12 Tax-Smart Charitable Giving Tips for 2023

Making charitable contributions in 2025 could be an important component of your financial and estate planning strategies, especially where taxes are concerned. Here are 12 ways to increase your charitable giving power while potentially reducing your taxable income this year and beyond.

1. Donate appreciated noncash assets instead of cash

If you're thinking about selling appreciated publicly traded securities, real estate, or other noncash assets and donating the proceeds, consider gifting the assets directly to the charity instead. Generally, you can eliminate the capital gains tax you would otherwise incur from selling the assets—as long as you've held them more than one year—and claim a charitable deduction for the fair market value of the assets.

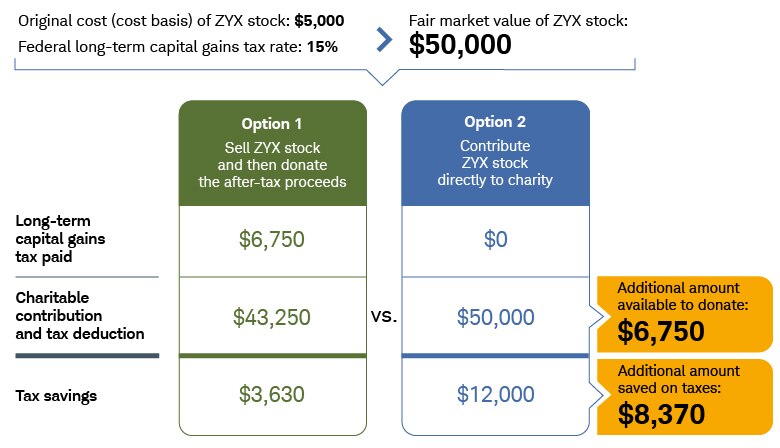

Eliminating the long-term capital gains tax—typically 15% or 20%, depending on your income level—can increase the charitable contribution available to charities by up to 20% as well as boost your tax deduction. Let's take a look at how this strategy would work if you owned stock ZYX with a current value of $50,000.

Donating stock assets vs. after-tax sale proceeds

Source: Schwab Center for Financial Research

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor's income tax rate (24% in this example), minus the long-term capital gains taxes paid.

You decide to sell ZYX stock, which has a cost basis of $5,000, and donate the proceeds to charity. After paying a 15% long-term capital gains tax of $6,750 ($45,000 × 15%), your charitable donation would be $43,250. At a tax rate of 24%, you would save $3,630 ($43,250 × 24% – $6,750) in taxes.

By donating ZYX stock instead, you wouldn't owe long-term capital gains tax—saving you $12,000 ($50,000 × 24%) in taxes and allowing you to gift the full $50,000 value, a win-win situation for both the charitable organization and you.

2. Combine tax-loss harvesting with a cash charitable contribution

If your publicly traded securities have declined below their cost basis, you could sell those assets at a loss and donate the cash proceeds to claim a charitable deduction. Through a process called tax-loss harvesting, you could use your capital losses to offset capital gains, up to $3,000 of ordinary income, or both. You may then carry forward any remaining loss amount to offset gains and income for future tax years.

3. Give private business interests

While publicly traded securities are the most commonly donated noncash assets, C-Corporation, Limited Partnership (LP), or Limited Liability Company (LLC) interests could make good charitable donations as well. This is especially true if the interests have been held more than one year, appreciated significantly over time, and retained more value than other assets you're considering donating.

Giving a percentage of a privately held business interest can generally eliminate the long-term capital gains tax you would otherwise incur if you sold the assets first and donated the proceeds. Plus, you can claim a charitable donation deduction for the fair market value of the asset, as determined by a qualified appraiser.

The Difference Between Public & Private Companies

4. Contribute restricted stock to a charitable organization

Generally, restricted stock cannot be transferred or sold to the public—including public charities—until certain legal or regulatory conditions have been met. However, once all restrictions have been removed and you take ownership of the stock, you can donate your appreciated vested shares to a qualified organization—which can then sell it. Gifting the vested shares of your restricted stock can help you eliminate long-term capital gains tax on the appreciation, and you can claim an income tax deduction on the asset's value at the time of donation.

5. Bunch charitable contributions in one tax year

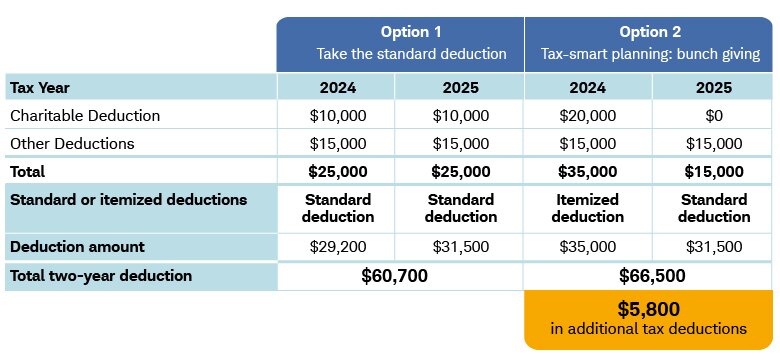

If you anticipate your total itemized deductions will be slightly below your standard deduction amount in 2025, you can combine or "bunch" contributions for multiple years into a single tax year. With this bunching strategy, you would itemize deductions on your current tax return and take the standard deduction on your future return to potentially produce a larger two-year deduction than you would get by claiming two years of standard deductions.

Here's an example of how a married couple with no children could have claimed an additional $7,300 in tax deductions by bunching their annual charitable contributions of $10,000 for both 2024 and 2025 on their 2024 tax return.

Taking the standard deduction vs. bunching charitable contributions

In this scenario, the couple averages $10,000 in charitable deductions and $15,000 of other deductions (a total of $25,000) each year. With Option 1, the couple has chosen to take the higher standard deduction amounts of $29,200 in 2024 and $31,500 in 2025—a two-year total of $60,700.

With Option 2, the couple bunched two years of charitable giving ($20,000) into tax year 2024 and will make no donations in 2025. By claiming $35,000 in itemized deductions for 2024 and taking the standard deduction of $31,500 for 2025—a two-year total of $66,500—the couple will save $5,800 more in taxes.

Source: Schwab Center for Financial Research

Standard deduction amounts are for married taxpayers filing jointly. This hypothetical example is only for illustrative purposes.

Bunching three or more years of charitable contributions may further increase your tax savings. A tax or wealth advisor can help determine if this strategy is right for your situation.

6. Combine charitable giving with investment portfolio rebalancing

Rebalancing often involves selling appreciated investments that have exceeded target allocations and using sale proceeds to buy more of the assets that have become underrepresented in a portfolio. To potentially reduce the tax impact of rebalancing, you can use a part-gift, part-sale strategy. This involves donating long-term appreciated assets in an amount that offsets the capital gains tax on the sale of appreciated assets and claiming a charitable deduction for the donation.

7. Offset taxes on a Roth IRA conversion

Converting a tax-deferred retirement account, such as a traditional IRA, to a Roth IRA can provide potential tax-free growth, qualified tax-free withdrawals after meeting the 5-year holding period, and no annual required minimum distribution (RMD). A Roth conversion can also eliminate the tax liability for beneficiaries (if account assets are passed to heirs). This strategy does carry tax implications, but by making a charitable contribution in the amount you converted and claiming a deduction, you may be able to reduce your federal income tax bill.

8. Minimize taxes on a retirement account withdrawal

Charitable deductions may also help lower taxes on withdrawals, including RMDs, from your tax-deferred retirement accounts. Taking a distribution offers the additional tax benefits of potentially reducing your taxable estate and the tax liability for account beneficiaries. But remember, you generally need to be over age 59½ to avoid an early withdrawal penalty.

9. Establish a charitable trust

Another tax-smart way to give is through a charitable remainder trust or a charitable lead trust. Both irrevocable trusts can be funded with a gift of cash or noncash assets. The difference between the two types is when you want your donation to go to charity.

With a charitable remainder trust (CRT), you or another noncharitable beneficiary would receive payments for a set number of years or for life. At the end of the trust term or upon death of all noncharitable beneficiaries, the remaining assets will be gifted to the public charity of your choice. You may claim a charitable deduction for the year you fund the trust, and the deduction amount is typically based on the present value of the assets that will eventually go to the named charitable organization.

With a charitable lead trust (CLT), the charity receives income from the trust for a specified term, after which the remaining assets will be distributed to an individual or multiple people. Your tax benefits will depend on the trust structure.

10. Name a charity as a designated beneficiary

Unlike individuals who inherit taxable retirement accounts, public charities don't have to pay income tax on bequeathed assets at the time of withdrawal, making them ideal beneficiaries of traditional IRAs or employer-sponsored retirement plans. Every penny of the donation will be directed to support your charitable goals beyond your lifetime. What's more, designating a charitable remainder trust as your beneficiary will combine a gift to charity with income to your heirs.

11. Use a donor-advised fund as part of your charitable giving strategy

In any of the 10 strategies listed above, you may be eligible for a charitable deduction by contributing cash and noncash assets to a donor-advised fund. This account allows you to invest contributions for potential tax-free growth and to recommend grants at any time to public charities of your choice. You can name your donor-advised fund as a charitable beneficiary of retirement assets, life insurance policies, or annuity contracts or as the remainder beneficiary of a charitable trust as well.

12. Satisfy an IRA RMD through a QCD

A qualified charitable distribution (QCD) doesn't qualify for a charitable deduction, but using one to satisfy all or part of your annual RMD can help lower your tax bill and meet your philanthropic goals. A QCD is nontaxable income, and for 2025, individuals age 70½ and older can direct up to $108,000 per year (up to $216,000 for married couples filing jointly) from their IRAs to operating charities1, not including donor-advised funds. Current tax law also allows you to direct a one-time, $54,000 QCD to a charitable remainder trust or charitable gift annuity for tax year 2025.

Sharing the wealth with charitable giving

Consider making charitable giving part of your financial plan. Your investment, tax, and legal advisors can help you determine the best strategies to amplify your generosity.

1Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.