4 Ways to Fight Identity Theft

From banking and shopping to job-hunting and even medical matters, our lives are increasingly conducted online—unintentionally creating troves of personal data for cybercriminals to potentially exploit. Identity thieves are using social media scams to develop relationships and build trust with unsuspecting individuals, and new technology like artificial intelligence is making it easier for fraudsters to collect information. Here's what you need to know about identity theft and some ways to help protect yourself.

What is identity theft?

Identity theft occurs when a bad actor steals your personal or financial information, such as your Social Security number, Medicare number, or credit card or bank account numbers. Once they have your details, criminals can commit identity fraud—which is a term for a whole range of crimes that can be committed with a stolen identity, including opening accounts or even impersonating you if they get in trouble with law enforcement.

How widespread is identity theft?

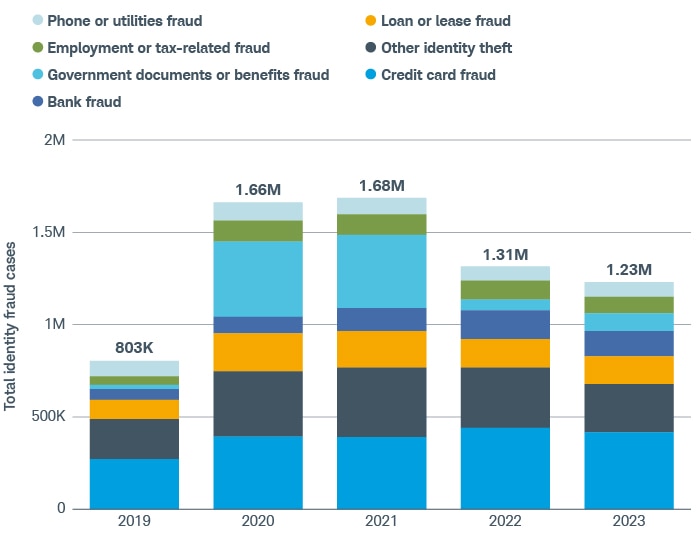

According to the Federal Trade Commission (FTC), identify theft victims have reported more than a million cases of fraud annually the past four years. In fact, at the height of the pandemic in 2020, the FTC saw a 3,000% increase in identity theft complaints related to government benefits alone. Although total incidence of identity theft has decreased slightly the past couple of years, some forms of fraud—such as using the victim's identity to open or alter credit card accounts—continue to occur at high rates.

Double trouble

The number of identity fraud cases more than doubled during the pandemic as bad actors found new ways to exploit consumer data. While the number of reports has declined since, they remain more than 53% higher than in 2019.

Source:

Federal Trade Commission, Consumer Sentinel Network Data Book 2019 and "The Big View: All Sentinel Reports."

Don't become a victim of identity theft

Scammers may be as busy as ever, but you can help prevent them from capitalizing on your data. Here are some steps you can take to safeguard against becoming an identity theft victim.

To protect against new accounts being opened in your name:

- Initiate a credit freeze: Start by placing a freeze on your credit report with each of the three credit reporting agencies—Equifax, Experian, and TransUnion—which makes it much more challenging for cybercriminals to use your identity to open a new account or qualify for a loan that requires a credit check. Should you need to apply for credit in the future, you must provide your password or personal identification number to the credit bureaus to temporarily lift the freeze. Consider freezing your kids' credit reports, too. Children may be more alluring targets for scammers because parents don't typically review their kids' credit history as often as they do their own.

- Request fraud alerts: You can place a fraud alert with any one of the three credit bureaus, which must then instruct the other two agencies to do the same. A fraud alert is less restrictive than a freeze, allowing creditors to access your credit report without any action from you. That said, they must verify your identity before opening a new line of credit in your name. Also, you'll need to renew your fraud alert annually, but it can be particularly beneficial as a means of protection if your information has been exposed in a data breach.

To protect your existing accounts:

- Enroll in multifactor authentication: Keeping your login credentials safe is a key step in safeguarding your accounts from unauthorized access. Consider adding multifactor authentication—a two-step process that requires you to enter a unique code, sent via email or text message, each time you attempt to log in to an online account. Many financial institutions and firms already require it as a means of identity protection when you access your accounts from an unfamiliar device, and many more offer it as an optional precaution in all instances.

- Monitor account activity: Although most firms offer security alerts, you should still regularly review your financial accounts for fraudulent activity. No algorithm is as good as you at spotting suspicious behavior.

Identity theft is so pervasive that it's important to do whatever you can to shield your sensitive information from criminals. Fortunately, just a little bit of protection can go a long way.

How to report identity theft

No matter how vigilant you are, you could still become a victim of identity theft. Follow these steps if you suspect a scammer has stolen your personal or financial information.

- Report fraudulent activity immediately to your financial institution, credit card company, or government agency (for example, if your Social Security number or driver's license has fallen into the wrong hands). The sooner you notify the appropriate entities, the faster they can act to prevent further damage.

- File a report with your local police and other authorities. If you are a victim of cybercrime, you can also submit a complaint to the FBI's Internet Crime Complaint Center (IC3).

- Finally, visit the FTC's IdentityTheft.gov, where you can report identity theft and get a personal recovery plan.