities were historically low during most of 2021, especially for short-term maturities. This made it difficult for muni investors, because even after considering the effect of taxes, Treasuries and other highly rated investments often yielded more than munis, even for investors in the highest tax bracket.

The MOB spreads are below historical averages

Source: Bloomberg, as of 11/18/21. The chart is truncated at 175% for visual purposes. The 5-, 10-, and 30-year MOB spreads reached 650%, 365%, and 252% respectively on 3/23/20. Past performance is no guarantee of future results.

If the supply-and-demand imbalance eases, as we expect it to do, MOB spreads should rise and yields for top-rated munis should move higher and closer to their longer-term averages. Spreads for lower-rated issuers should also rise, which would allow investors to achieve higher compensation for taking on credit risks.

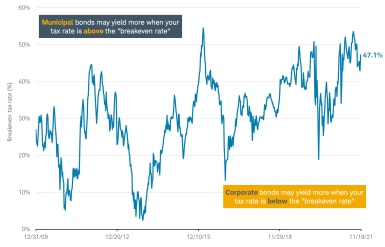

No big tax hikes may lead to higher yields

To help pay for the Build Back Better spending package, Democrats originally had proposed increasing taxes on top earners, but as of this writing, many of those proposals were dropped. They could be added back in as negotiations move along but there is strong pushback against raising taxes. Among the original proposals were to increase the top tax rate to 39.6% from 37%, limit allowable deductions, levy a 3% surtax on individuals with an adjusted gross income above $5 million, and increase the top corporate tax rate to 26.5%. Municipal bonds generally pay interest income that is exempt from federal and potentially state income taxes. At higher tax rates, munis generally yield more than comparable taxable bonds like corporates or Treasuries.

The muni market responded to the prospect of higher taxes with yields moving lower relative to taxable alternatives as illustrated by the change in the “breakeven” tax rate. The “breakeven” tax rate is the tax rate at which a municipal bond will yield more than a corporate bond before adjusting for taxes. As illustrated in the chart below, this rate is currently 47.1%, meaning if an investor’s combined tax rate (federal, state, local, and other applicable taxes) is above 47.5%, munis yield more than corporate bonds after taxes. The breakeven tax rate is near the highs over the past decade. Since taxes may not rise as much as originally proposed, we would expect muni yields to rise and the breakeven tax rate to fall.

The breakeven tax rate is near 10-year highs

Source: Bloomberg. As of 11/18/21 using weekly data. Bloomberg Municipal Bond 7 Year (6-8) Index and Bloomberg Intermediate Corporate Index. The “breakeven” rate is the tax rate that makes the after-tax yield for the corporate bond index equivalent to the yield for the municipal bond index.

Concerns over credit should remain low

We have a positive view of the credit quality for most muni issuers. The current economic recovery, as well as the substantial fiscal support, have helped to bolster revenues for many muni issuers. As an example, the 50-state total of rainy-day funds was estimated to be higher in fiscal year 2021 compared to the pre-pandemic high according to the Pew Charitable Trusts. The improvement in credit conditions is reflected in muni upgrades and downgrades. For the past two quarters, credit rating agency Moody’s has upgraded more bonds than it has downgraded. In addition, defaults are relatively low and mostly occurring in the riskier parts of the muni market, such as unrated issuers, land-secured deals, and health-care and hospital facilities.

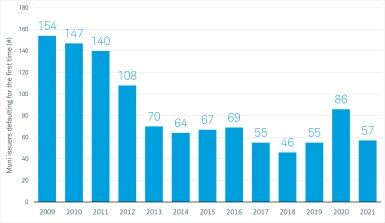

Muni defaults have been relatively low

Source: Municipal Market Advisors, as of 11/17/21. 2021 is year-to-date as of 11/17/21.

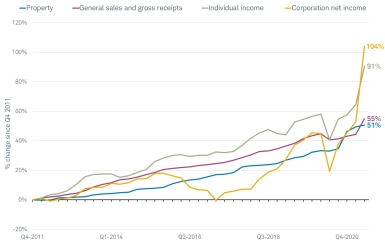

In 2022, we anticipate that credit conditions will remain favorable for most municipal issuers and defaults should continue to remain low. Revenues have surged, led by an increase in corporate and income taxes. Greater revenues allow issuers greater financial flexibility. Moreover, the improving property market should benefit local governments, as property taxes tend to be their largest source of revenues.

Tax revenues have surged since Q4 2011

Source: U.S. Census Bureau, Quarterly Summary of State & Local Taxes, as of Q2 2021, which is the most recent data available.

In addition to the improving revenue picture, funded levels for state pension plans are improving as well. According to projections by The Pew Charitable Trusts, “state retirement systems are now over 80% funded for the first time since 2008.” This is notable because an 80% funded level is considered to be fully funded. However, funded ratios vary by state, with some states like Illinois, New Jersey, and Kentucky largely lagging others.

What to do now

We expect 2022 to be characterized by some volatility but ultimately better investment opportunities than so far in 2021. We would suggest investors target a below-average duration, because bonds with lower durations typically experience smaller price declines to rising interest rates. A bond ladder strategy can be appropriate, because it can take the guesswork out of trying to time interest rates.

Given our positive view of credit quality, we suggest that investors moderately add some lower-rated issuers to their portfolios. Valuations are more attractive in the lower-rated portion of the muni market. Although we think that it’s appropriate to add some lower-rated issuers, we would caution against adding too much as they are still prone to more volatility relative to higher-rated issuers. As a rough starting point, we would suggest putting no more than 40% of a muni portfolio in BBB/Baa and A/A rated issuers. That could be further broken down by 10% to 15% BBB/Baa and 25% to 30% A/A. Consider these weightings a rough starting point and deviate from them based on your own personal risk tolerance and needs. For reference, the Bloomberg Muni Bond Index, which is a commonly tracked index for the muni market, is 16% Aaa, 50% Aa, 26% A, and 9% Baa.

1 As of November 17, 2021.

What You Can Do Next

Follow the Schwab Center for Financial Research on Twitter: @SchwabResearch.

Talk to us about the services that are right for you. Call a Schwab Fixed Income Specialist at 877-566-7982, visit a branch, find a consultant or open an account online.

Explore Schwab’s views on additional fixed income topics in Bond Insights.

By

By