MARK RIEPE: As I record this episode, it's summer 2022, and last year at this time, many of us were watching the Tokyo Summer Olympics. To an extent, almost all sports at the Olympic level are inherently risky. But some are more so than others.

Let me give you an example. At the Summer Games of 2016 in Rio de Janeiro, a study found that the riskiest sport was BMX cycling. That is if you define risk as risk of injury. 38% of BMX cyclists suffered injuries, compared to 8% of Olympians overall.1

Another risky Olympic sport also involves riding—but this time, it's horses. The equestrian sports that require jumping entail a 1,200-pound animal galloping and jumping substantial obstacles. A miscalculation, stumble, or a horse clipping a fence and falling can all result in serious injury or worse.2

Within the universe of equestrian sports, the eventing competition is especially dangerous. One estimate is that five out of every 100 riders competing will fall in an eventing competition. And out of every 55 falls, approximately one will result in serious injury.3

Not surprisingly, competitors are required to wear a protective safety vest,4 and many add a vest that inflates like an airbag and protects the rider from being crushed if they fall off.5

I'm Mark Riepe, and this is Financial Decoder, an original podcast from Charles Schwab. It's a show about financial decisions and the cognitive and emotional biases that can cloud our judgment.

What makes eventing interesting for this episode is that in upper-level competitions, riders must decide how many additional risks they're willing to take in their pursuit of victory. Before I explain that, let’s take a step back and give you some context on this type of competition.

Eventing has been described as a triathlon for horses,4 because it comprises three distinct disciplines.

The first component is dressage, during which each horse-and-rider pair performs the same test, or sequence of movements, in a ring, showcasing precision, obedience, and partnership.

In the second phase, known as cross-country, competitors gallop about four miles over varied terrain and jump over approximately 35 solid obstacles.

The final phase is stadium jumping, where the horses jump a course of fences in an arena.

I want to focus on cross-country. It's a timed event, and course designers include several options where shorter routes pose a bigger challenge—for example, a higher or wider fence, a tricky approach to a jump, or an especially narrow obstacle. These all tempt the horse to stop in front of the jump and increase the chances of a fall.

Of course, if the rider doesn’t like the short, most direct routes through the course, there are more roundabout options available. These routes have easier obstacles but they take longer. And that’s the crucial trade-off that’s a lot like the risk-reward trade-off that investors grapple with.

When planning their strategy, riders must consider the horses' strengths and weaknesses. If the horse doesn't like water, the rider might choose the route that has fewer jumps within a water complex. If the horse has a long stride, the rider might try to avoid sequential jumps that are very close together.

Riders also have to be flexible enough to alter their plan if something goes wrong. For example, if the horse stops in front of a jump and refuses to try it—they must circle back and try the jump again, which adds to their time. If they want a higher placing, they must make up that time later on the course.

At some level, all sports involve risk and a trade-off between risk and return, but in other sports, athletes take risks based on their confidence in their abilities on a particular day. In equestrian sports, the rider has to evaluate how the horse is feeling as well. Horses are not machines, and this adds a layer of unpredictability. Even the most well-trained horse that trusts its rider is not 100% reliable 100% of the time.

Our editor on this episode, who actually knows what she’s talking about when it comes to horses, tells me that it’s like playing tennis with a racquet that has a mind of its own.

The eventing competition is similar to investing, because of the tradeoffs you have to make between risk and reward—and because you as an individual investor only control so many of the factors that influence your portfolio's performance.

A horse is never completely predictable, just like the markets are never predictable. Riders have to make decisions about whether they'll take the riskier track or the less-risky option—and investors have to decide how much risk and volatility they can stomach in pursuit of their financial goals And there are no guarantees in either activity.

Nevertheless, decisions must be made because finding that right balance between risk and return is fundamental to investing success, and Susan Hirshman is here to discuss risk and how to determine how much of it is right for you.

Susan is a director of wealth management for Schwab Wealth Advisory.

She’s a Chartered Financial Analyst and CERTIFIED FINANCIAL PLANNER™ and has worked for many, many years as an advisor to high-net-worth and ultra-high-net-worth investors.

Susan, glad you could join us today.

SUSAN HIRSHMAN: Thank you for having me. I'm excited to be here.

MARK: So, Susan, we talk all the time about how it's important to balance risk and return when it comes to investing. And the importance of generating good returns, I think that's pretty obvious to most people, but I'm not really convinced that the risk part is really appreciated as much. So why is risk important?

SUSAN: You know, Mark, I couldn't agree with you more. On all the financial media, financial advertising, there's so much focus on return, but a conversation about risk is really where I believe an investor should be focused, and here's why: A person's attitude, a person's expectations of risk versus … that's the key word … versus how that person actually acts upon experiencing that risk, that difference is, I believe, one of the most significant drivers of an investor's long-term success.

MARK: You spent a, you know, career, really, working with individual investors. When you ask them about risk, because I know you bring it up in every conversation, what does that mean? What does risk look like? What does it feel like that to that real-world investor?

SUSAN: Yeah, and this is one of those times when we do the famous wealth management answer of saying, "It depends." So it really depends on who you ask. One of my favorite expressions is that risk is in the eye of the beholder. The concept of risk is so unique to each person. It's dependent on their specific views. It's dependent on their past experiences, their current circumstances, and, really, most importantly, their frame of reference. And what I mean by frame of reference is this: If their frame of reference is short term, if their frame of reference is a trader mentality, what their definition of risk is, is "I am losing money." Right? On the opposite side, if you have a long-term view, what I like to call a more wealth-management, holistic view, then the big risk there is the risk of not meeting my life's goals. It's about achievement of life's goals. That's the big difference.

MARK: Yeah, so the trader … see if I can paraphrase this… the trader is "Did I lose money today? Did I lose money last week? Did I lose money last month?" Whereas, you know, to use your phrase, holistic wealth management, "'Am I still on track to reach my goals? Yes or no?" I mean, is that kind of the distinction?

SUSAN: Perfectly said.

MARK: So we like to make the distinction internally here, here at Schwab, between risk tolerance and risk capacity. So let's leave risk capacity off … we'll just push that off to the side—we'll get to that later. What does risk tolerance mean to you?

SUSAN: Yeah, so risk tolerance is really about behavior. So it's the amount of volatility or downward pressure that one can experience that doesn't cause them angst, that doesn't cause them great stress. And, most importantly, it doesn't cause them to take actions that are detrimental to their long-term investment success. I call it the sleep-at-night factor.

MARK: And it's … I think the way you defined it, it's inherently in an emotional concept, right?

SUSAN: Without a doubt.

MARK: Well, what's interesting is that makes it so difficult, then, to determine what your tolerance of risk is, given that, you know, emotions are volatile and they're hard to pin down. So how do you … for our listeners, how should they go about determining their risk tolerance?

SUSAN: Yeah, it's not easy, and it's not necessarily quantifiable, right? So the best way to do that is really through self-reflection, and I like to take clients through a series of questions to get them really thinking about their actions in the past, their feelings, their emotions. So, Mark, do you feel like self-reflecting?

MARK: Not today. Maybe … maybe later.

SUSAN: Well, I can share the five questions that I typically ask. Would that be of interest?

MARK: Sure. Sure. The more practical, the better. We are … news you can use—that's Financial Decoder. So take it away.

SUSAN: Awesome. So the first question is this: "How has your family experiences with money from childhood through the present affected your feelings and attitudes today towards money and wealth, and why?" "How did you feel and behave in prior market selloffs? Did you stay the course? Did you sell everything? Did you invest more? Why?" "How did your past expectations for your portfolio differ from past reality? Why?" "What learnings do you have regarding your past investment behaviors? Why?" And lastly, "Are there any differences in your current situation, in timing or current circumstances, that would cause you to act differently today or in the future than you did in the past?" And then "Why?" The whys are really the key to understanding a person's risk tolerance.

MARK: Yeah, you got to get that thinking behind it. It's not just this bloodless exercise of just answering sort of yes or no. It's what's the thinking? What was going through your head? I also like the fact that you're grounding it … those questions, four of the five questions are grounded in sort of historical reality, what people have actually done. Because we've done episodes in the past where there's a lot of documentation that people have … they don't do a great job of predicting their feelings to the future. And by figuring out what they've done in the past and then adjusting it for how, maybe, the world has changed, I think that makes a lot of sense. So give me some examples of what this looks like in practice.

SUSAN: Yeah, so I have a great example, I think, is one client that I worked with. I started working with him six months after COVID started. And when COVID started, he panicked and sold his portfolio and put it all in cash. So here we were six months later, and he was really angry at himself because he was missing a big part of the bull market. So we took a step back and went through those questions, and two things that I learned about him. Number one was the fact that his family growing up had tremendous money issues, a lot of fighting in terms of his parents. And, also, his parents worked practically to the day they died. And he did not want to have that life, and he was really fearful that that would come and be his life. And the second thing that we learned was that he promised his family that he was going to work really hard for 20 years and then be able to retire early. And so if he wasn't able to achieve that goal, he said he would be a failure. So those two emotional, strong feelings of fear and failure, those drove his behavior, even though he said he was an aggressive investor.

MARK: Despite the process you laid out, and, again, you've been doing this a long time, you've talked to a lot of people over the years, helped a lot of people over the years, this is still hard to do, though. So what's the biggest challenge in determining somebody's risk tolerance?

SUSAN: So I think the number one challenge is understanding what is it that I want my portfolio to do, right? What am I trying to achieve, and so what are my goals? And then how is my portfolio aligned with those goals. And how in different market scenarios, would my portfolio work, and would I still be able to achieve those goals? So without that knowledge, you really are just walking in the dark. With that knowledge, that's when people who have a risk tolerance of, let's say, a moderate aggressive, we can go back to them, show them, "OK, we had some dips, but we're still on track."

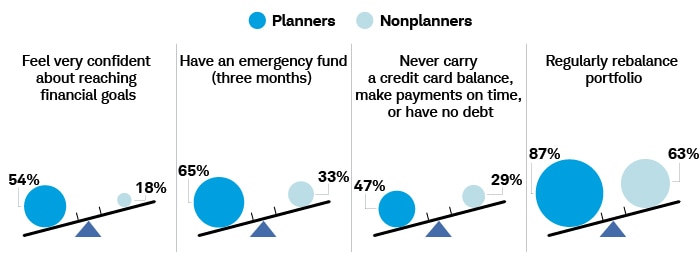

MARK: So it's almost like you're implying that it's going to be a lot easier to figure out a risk tolerance that you can stick with if you've gone through that planning process to lay out your goals and their relative importance to one another. Is that right?

SUSAN: I couldn't have said it better.

MARK: So I think that's been a nice lead in, then, to the concept that we punted a few minutes ago, risk capacity. So what is that all about?

SUSAN: Where risk tolerance is all the emotions that we've been talking about, risk capacity is all about the numbers. So that is the data gathering, right? It's getting together the information about your cash flow, your investments, your timing of goals, the amount of the goals, your tax situation, all those different things. Having to look at them all together and to say, "In my short-term goals, do I have enough liquidity to meet them? Would I have to sell any portion of my portfolio at an inopportune time?" So, in essence, it's "How much risk can I take on? How much loss can I bear that will not hinder me from achieving my goals?"

MARK: So it's sort of if risk tolerance is how much can I lose and still sleep at night, risk capacity is how much can I afford to lose and still be able to pay my bills, right?

SUSAN: Exactly. Exactly.

MARK: Give me some more… like you did before, give me some other kind of practical examples that you go through when working with clients.

SUSAN: Yeah, so I had a client experience recently that … he has twins and … going to college within the next two years. And he is going to retire 15 years out. So his portfolio is going to fund both goals. But in talking with him, we identified that he wants to ensure that those kids go to college. He wants to ensure that those kids get out of the house, and he becomes an empty-nester. So when talking about his risk capacity for that specific goal, we realized that it's near term, he needs to have that liquidity. His capacity for that goal is low, whereas his retirement is 15 years out. He has a higher capacity for the ups and downs of the market.

MARK: So you started to describe that process of making that determination a little bit earlier. Maybe expand on that—how do people go about determining their risk capacity?

SUSAN: So it's identifying, first, what your goals are, again, by dollar amount and timing. It's looking at your cash flow. It's looking at your liquidity. It's looking at your tax situation. It's looking at your portfolio. Combining all that information, then we can determine (a) "If I had loss in my portfolio, could I meet my short-term goals in an easy way, or would I have to create some sort of liquidity that could be harmful to my situation?" So it's really through analysis.

MARK: So, Susan, let's talk a little bit about when risk tolerance and risk capacity, they start to intermingle with one another. So for a given goal, should the investor have a risk tolerance and risk capacity that are consistent with one another?

SUSAN: In essence, yes, because think about it this way. You have … our client that was going to fund the college education of his children, he wanted to make sure that those assets are there, and he knew the exact amount that he needed. So his risk capacity was low. And because we spoke about … and he didn't want to sell at an inopportune time, his risk tolerance for those assets were low. But on the other side, his risk capacity and his risk tolerance for his retirement was higher, and he was more aggressively invested. What I often see is that people's risk capacity could be low, but they're trying to hit it out of the ballpark. So they say their risk tolerance is high, and they will take … I had a couple that had $100,000 invested … in cash for a new home, but then they put it into a more aggressive because they wanted to maximize. And I heard from them the other day, and now they're having to put off the house.

MARK: You talked about houses. You've mentioned retirement. You've mentioned college savings. So I think the reality there is that people, in fact, have multiple goals. So is it OK or is it reasonable to expect that people would have different risk tolerances depending on the particular goal they have?

SUSAN: Without a doubt. And I always like to think of goals in three buckets, in a way, is my must-have, my nice-to-have, and my aspirational. So my must-have goals, again, it's all about the dollar amount and the timing. First, I make sure those are taken care of. Then my nice-to-have, I can possibly take on a little bit more risk. And my aspirational, perhaps I can even take on a little bit more risk for those because they're dreams, and I'm just trying to see if I can make it happen.

MARK: How do you handle situations where you've got a couple and partner one has a risk tolerance that is diametrically opposed to partner number two?

SUSAN: Yeah, and that's really common. And the basic way to reconcile it is really through conversation and awareness. So two things when I say awareness. One is for each of them to really understand why the other has that feeling. I like to do those five questions I mentioned separately for each couple to get an understanding. And then, hopefully, that brings understanding between the two of them. The other understanding, again, comes back to that wealth management plan. To your point earlier, that's the tether, right? That's the foundation. And what you can see with that wealth management plan is "If I take more risk, will I be able to achieve my goals? What will my portfolio look like over time?" So having data, showing people pictures, giving them an understanding really helps a couple come to terms with their overall risk tolerance.

MARK: Everything we've been talking about up to this point, you know, for the most part, we've been talking about market risk, you know, portfolios and whether the portfolio is big enough, or where there's a shortfall relative to the goal, or if I gained or lost money recently. It's all really been about kind of the portfolio. But there are other risks, if we kind of move away from the investing side and think about somebody's broader financial life. There are other risks involved with the rest of the financial life. Is that right? And how do you think about risk in that context?

SUSAN: Yeah, and I love that you asked that question because that's what wealth management … that's the wealth management process … is looking at those risks. And, unfortunately, those risks do not get enough attention, right? We don't hear enough about those risks. We hear too much about market risk. So those risks are the ones that we don't like to talk about, but these risks are the ones that can have the greatest impact on your portfolio. So I call them the six Ds. They're death, they're disability, dementia, destruction, divorce, denial. I know these are not happy topics. But what I always used to say to clients is that … "Think about it this way: Instead of taking it from a side of negativity, think about it as a way of positivity. What you're doing is putting your family in the best possible situation at times of extreme unhappiness and stress. And isn't that a beautiful, beautiful thing?"

MARK: I think that's exactly right. Just because you ignore a risk doesn't mean the risk isn't there, right?

SUSAN: Oh, yes. And another favorite expression of mine is "Doing nothing is a decision unto itself." So by doing nothing, you are, in fact, making decisions. Not focusing on your estate plan, you made a specific decision that you are OK if your assets go to people that you don't want them to go to. You're OK if there's family strife. So doing nothing is a decision.

MARK: Yeah, I think, also, if you do nothing about a risk, essentially, you're saying the probability of it is zero, and you don't really … it's not really that important to you, right?

SUSAN: Yeah, and we all know probability of death and taxes … pretty high.

MARK: I think that's right. Susan Hirshman is the director of wealth management for Schwab Wealth Advisory. Susan, thanks for being here today.

SUSAN: Thank you.

MARK: One topic we try to cover on every episode are biases that impede decision-making. Here are a few that are relevant when you’re deciding how much risk to take with your portfolio.

First, avoid making a decision about risk when under stress. If recent market conditions have raised your blood pressure, then that’s not a good time to quickly overhaul your portfolio’s risk profile.

Market volatility is one source of stress, but there are others. For example, if your spouse has recently passed away, or you’ve lost your job.

When we're under stress, we can get short-sighted. It’s as if stress gives us tunnel vision, and we tend to focus on all the undesirable outcomes of the choice we're making because of our negative mindset.

One way to broaden this tunnel vision is to take some time. Wait until you're in a better state of mind and have regained your emotional equilibrium and then reassess.

Your mindset will change, and you’ll be able to reflect on the decision and hopefully make a better one.

To learn more about stress, check out the "Under Pressure" episode of our Choiceology podcast.6

Second, avoid making decisions about risk when past returns have been exceptionally good. As we’ve mentioned many times on this podcast, we’re prone to let the recent past exert too much influence on our judgment.

Just like with my point about stress, you want to let the warm glow from the high returns cool off a bit before making any big changes in your level of risk taking.

Third, just because you’re a risk taker in one aspect of your life doesn’t mean you’re a risk taker in all aspects of your life.

In other words, just because you’re a skydiver on weekends doesn’t mean you'll be comfortable taking risks with your finances.

Most people seem to compartmentalize their attitudes towards risk and view each activity in isolation.7

This presents a problem if you’re new to investing. How do you know what level of risk you can tolerate if you have no experience and you can’t rely on how you’ve approached risk in other areas of life?

One idea is to try to think about other financial activities and your comfort level with risks in those areas. For example, insurance. Do you choose a high-deductible or low-deductible policy? Do you even buy insurance?

How you act in other financial domains may be a better predictor of your comfort level with investing than, say, your willingness to ride the most spectacular roller coasters, take on the double-black-diamond ski runs, or get on an independent-minded horse for a ride through an Olympic cross-country course.

My fourth and last point is to not think of investment risk taking as an all-or-nothing decision. By that I mean the choice isn’t between putting all of your money in a bank account or putting it all in the latest hot stock.

There’s a lot of room in between those two extremes.

I know that seems obvious, but when we do public events, it’s amazing how many of the questions are of this all-or-nothing variety.

Also, for most financial products, you’re not making choices that are forever-type decisions where the choice you make is irrevocable.

Feel free to ease into your choices and make a series of small changes over time rather than one big decision.

For more information on risk tolerance and investing, talk to your financial advisor or a Schwab representative. And there are informative articles on risk at Schwab.com/Learn.

Thanks for listening. If you've enjoyed the show, please leave us a review on Apple Podcasts. And if you know someone who might like the show, please tell them about it and how they can also follow us for free in their favorite podcasting app.

You can also follow me on Twitter @MarkRiepe. M-A-R-K-R-I-E-P-E.

For important disclosures, see the show notes and Schwab.com/FinancialDecoder.

1 Torbjorn Soligard et al. "Sports Injury and Illness Incidence in the Rio de Janeiro 2016 Olympic Summer Games: A Prospective Study of 11274 Athletes from 207 Countries," British Journal of Sports Medicine (2017): 1265, https://bjsm.bmj.com/content/51/17/1265.

2 Kevin McFarland, "These Are the Most Dangerous Olympic Events," Wired, August 16, 2016, https://www.wired.com/2016/08/dangerous-olympic-events/.

3 "Eventing Risk Management Programme Statistics 2005-2015," inside.fei.org, February 26, 2016, 19, 23, https://inside.fei.org/system/files/FEI_StatisticsReport_2005-2015_26.02.2016_0.pdf.

4 Federation Equestre Internationale, FEI Eventing Rules, Chapter 7, General Competitions Rules, article 538.3, https://inside.fei.org/sites/default/files/2022%20Eventin%20Rules_clean%20version.pdf.

5 United States Equestrian Federation, "Eventing," usef.com, https://www.usef.org/compete/disciplines/eventing.

6 "Under Pressure," Choiceology with Katy Milkman, season 9, episode 6, May 23, 2022, https://www.schwab.com/learn/story/under-pressure-with-guests-svetlana-savranskaya-gary-slaughter-modupe-akinola.

7 Elke U. Weber, Ann-Renee Blais, and Nancy E. Betz, “A Domain-Specific Risk-Attitude Scale: Measuring Risk Perceptions and Risk Behaviors,” Journal of Behavioral Decision Making, 2002.