2026: International Stocks Seem Set to Shine

Key takeaways for your portfolio:

- Surprise! International stocks are winning as we head toward the end of 2025. While the S&P 500® index is having a great run, developed international equities have been outperforming, demonstrating that looking beyond the U.S. can potentially pay off.

- Diversification isn't just a fancy word, it's your free lunch in investing. Spreading your money across different countries can potentially help you capture growth wherever it happens. It's like having multiple horses in the race!

- Europe looks particularly bright for 2026. Thanks to interest rate cuts by central banks and countries like Germany making big spending moves, the region seems poised for strong economic growth next year, supporting the outlook for international equities.

When you think about stock market success, your mind probably jumps straight to the U.S. And why wouldn't it? After all, the S&P 500 index is on track for yet another year of double-digit total returns. But here's a key insight that might surprise you: 2025 has been a perfect example of why international stocks from developed markets shouldn't be overlooked. That's because they're not just taking part in this year's rally, they're on track to outperform U.S. stocks again this year. And this performance is far more than just a one-off event. In fact, it's a powerful reminder that the investment world is much bigger than just the U.S.

Surprise: the U.S. stock market hasn't always been #1

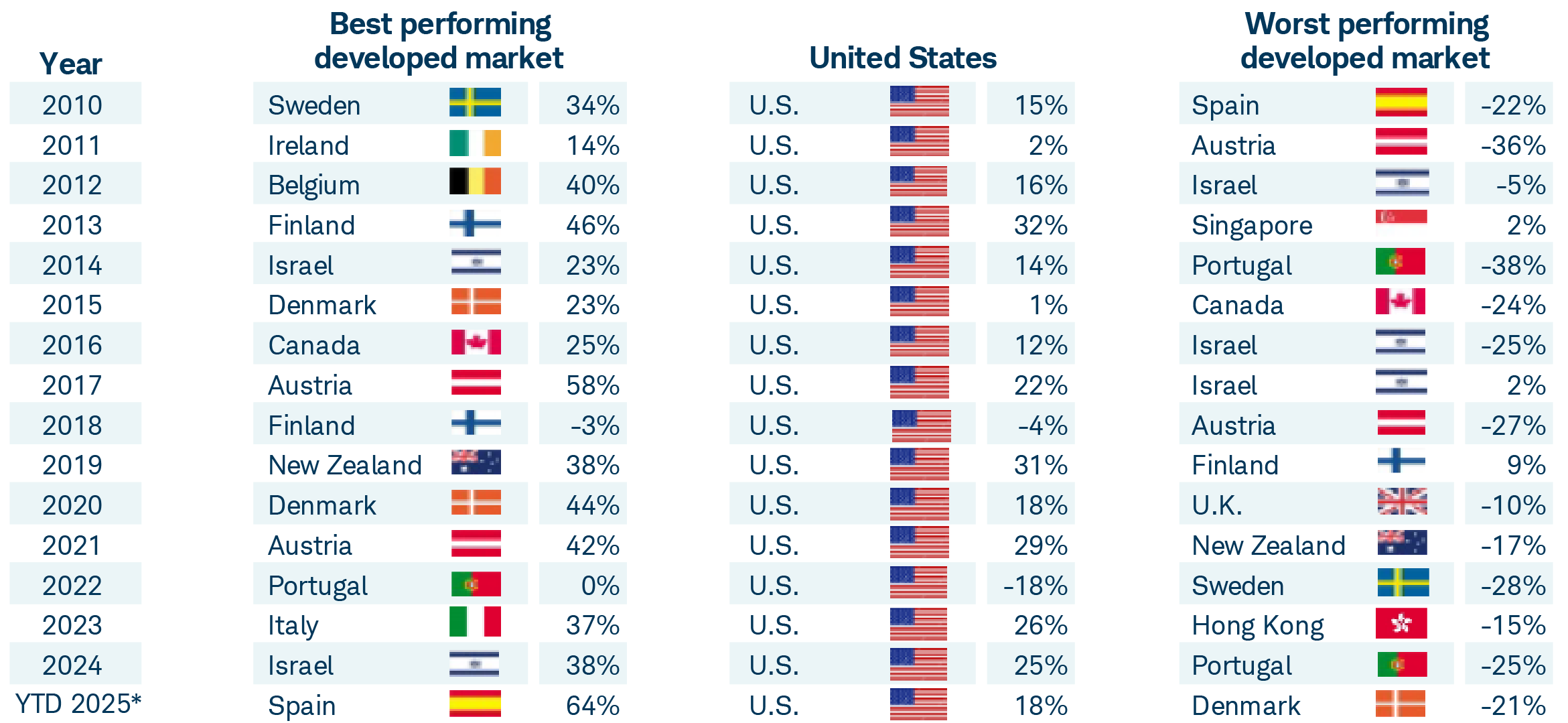

Sources: Schwab Center for Financial Research; Morningstar, Inc. Data as of 10/31/25.

*Returns for 2025 are year to date through October 31. Based on developed markets as designated by MSCI®. Each market, except the U.S., is represented by annual total returns of the MSCI country index and is net of taxes. The S&P 500® index represents the U.S. market's annual total returns. Returns assume reinvestment of dividends and interest. All total returns are in U.S. dollars. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. For more information on indexes, please see https://www.schwab.com/resource/index-and-investment-term-definitions.

International stocks: your portfolio's free lunch opportunity

Glancing at the above chart, you'll quickly notice that U.S. stocks haven't been the top performers over the past decade and a half. Think about this for a second. It means that year in and year out, another developed stock market has stepped up and taken the lead. One year it might be Germany, the next maybe the United Kingdom or France, and then perhaps a smaller, but robust developed economy.

The point is, if you're only relying on U.S. stocks, then you're essentially betting on just one horse in a multi-horse race, an approach that history suggests isn't always going to be a winning proposition. This year, 2025, is on track to echo this reality, demonstrating a key investment principle: the potential benefits of diversification. By spreading your investments across different countries, you increase your chances of capturing growth wherever it happens to be strongest during any given year.

Developed international equities look good for 2026

Looking ahead to 2026, the future for international stocks looks quite bright, as a range of powerful forces align to encourage a supportive backdrop:

- An interest rate boost is pending: Overseas central banks were proactive in cutting interest rates over recent years. These cuts didn't instantly transform the local economic landscapes but their lagged effects are incredibly powerful and should kick in during 2026. Cheaper borrowing costs encourage businesses to invest, expand, and hire, while making consumer spending more affordable. These stimulative effects may begin to really kick in next year, providing a significant boost to economic activity.

- Europe's moment to shine: Europe is poised for solid growth. The European Central Bank has made substantial interest rate cuts—an aggressive 2.35% reduction from June 2024 to June 2025. And Germany is driving future optimism. As the European Union's largest economy, Germany is rolling out its biggest fiscal spending package in more than three decades. Sectors like Financials and Industrials, which are often sensitive to economic cycles and government spending, are well-positioned to benefit. Helped by this backdrop, Germany's GDP is expected to accelerate in 2026 and 2027, based on International Monetary Fund forecasts. And any positive spillover effects from Germany's growth might enhance Europe's broader economy, potentially translating into higher overall corporate profits for companies across the region.1

- Favorable dynamics versus the dollar: Currency exchange rates are another critical piece of the international investing puzzle. The outlook for the U.S. dollar remains less than ideal, especially if expectations for more Federal Reserve interest rate cuts build in 2026, or if the U.S. central bank's independence becomes an even bigger topic of concern. A weaker dollar tends to help U.S. investors in international equities.

- Stronger earnings and attractive valuations: Beyond economic forecasts and currency shifts, the underlying fundamentals also look solid. Earnings for companies in developed international markets are expected to accelerate in 2026. These forecasted growth rates compare favorably with the earnings growth expectations for companies in the S&P 500 index. What's more, many international stocks are trading at attractive valuations compared with their U.S. counterparts. This suggests the possibility of buying into strong companies with good prospects at more reasonable price points.2

Explore beyond the unstable U.S. stock backdrop

In the U.S., instability characterizes the current economic and market backdrop. Tariff uncertainties, persistently sticky overall inflation, questions about the Federal Reserve's future independence, and the dominance of a handful of mega-cap stocks amid AI momentum are all playing ever-shifting roles. Amid this complicated backdrop, the only free lunch in investing—diversification—is still a timeless investment principle worth remembering.

So, instead of just concentrating on U.S. stocks, think about exploring the potential benefits of spreading some of your capital across additional countries. When one region, sector, or industry is having a tough time, another might be soaring, potentially smoothing out your portfolio's overall performance. It's about trying to capture growth wherever it occurs globally, without necessarily concentrating risk in only one place. And it's a strategy that's proven its worth over time, offering a powerful way to build a potentially more resilient and rewarding investment portfolio.

What to consider next

Given the global outlook for 2026, attractive relative valuations for international equities versus U.S. stocks, and the relative performance between the two over the past 15 years, consider exploring whether international stocks deserve a more prominent place in your portfolio. And if you're looking for a way to invest in international equities, keep in mind that some of the most popular choices are exchange-traded funds (ETFs), mutual funds, and separately managed accounts.

Looking for an international equity fund?

Explore ETFs at Schwab.

1 Schwab Center for Financial Research, "2026 Outlook: International Stocks and Economy," published 12/09/25; accessed 12/12/25: https://www.schwab.com/learn/story/international-stock-market-outlook.

2 Ibid.