5 Questions for Later-in-Life Marriages

Love and companionship can occur at any stage in life, but discovering a partner later on brings a special kind of joy and meaning. While embracing a new chapter together will undoubtedly be exciting, it can also come with additional complexities such as having adult children from previous relationships, complex assets, and established money habits and beliefs.

Here are five questions for those walking down the aisle later in life may ask themselves before tying the knot.

1. Where do your financial values overlap—and where do they diverge?

Communication is a barometer for a successful union, especially where your finances are concerned. In fact, in a recent survey of 1,000 individuals who are divorced or in the process of divorcing, nearly one-fourth reported financial concerns as a factor.

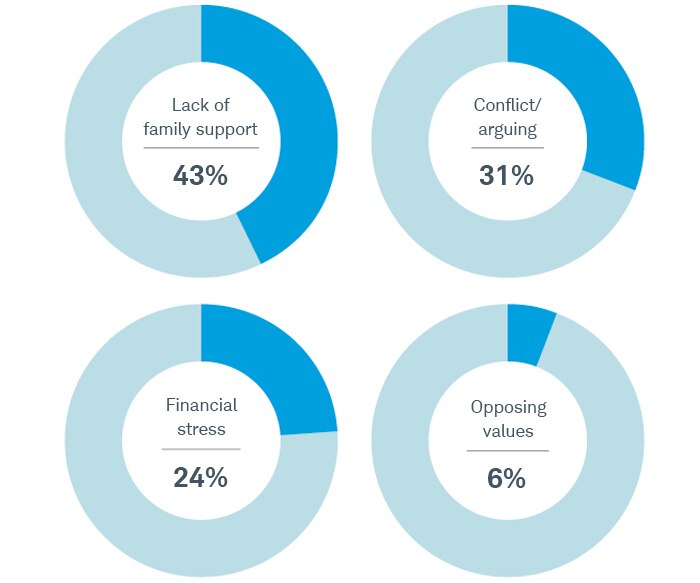

Breaking points

Advance planning and open communication can help couples avoid some of the most common causes of divorce.

Source: Forbes Advisor, as of 08/15/2023.

For illustrative purposes only.

Money is often central to many conflicts, and the topic may feel personal because of your past experience or own views on wealth. The point of discussing your financial commonalities and differences lies in the insight you receive regarding each other's deep-seated beliefs about money.

Start with some big picture, open-ended questions like:

- What does having enough money mean to you?

- What experiences with money did you have in childhood?

- What money lessons did you learn before we met?

- What pet peeves do you have when it comes to handling money?

You don't have to agree with each other's viewpoint, but you do want to come away with a better understanding of your partner's relationship with money so that you can work through future challenges from a place of mutual understanding and respect.

2. How will you (or won't you) combine your finances?

Anyone entering a relationship has to grapple with how their partner manages money. But an additional wrinkle with mature marriages is that each of you may have amassed significant assets and managed your money independently for years.

This can make merging finances particularly complex, so couples could start with the most basic question: How will we combine our assets—if at all?

You might consider keeping your individual investment, retirement, and bank accounts that you had before marriage separate for legal and legacy purposes. But you could open a joint account for shared costs such as mortgage payments, entertainment, and other day-to-day expenses to which you would both contribute.

The system can be a good starting point for discussing how much each spouse should contribute to the household—especially if one is significantly wealthier than the other. It also gives you the latitude to engage in your own spending habits without causing marital strife and to fund individual goals, such as making gifts to adult children.

You also may want to discuss your respective income and estate plans, credit scores, insurance policies (including life and long-term care, where applicable), outstanding liabilities, and philanthropic commitments.

Some states will have specific rights for the new spouse, like in community property states where income, assets, and debts accumulated while married are considered jointly owned. Having clarity on these issues may help you both understand the financial implications of marriage now and for your legacy.

3. How will marriage affect your retirement plans?

If you're still employed and saving for your later years, could getting married in your prime change your retirement timeline? For example, spouses with an age difference of five years or more may need to decide if they will retire around the same time or if the younger spouse will continue to work for many more years.

You may also have different visions of how you want to spend your retirement—traveling, perhaps, or moving closer to family. Getting married later in life may mean adjusting your priorities as a couple, including updating your financial plan so it aligns with your individual and shared goals.

Another consideration is how marriage could affect your sources of retirement income, such as Social Security. For example, you can generally collect your own full retirement benefits or up to half of your spouse's benefits, whichever is greater. However:

- If you're already collecting based on an ex-spouse's work history, getting remarried will likely end that benefit, and future benefits will be based on your or your new spouse's work history.

- If you're widowed from a previous marriage and planning to collect survivors benefits, remarrying before age 60 could eliminate that option. (Learn more about survivors benefits.)

If both partners have accumulated significant tax-deferred retirement assets, your required minimum distributions together—which kick in at age 73 or 75, depending on your birth year—could push you into a higher tax bracket and increase your Medicare premiums. If you have more savings than you'll need and are worried about taxes, you may want to incorporate tax smart ways to distribute those assets, including gifting and charitable strategies before and during retirement.

A qualified financial advisor can help you think through your shared retirement vision and strategize the best way to maximize your savings.

4. How will you plan for illness or incapacity?

Communicating and assigning your health and financial proxies is especially important as you age. An estate attorney can help adjust your plan in the event of illness or incapacity, including the extent to which you'd like other family members involved. Adult children, in particular, may feel entitled to have a say in your medical treatment plan or other critical decisions.

Consider these legal documents:

- A living will: Also referred to as an advance directive, this outlines your preferences regarding medical intervention and end-of-life care.

- A health care proxy: Sometimes called a medical power of attorney (POA), this gives your designated proxy the authority to make medical decisions in any situations not covered by a living will.

- A HIPAA authorization: This document allows healthcare providers to share medical information with designated family members.

- A financial POA: This delegates control over any financial matters you specify, such as paying bills, making gifts, or managing property. Without a financial POA, a court may need to appoint a conservator to manage anything you don't own jointly with your spouse.

Beyond planning for declining health from a legal perspective, also discuss how you'll navigate any long-term care needs. Ongoing care can be a high-stress and high-emotional undertaking—so you should be realistic about what each of you is willing and able to commit to.

Long-term care insurance is an option but may be costly if you're older and already battling a few health conditions. If you decide to self-fund your care, factor current and future costs into your plan.

It's common to defer or avoid thinking about the possibility of incapacity, or even death, especially early on in a marriage but it's important to discuss and make decisions about these eventualities as a couple, especially while you're still healthy, and to communicate them to your families.

5. Who will inherit your assets?

Whenever you experience any major life change, you should review your estate plan. This means updating not only your will and any trust documents but also your beneficiary designations and how you title (individually, jointly, etc.) certain assets like a primary or vacation home. It's not uncommon for an ex-spouse to receive a retirement account or life insurance payout simply because the beneficiary details were never updated after the divorce.

Deciding how to divide assets between your spouse and children from a previous relationship can be especially sensitive and complex. Bottom line is to be clear with your intentions—to both your partner as well as your individual heirs.

For example, consider Neil, 55, a small-business owner and widowed father of two teenagers. He's engaged to Sarah, 60, a successful real estate investor and divorced mother of three adult children. Neil wants to ensure his minor kids are provided for after his death, whereas Sarah wants to pass most of her assets to her adult children while still providing some financial support for Neil.

Before Sarah and Neil marry, they create a prenuptial agreement in which each waives rights to alimony and any property that predates their marriage (see "In defense of prenups"). Given their complex situation, they also employ:

- A qualified terminable interest property (QTIP) trust: Sarah places her real estate investments into a trust that, after her death, will pay Neil regular income from the assets for the rest of his lifetime. After Neil's death, the trust will distribute the remaining assets to Sarah's adult children in accordance with her wishes. QTIPs preserve the advantages of the marital deduction, deferring estate taxes until the death of the surviving spouse. However, they are irrevocable—meaning they cannot be changed—and the surviving spouse is limited to income from the assets and cannot access the principal in most cases.

- Permanent life insurance policies: Because Neil owns a small business, which can be difficult to value and divvy up among multiple heirs, he takes out a permanent life insurance policy to ensure his children are provided for immediately after his death.

By using various methods of estate planning, Sarah and Neil are able to provide peace of mind for themselves and their loved ones.

No matter your asset level or estate-planning needs, consider working with professionals to help you anticipate potential issues to minimize conflict when you die.

After any major life change, review and update your accounts, beneficiary designations, and estate-planning documents. View our estate planning checklist.

Coming together

Joining and committing yourselves to each other is truly wonderful, regardless of age. Differences in opinion are inevitable, considering the financial and personal histories, values, and lessons that span decades. Just remember that your goal isn't about "winning" the argument but the choice to deepen your understanding of your spouse's needs and concerns with empathy, respect, and love as your guide.

In defense of prenups

Prenuptial agreements—contracts that list the assets and debts of each person and how they should be handled in the event of death or divorce—are sometimes seen as signaling a lack of trust in your future spouse.

However, for many, they can provide clarity and peace of mind, especially for children or other heirs who may worry that a new spouse is going to end up with what they believe should rightfully go to them.

What's more, the process of creating and sharing a prenuptial agreement can provide a couple with a forum to discuss many of the issues raised in this article and help foster more thorough estate-planning conversations—as well as communicate their wishes to their heirs.