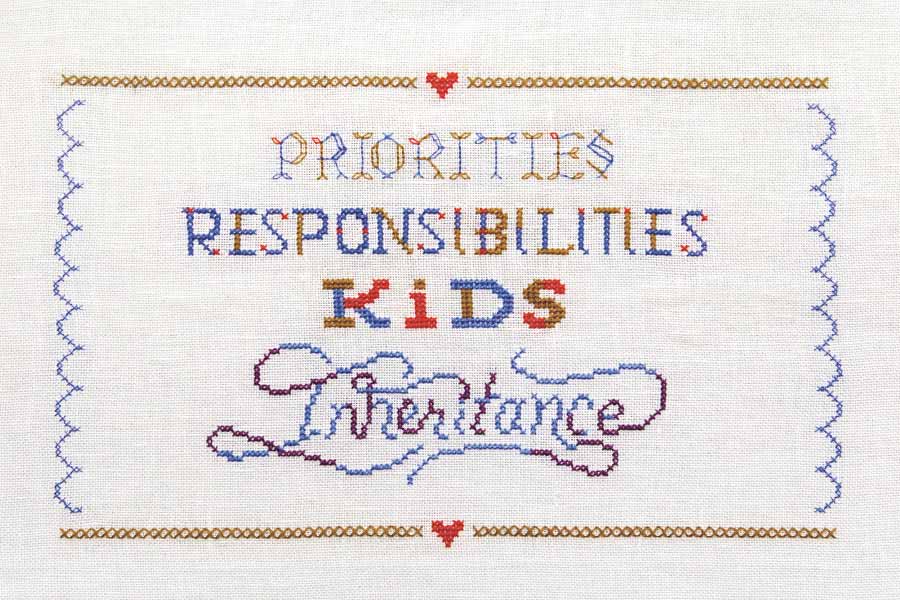

4 Financial Conflicts Faced by Couples

When Schwab's wealth strategists work with couples, some issues come up again and again. Here, they share their advice on how to find financial common ground.

Different priorities

"I think every couple faces this conflict in some way," says Jeannie Bidner, CFP®, a wealth manager with Schwab in Denver. "Maybe one person tends to be a spender and the other is more inclined to save. My advice is to avoid turning this into a me-versus-you situation by accusing your partner of being too frugal or too extravagant. Instead, talk about what money means to each of you and where those values came from, such as whose family had money or how each of your parents viewed spending. It can help to take a step back and understand why we are the way we are before discussing which goals to prioritize and deciding on the best course of action—together."

Lopsided financial management

"It's common for one partner to be more engaged with money than the other," Jeannie says. "That's not bad per se, but if those differences get in the way of your goals as a couple, you need to address the issue. One approach is to divide financial tasks by areas of strength. If the partner who's less engaged financially is great at thinking about the big picture, for example, have them take the lead on fleshing out your shared vision for the future. Once you're in agreement on where you want to go, the more money-minded partner can put together a financial road map. When you both have a clear role and a shared understanding of what it will take to achieve your goals, you may find that the less financially focused partner becomes more engaged."

Helping adult children

"I often meet with couples who disagree over how to help their adult kids," says Jullie Strippoli, a Schwab financial consultant based in Austin, Texas. "One might believe a child must be entirely self-sufficient while the other might be more willing to help. My suggestion is to view any financial assistance through the lens of the child's specific situation. If they regularly can't make ends meet because they're spending recklessly, for example, you might decide some tough love is appropriate. However, if they're financially responsible and simply need occasional help—such as coming up with a security deposit on an apartment or covering expenses while in grad school—you and your spouse might find some middle ground. Every child is unique, and your approach to helping them can be, too."

Disagreement over an inheritance

"Incorporating kids from an earlier marriage into a shared estate plan is another situation that's ripe for conflict, particularly when doing so means the surviving spouse inherits less," says George Pennock, a Las Vegas–based director in Schwab's Wealth Strategies Group. "If your estate plan includes a trust, exercise care when selecting a trustee to oversee these resources. Stepchildren serving as trustees for stepparents, for example, can be especially awkward and problematic. For couples in this situation, purchasing life insurance to benefit either the surviving spouse or the deceased spouse's children is one way to help ensure all family members are amply provided for and help avoid acrimony during the estate settlement process. Working with a seasoned estate planner can also help you see around corners and ease potential conflicts before they arise."