2025 Planning and Wealth Management Outlook

Heading into 2026, investor concerns about tax law changes, tariff impacts, and shifting economic expectations that dominated 2025 have begun to settle. While uncertainty is part of planning and investing, guiding principles that define effective wealth management remain unchanged: think in decades, integrate all aspects of your financial life, and treat wealth as a way to achieve goals.

For most investors, having a plan, investing, and then managing wealth serves two essential functions: to build wealth, and then use wealth confidently, comfortably, and in a way that reflects your values and priorities.

Our 2026 wealth management outlook centers on three themes to help investors make smarter, more intentional decisions.

- Time horizon: Focus on the timing of your investing goals.

- Multiple goals: Design your portfolio around distinct outcomes.

- Taxes and legacy: Plan with more clarity thanks to new tax laws.

Focus on the timing of your investing goals

Time horizon remains one of the most important factors in any investment plan. Think about your investing goals and the urgency—or time horizon—for each of them, then align your portfolio with your goals.

With interest rates stabilizing, inflation trending toward target ranges, and volatility reverting to long-term norms, investors who anchor decisions to true time horizons rather than short-term noise continue to make more rational, durable choices that are affected less by emotions.

It can be helpful to divide investing goals across three different time horizons:

- Long-term goals demand growth exposure. For retirement, multi-decade wealth building, or legacy planning, assets higher growth potential—especially equities—remain central.

- Intermediate-term goals require deliberate structuring. More predictable bond markets allow for better matching of assets to spending timelines.

- Short-term goals need liquidity. Liquidity is a tool, not a default. Cash must be sized to specific needs, such as near-term spending, emergency reserves, and opportunity capital.

Getting the time horizon right drives nearly every other investment decision.

Both sides of your balance sheet matter. Banking and credit decisions on how cash is held and how credit is used are often treated as separate from an investment strategy, but they are equally governed by time horizon and can have a meaningful impact on long-term outcomes.

On the cash-flow and banking side, the rate-cutting cycle underway at the Federal Reserve continues to push yields lower on short-term vehicles, such as money-market funds, high-yield savings, and cash-like mutual funds. While yields remain respectable, the trend is downward. In 2025 we highlighted the value of locking in higher rates through short-term Treasury ladders, CD ladders, or short-duration bond ladders for near-term spending needs. That principle still holds in 2026. Even though yields on the short end of the curve are no longer as attractive as they were 12 months ago, structured ladders remain a disciplined, time-horizon-aligned approach to cash management.

On the borrowing and credit side, home financing remains the single-largest debt decision most households will make. Mortgage affordability continues to be a defining constraint, and while 30-year mortgage rates have declined modestly over the past year, they remain persistently above 6%. Neither we nor most economists expect a return to the 3% mortgage rates of the post-2008 zero interest rate policy, or ZIRP, era. Those conditions were the product of an abnormal monetary policy environment unlikely to be repeated in the foreseeable future.

30-year mortgage rates are falling but remain above 6%

Source: Schwab Center for Financial Research.

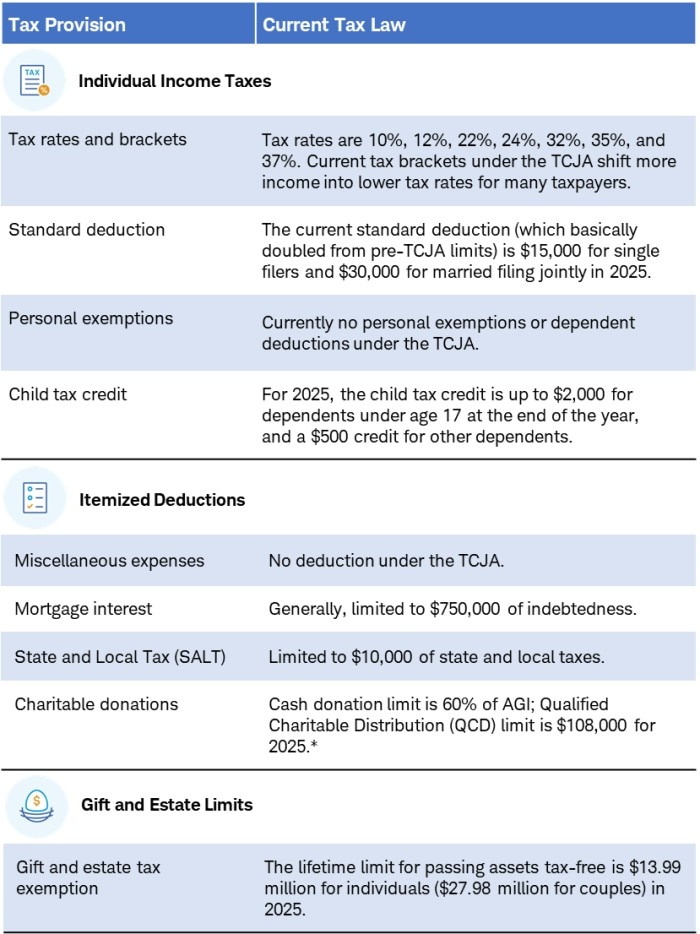

*A Qualified Charitable Distribution (QCD) allows IRA owners age 70½ and older to donate up to $108,000 in 2025 to qualified charities. This annual limit is adjusted each year for inflation.

Manage continued concerns about inflation

Discussions around ultra-long mortgages of 40- or 50-year terms are re-emerging in policy circles. While a longer mortgage may reduce the monthly payment, the trade-offs are substantial. It dramatically increases the total cost of borrowing and slows principal amortization, delaying meaningful equity buildup.

Both sides of the balance sheet—assets and liabilities—must be aligned with an investor's spending horizon, liquidity needs, and long-term financial plan. Banking and credit management are not administrative details; they are core components of a wealth management strategy.

Design your portfolio around distinct outcomes

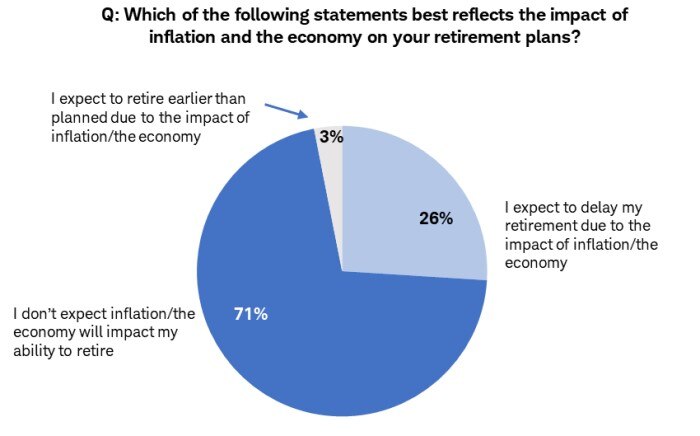

Source: Schwab survey fielded September 24 to October 8, 2024.1

Every investor has multiple goals—retirement, lifestyle, major purchases, charitable giving, and legacy planning. A frequent tendency is treating all goals the same. Personalization is not about maximizing returns across a single blended portfolio; it is about aligning resources to specific outcomes.

The time-horizon focus of our first theme can also impact investments. Different investments achieve different objectives, and different goals have different priorities.

- Some goals require growth.

- Some require stability.

- Some require liquidity.

- Some require tax efficiency or a clear path toward eventual transfer to the next generation.

A portfolio designed solely to "make more money" ignores the real purpose of wealth. By clarifying goals and allocating capital accordingly, investors can make better trade-offs, understand how much risk is appropriate for each goal, and know which dollars must remain flexible versus which should stay invested for years or decades.

Clarifying and prioritizing goals is no longer a luxury; it is core to effective wealth management. This is true in any year, but perhaps particularly true in years after strong stock market performance, heightened uncertainty about the direction of growth and the economy, and a declining rate environment.

An online inflation calculator can help you see how inflation has changed the value of the U.S. dollar and what return your savings and investments would require to keep pace with inflation. Access the Schwab Moneywise inflation calculator at schwabmoneywise.com/inflation-calculator.

Goals-based versus return-focused investing

Few people enjoy paying taxes, and no investor solves the problem by earning less or holding fewer assets. With the passage of the Budget Reconciliation Act of 2025 (also called the One Big Beautiful Bill Act, or OBBBA), which extended key tax provisions of the Tax Cuts and Jobs Act of 2017 and introduced new ones, uncertainty has fallen, and investors can plan with more confidence.

The question for 2026 is straightforward: Which new or extended provisions apply to you, and how can you use them effectively? Tax brackets, contribution limits, estate and gift tax thresholds, and capital-gains treatment all matter for long-term wealth management planning. But the broader message is unchanged: tax planning is a year-round exercise, and filing a return simply reports what already happened.

A more effective approach is to make tax-aware decisions continuously by structuring withdrawals, selecting investment vehicles, timing income, and building portfolios that reduce, defer, or mitigate tax drag over time. Your CPA or tax professional will always be essential for personalized guidance, but tax-aware wealth management remains central to long-term outcomes.

Turn wealth into meaning with legacy planning. Legacy planning is often discussed through a technical lens—estate taxes, trusts, beneficiary designations, gifting strategies, and their related steps or tactics. Those matter, but the real work of legacy planning isn't limited to the mechanics. It is deciding what you want your wealth to accomplish for the people and causes that matter to you.

At some point, the wealth management questions shift to:

- How much wealth is "enough" for my own needs?

- What impact do I want to have while I'm here?

- What do I want the people I care about to experience? Security, opportunity, responsibility, or all three?

- What values do I hope my wealth reflects?

These can feel like abstract questions, but having a plan helps. Answers to these questions can shape decisions on lifetime gifting, charitable giving, the structure and timing of inheritances, donor-advised funds, family education, and the overall design of an estate plan.

A thoughtful legacy plan does three things:

- Protects what you've built.

- Directs it clearly and efficiently.

- Expresses your hopes for the next generation, and the imprint you want to leave.

Whatever your level of wealth, or wherever you are on your financial journey, we suggest that a solid estate and legacy plan, starting with foundational documents, be a wealth management key objective in 2026.

Bottom line

Effective wealth management takes a long view. It distinguishes between multiple goals, integrates tax and legacy considerations, and manages both sides of the balance sheet with discipline and a plan.

The environment for investors will continue to shift—interest rates, markets, policy—but the principles of investing and wealth management do not. Investors who approach their planning with intention, structure, and an understanding of what they want their wealth to accomplish will be better positioned to build wealth, achieve goals, and use money meaningfully and with confidence throughout their lives and for those who follow.

1. The online survey, fielded September 24 to October 8, 2024, received responses from 1,014 American investors aged 23 to 85. The survey was conducted for Schwab by C Space and explored perspectives on retirement among both retirees and those planning for retirement.