Payback Time With a Potential Payoff

Key Points

Last Week, the European Central Bank (ECB) announced a plan to begin a tapering of their emergency bond purchases enacted in the aftermath of the global pandemic.

The ECB isn’t the first central bank to consider reining in stimulus—interest rate hikes are underway for an increasing number of countries.

Contrary to the fear that it’s payback time as a gradual slowing of record-breaking stimulus heralds a major drop for the world’s stock markets, the evidence suggests the potential for a positive outcome.

The European Central Bank (ECB) headed off the U.S. Federal Reserve (Fed) with their announcement to taper their emergency bond purchases enacted in the aftermath of the global pandemic. The Fed is probably not far behind; we anticipate a similar announcement likely to come later this year. But they aren’t the first central bank to consider reining in stimulus—interest rate hikes are underway in an increasing number of countries. It’s payback time as central banks around the world begin to reverse the measures enacted in response to the pandemic. For investors, the payback may lead to a payoff.

Taper-lite

Last Thursday’s ECB policy statement upgraded the growth and inflation outlook for Europe. Responding to this positive news, it also announced a slow reduction in the pace of its asset purchases (QE) compared to its average since March of this year. This move qualifies as “taper-lite” (instead of a full taper) given that:

- Currently, there is no planned end to the Pandemic Emergency Purchase Program (PEPP)—those discussions are anticipated to take place in December. The total asset purchases for PEPP will probably continue at an average monthly rate of around 60-70 billion euros per month in the coming quarter (compared with 80-90 billion in recent months). Further reductions in purchases may be coming early next year, but there is no timeline to winding up the program, yet.

- The ECB still plans to continue its pre-pandemic Asset Purchase Program (APP) until shortly before it raises interest rates—meaning that even if they eventually phase out the PEPP program purchases of 65-70 billion euros per month sometime next year, the 20 billion euros per month under APP will go on (or potentially increase as needed).

The change in asset purchases is likely to make a negligible difference to overall financial conditions or equity markets. We expect more announcements at meetings in the coming quarters, as this was a very gradual start to the removal of stimulus which delivered the easiest financial conditions since the 2008-09 Great Financial Crisis.

Financial conditions easiest since pre-Great Financial Crisis

A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms.

Source: Charles Schwab, Bloomberg data as of 9/8/2021.

Although stock markets seem to hang on the words and actions of central bankers, past periods of tapering in Europe have not seen Eurozone stocks weaken. Indeed, just the opposite. The major stock market declines typically came along with the ECB growing its balance sheet to address a weakening economic outlook.

Eurozone stocks and ECB balance sheet tapering/trimming

Source: Charles Schwab, Bloomberg data as of 9/8/2021.

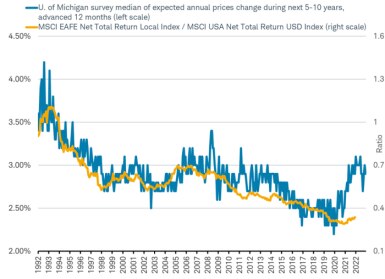

Rate hikes rising

The ECB is not unique in its beginning to rein in stimulus. The Bank of Canada has already tapered asset purchases and looks set to hike rates a year from now. The United Kingdom is now widely expected to raise rates in the first half of next year. The central banks of Norway and New Zealand may both hike rates this year. In fact, an increasing number of the world’s central banks are raising rates, as you can see in the chart below.

Return to rate hikes

* Based on study of 76 central banks

Source: Charles Schwab, Bloomberg data as of 9/8/2021.

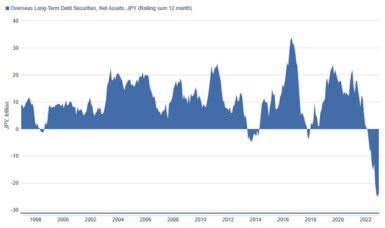

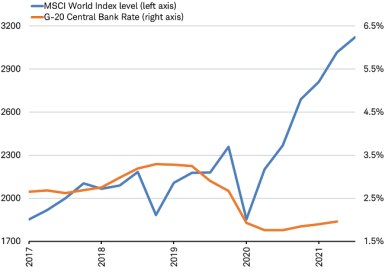

As a result, the average central bank policy interest rate for the Group of 20 nations has already started to rise, although remaining very low on a historical basis, as you can see in the chart below. Overlaying the MSCI World Index of stocks onto the Group of 20 nations average policy rate, it seems that the rise in rates has not been an impediment to stock market gains.

Lift off: G20 central bank rates

Source: Charles Schwab, Bloomberg data as of 9/8/2021.

Historically, this observation has also held true looking back further, as seen in the table below. When central banks rates were rising from a low level (below average), stocks in the MSCI World Index performed best (+10.3%). When they were being cut from a high level (above average), stocks in the index performed the worst (-17.8%). This makes sense since it is the economic and earnings environment that is the primary driver of the stock market performance and central bank behavior. When the economy is strengthening after a downturn central banks often lift rates from low levels seeking to normalize policy. When the economy is weakening, central banks are often cutting rates to support economic activity. In the next year, global economic growth is expected to remain above average, and the rise in policy rates is likely to come amid a favorable backdrop for stocks.

Annual performance of global stocks under different policy rate environments

Annual performance of MSCI World Index for all years since 1997.

Source: Charles Schwab, Bloomberg data as of 9/10/2021.

Reining in monetary stimulus of the past year and a half seems to be underway around the world, with the U.S. likely to follow. Contrary to the fear that the payback for a gradual slowing of stimulus is a major drop for the world’s stock markets, the evidence suggests potential for a positive outcome. This would be consistent with the top right quadrant in this table. The payback may lead to a payoff for investors.

Michelle Gibley, CFA®, Director of International Research, and Heather O’Leary, Senior Global Investment Research Analyst, contributed to this report.

What You Can Do Next

Follow Jeffrey Kleintop on Twitter: @JeffreyKleintop.

Explore Schwab’s views on other international topics.

Talk to us about the services that are right for you. Call us at 800-355-2162, visit a branch, find a consultant, or open an account online.