Is There a Perfect Time to Invest? Bah! Humbug!

Dear Reader,

While I don’t share Scrooge’s negative sentiments about the holidays, when it comes to trying to find the perfect time to invest, I do find myself thinking: Bah! Humbug! Why? Because it’s been shown over and over again that trying to time the market is a bad idea. In fact, it could cost you—big time.

With the dramatic market moves we’ve seen recently, I can appreciate your hesitation. But the most important considerations are your own goals, your appetite for risk, and how long you can afford to keep your money invested—not what the market is doing at any specific moment.

So, if you have money to invest, I’d encourage you to steadfastly avoid trying to time the market. Here’s why.

It’s about time—not timing

Chances are slim that even the savviest among us will hit all the market highs and miss all the lows. Instead, the best way to improve your odds of success is to stay invested over time, no matter when you start.

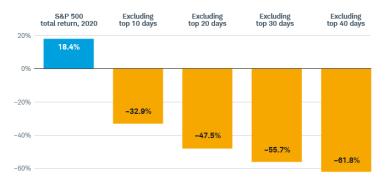

Take last year, for example. During 2020, the S&P 500® Index saw a total return of 18.4%. If you were invested during that volatile year, you’d have done pretty well. But if you’d sold when the market dropped, not only would you have locked in your losses, you’d also have potentially missed out on those trading days with the greatest gains, which would’ve meant even bigger losses. For instance, if you’d missed the top 10 trading days of 2020, you’d be down 32.9%. If you’d missed the top 40 days, you’d be down a whopping 61.8%! (See “Staying power,” below.)

There’s no time like the present

To me, nothing beats using numbers to make a point. So, here are a few more that may convince you not to wait any longer.

Had you invested $2,000 in stocks annually for the past 20 years with absolutely perfect timing—always buying low—you’d now have $174,535. However, even if you’d invested that same amount of money in stocks with the worst timing—always buying high—you’d have $140,895. Not so bad, right? Now here’s the clincher: If you’d kept that money in cash investments all those years, you’d now have only $64,124.

So, whether your timing was good or bad, you’d still be way ahead by putting your money in the stock market.

Take a lesson from Scrooge

Ultimately, deciding when and how to invest isn’t so much about short-term market moves, it’s about you and your long-term goals.

Investing in the stock market is a long-term proposition. Money you’ll need short term should be in more stable investments like cash, certificates of deposit, or short-term bonds. With money for longer-term goals like retirement or a child’s education, you can often afford to take on more risk because you have time to weather the market’s inevitable ups and downs. Again, it’s not about timing the market—it’s about giving yourself the time to reap the potential rewards while riding out the downturns.

To make it even easier on yourself, you could put your investing on autopilot by automatically contributing a fixed amount or percentage at regular intervals (a strategy known as dollar-cost averaging), which can help take emotion out of your day-to-day decision-making.

Of course, when times are uncertain, it’s easy to get spooked by the ghost of investing opportunities past or the specter of future losses. But take a lesson from Scrooge: To avoid regrets—past, present, and future—ask not what the market is doing at any given moment, but rather whether putting money in the market is the right strategy for you.

What You Can Do Next

Read more insights from Carrie about real-world money matters.

By

By