Tax Bill or Tax Refund? Find Out Why

In a perfect world, you'd know exactly what your income tax obligation was at the beginning of the year and could withhold accordingly, so you'd never be owed a refund or receive a surprise tax bill.

In the real world, however, calculating your tax obligation in advance is difficult because your income might change or you may want to claim certain deductions. That's why most people either receive a refund or have to pay a bit extra when they file.

Neither is a judgment about your finances. A refund just means you withheld too much from your paycheck, while an additional tax liability means you didn't withhold enough.

What's in a refund?

As exciting as refunds are, they're really just the federal government returning the extra amount you paid. While some people prefer to receive a large refund at tax time, there may be better ways to save money. In fact, when you withhold too much, you're effectively giving the government an interest-free loan: The government gets to use your money, and then returns it to you without paying any interest—not a great investment.

We generally recommend doing a bit of advance tax planning and then fine-tuning your withholding so you're paying just enough to cover your tax bill. (If you don't withhold enough, you may face penalties.) The upshot would be having more money that you could invest for a return or spend as needed, without having to wait for a refund after you file your taxes.

What's your actual tax liability?

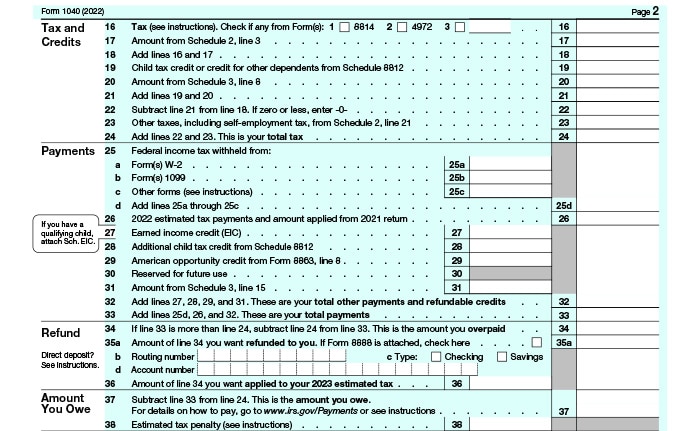

The following information from the Form 1040, which you use to file your taxes each year, will help you determine your tax liability—and whether you'll get a refund or end up owing more:

- Line 24: The total tax due is what you owe in taxes for the year.

- Line 33: These are your total payments for the tax year (a combination of eligible credits and payments you've already made), including tax withheld from your income during the year.

Is the number on Line 33 larger than the number on Line 24? If so, that means you withheld too much. Go to:

- Line 34: This is your refund.

Or is Line 24 larger? If so, you didn't withhold enough. Go to:

- Line 37: This is the amount you owe.

Image of Form 1040 for 2022

Source: IRS Form 1040 for 2022.

How to prepare for next year

Generally, your employer withholds on your behalf, based on two critical bits of information:

- The amount you earn

- The information you provide on your Form W-4

So, if you want a large refund next year (again, not recommended, in our opinion), you can update your elections to increase how much is withheld from your paychecks.

But your elections should not be "set it and forget it." If your circumstances change during the year—for example, you get a raise, add to your family, or if an older child moves out of your house—we recommend that you revisit your W-4 elections. In fact, it's a best practice to check your elections once or twice a year no matter what to make sure that you are on target. To make this a little easier, you can use the IRS' Tax Withholding Estimator to adjust how much is withheld from your paychecks month to month. To use this tool, you need:

- Paystubs from all your jobs (including your spouse's)

- Information on other sources of income (e.g., side jobs, self-employment)

- Your most recent tax return

It's also important to know that withholding isn't just something that happens when you work at a company (or multiple companies, if you have more than one job). Tax withholding continues into retirement, but the focus shifts from wages to other sources of income, like Social Security, retirement accounts, or money from an annuity or pension.

If your situation is complicated, we recommend that you meet with a tax professional to learn more about your options.