Do You Have Enough for Retirement?

Many retirees risk outliving their retirement savings. The reason? Either failure to save enough—or failure to plan ahead.

While many of us understand the need to set aside a portion of our income on a regular basis for our golden years, far fewer have a plan for determining if they've saved enough to retire and a strategy to convert those savings into a lasting income. In fact, only 54% of planners and 18% of non-planners are confident that they'll achieve their financial goals.1

Creating income during retirement may sound daunting, but it doesn't have to be. We recommend doing so in four simple steps: plan, invest, distribute, and monitor. In this article, we'll take you through the first, and arguably most important, one: planning—including how much you'll need during retirement and assessing whether you've saved enough when the time comes.

Your life, your plan

First, start with a vision—and projection—of your retirement finances. No two retirements are the same. Your plan should encompass your vision: What are your goals, and what resources will you need to meet them? Here are three basic questions you should ask as you begin the planning process:

- How much will you need to spend to achieve your goals?

- How much do you expect to earn from your savings, Social Security, and other potential sources of income?

- What will you do if your savings fall short?

1. How much will you need to spend?

One school of thought says you'll need 75% to 80% of your current income to maintain your present standard of living. That's because some costs—such as mortgage payments or work-related expenses like clothing and commuting—are expected to decrease or go away altogether.

However, while some expenses may be reduced, others—such as travel, entertainment, and health care—may increase. Therefore, it might be safer to assume you'll need roughly the same level of annual income that you earn now minus other potential sources of income, such as savings and Social Security.

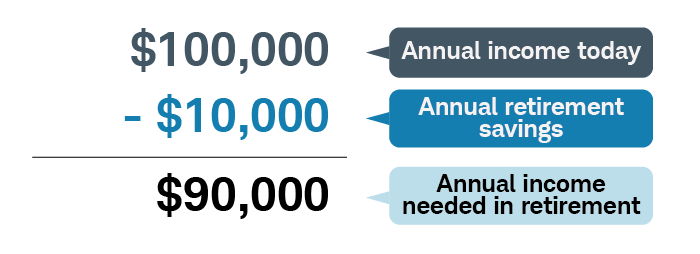

As an example, let's say you earn $100,000 a year before taxes and are saving $10,000 a year toward retirement. Based on the 75% to 80% rule, you'd need between $75,000 and $80,000 a year in retirement. But it's safer to assume that you'll need $90,000 annually—that is, $100,000 minus the $10,000 you are currently allocating to retirement savings—all things being equal.

How much of your current income will you need?

Source: Schwab Center for Financial Research

Another approach is to create a detailed budget by breaking down anticipated expenses into two groups:

- Essential expenses, or those you can't live without, such as food, health care, and housing.

- Discretionary expenses, or those that are nice to have (not need to have), like entertainment, restaurants, and travel.

If you own your home, you should also budget for costs like major appliance replacements and other improvements and repairs that may be required during your retirement. You might also include possible one-time expenses, such as moving or taking that dream trip you've been putting off.

A detailed budget can be more meaningful, and helpful, near retirement.

2. How much retirement income can you expect?

Once you have an idea of how much you'll need to spend, you can begin to calculate whether you'll have enough resources.

First, tally up any earnings you expect to receive from pensions, Social Security, and any other sources of income—separate from your savings. Then, subtract that amount from your estimated expenses to determine how much income will need to come from your portfolio.

Learn more about planning for nonportfolio income, including Social Security and other retirement income.

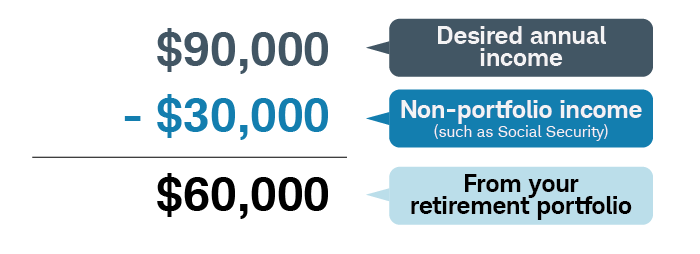

For example, let's say you're aiming for $90,000 in annual spending. Assuming your nonportfolio income amounts to $30,000 a year, you'll need $60,000 a year from your portfolio.

Gauging your annual retirement portfolio income

Source: Schwab Center for Financial Research

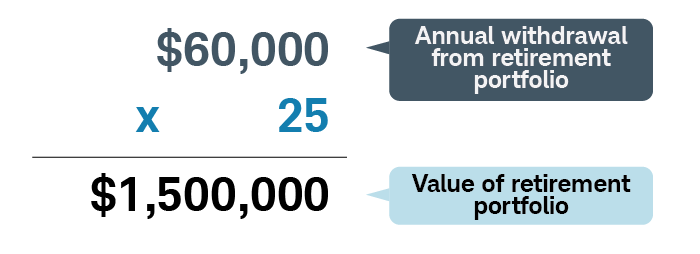

According to our research, a portfolio that's roughly 25 times as large as the amount needed for your first year of retirement has a very high likelihood—if invested appropriately—of lasting 30 years or more under most market scenarios, even with increasing your withdrawals each year to give you a pay raise and keep up with inflation.2 With that 25x target in mind and an annual portfolio withdrawal of $60,000, a portfolio value of $1.5 million—supplemented by non-portfolio income—would support your retirement spending.

Calculating your retirement savings goal

Source: Schwab Center for Financial Research

Although the so-called "25x rule" is a target, if you're nearing retirement and haven't reached this 25x savings target, don't panic. We view this guideline is a conservative target. It should provide a rough sense of an amount that, if invested based on your retirement time horizon, will very likely last through a 30-year retirement—even allowing for poor markets and for consistent increases in spending each year. That said, it's always a good idea to work with a financial planning professional who can take your current situation into account to create a personalized, more nuanced retirement transition and income plan—especially as you near retirement.

3. What if your savings fall short?

While some investors will find themselves on target, others will discover that they may not have saved as much as they would have liked. If you experience the latter, here are several ways to adjust:

Step up your saving

- Contribute the maximum to your 401(k).

- Contribute to an individual retirement account (IRA).

- Contribute to a SEP-IRA if you're self-employed.

- Make additional catch-up contributions if you're over 50.

- Earmark bonuses, raises, and tax refunds for retirement.

Consider waiting

- Work longer to help preserve your savings.

- Work until you're eligible for Medicare to avoid the expense of private coverage.

- Wait to collect Social Security. You can begin collecting benefits as early as age 62, though it will be reduced by 25%–30% compared with your full retirement age (between 66 and 67). Once you attain full retirement age, every year you wait up to age 70 increases your benefit by 8%. Waiting beyond age 70 will not increase your benefit, however.

- Consider a phased retirement that includes part-time work to help reduce the need to file for Social Security payments before full retirement age and to reduce withdrawals from your portfolio.

Prioritize

- Reduce discretionary spending by separating "nice to haves" from "need to haves."

- Cover "need to haves" with proceeds from pensions, Social Security, and other relatively reliable sources of income whenever possible.

- During retirement, prioritizing spending is helpful too. In a down market, you can reduce discretionary spending to help savings last.

But no matter your stage of life, you can only plan and save with the resources you have at your disposal. Focus on the positive and remind yourself that you've done a great job saving.

Periodic check-ins

It's important to remember that retirement-income planning isn't a "set it and forget it" exercise, especially in the years just prior to retirement and after retirement begins. Rather, a retirement plan that goes beyond the general guidelines suggested here should be a working document that is reevaluated at least annually to account for any changes to inflation, investment returns, life expectancy, spending, and taxes.

This may sound like a lot of work, but by planning today, you can confidently count on going the distance tomorrow. Following a plan, but remaining flexible, can help make your savings last so that you can enjoy your retirement. And the more flexible you remain in retirement—making reasonable adjustments when markets change, based on a financial plan—the more successful you will likely be over the long term.

1Charles Schwab, Charles Schwab Modern Wealth Survey 2021 (Logica Research, 2021), https://content.schwab.com/web/retail/public/about-schwab/schwab_modern_wealth_survey_2021_findings.pdf.

2This is a general estimate only. It is recommended that investors use a retirement-plan calculator with Monte Carlo simulations for a more refined, personalized estimate.