5-Step Tax-Smart Retirement Income Plan

Most retirees don't have enough invested and saved to live off the interest alone—even when combined with Social Security, pensions, and other nonportfolio income—so at some point, they'll need to start drawing down their investment assets. The challenge is doing so in a way that minimizes the drag from taxes. After all, every dollar lost to taxes is one you can't spend.

The order in which you tap your assets could affect how long your money lasts in retirement. Not all investments or accounts are subject to the same tax treatment, and by liquidating them in the most tax-efficient way possible, you may be able to extend the life of your savings. With that in mind, consider the following steps to making tax-smart withdrawals in retirement.

Step 1: Start with your required minimum distributions (RMDs), if applicable

If you're 73 or older, required minimum distributions (RMDs) should be your first stop when tapping your retirement portfolio to avoid paying up to a 25% penalty for withdrawing late or not at all. (Most financial institutions can help calculate your RMDs when the time comes.)

Whatever you withdraw will be taxed as ordinary income, so if you don't need this money to cover your living expenses, consider depositing the funds into a taxable brokerage account, where it could potentially continue to grow.

Step 2: Tap interest and dividends

Next, withdraw the interest and dividends from your taxable accounts while maintaining your original investment, which can then potentially grow and continue generating income in the future. (Be sure to consider turning off automatic reinvestment of interest and dividends on your bond and stock funds, CDs, and individual stocks.)

That said, interest is taxed as ordinary income—unless it's from a tax-free municipal bond or municipal bond fund. Dividends, on the other hand, are often taxed at the lower capital gains rate of 0%, 15%, or 20%, depending on income level—provided certain requirements, such as minimum holding periods, are met.

Step 3: Cash out maturing bonds and CDs

Many retirees rely on bonds and certificates of deposit (CDs) to generate regular income. Laddering such investments—that is, buying bonds and/or CDs with staggered maturity dates and reinvesting the principal as each comes due—can help provide a steady stream of income from interest payments while evening out your portfolio's yields over time.

However, should you still need cash after exhausting RMDs (if you're of age) and your interest and dividends, the principal from a maturing bond or CD is often the next place to turn. Instead of reinvesting the principal, consider using that cash to fund your living expenses. This can be very tax-efficient since you generally won't owe taxes on the principal returned to you. Generally, you'll want to hold on to the bond or CD until its maturity date to avoid triggering potential capital gains taxes on any earnings from selling early.

Step 4: Sell assets as needed

The next major source of income is to sell additional investment assets, such as stocks or mutual funds, in the most tax-efficient way possible. But which accounts should you tap first—and in what proportion?

Using a tax loss to get a tax break

Next, focus on selling investments you've held for more than a year to take advantage of the lower long-term capital gains tax rates. (Selling assets held for a year or less could result in the higher ordinary income tax rates.) You can sell these appreciated investments as part of your regular portfolio rebalancing, using whatever's necessary to meet your spending needs and reinvesting the remainder in underweight areas of your portfolio.

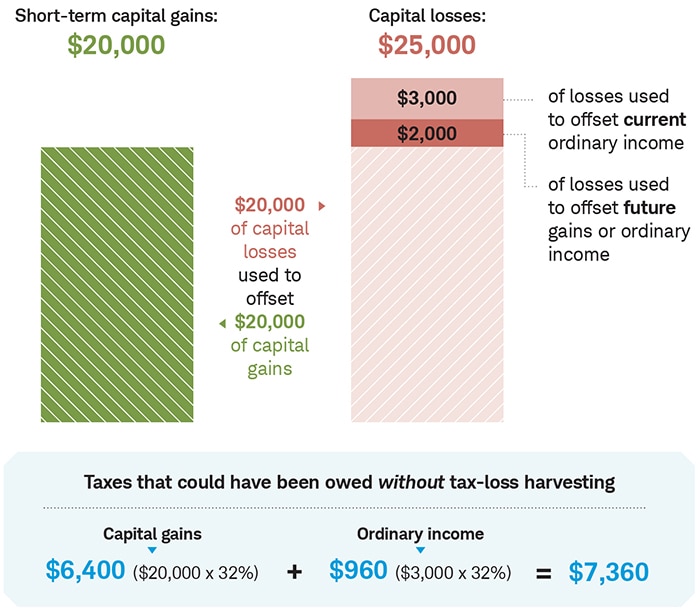

A hypothetical investor who realized $20,000 in short-term capital gains and has $25,000 in unrealized capital losses could use tax-loss harvesting to cut down her tax bill.

Source: Schwab Center for Financial Research.

Assumes a 32% combined federal/state marginal income tax bracket, with short-term capital gains taxed at the ordinary income tax rates. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product, and the example does not reflect the effects of fees.

Step 5: Save Roth accounts for last

It's generally best to delay taking Roth IRA and Roth 401(k) funds for as long as possible so that the investments can potentially benefit from continued compound growth. This can be done since Roth accounts aren't subject to RMDs, and withdrawals are entirely tax-free after age 59½ assuming you've held the account for at least five years.

Plus, if you leave a Roth account to an heir, their withdrawals will also be tax-free. The laws could always change, but at least for now, it's one of the best assets you can pass on to the next generation.

Get help if you need it

While some retirees enjoy actively managing their investments, others might not want to get bogged down in the intricacies of handling their withdrawals and taxes. Determining which assets to sell can be complex, and some savers could benefit from working with a financial advisor, a tax professional, or an automated robo-advisor. Either way, managing your tax liability can be an effective way to help keep more money in your pocket and potentially extend the life of your savings.

Creating tax-smart withdrawals during retirement

Schwab Intelligent Income®—a feature of Schwab Intelligent Portfolios®—is an automated investing solution that generates a predictable, tax-smart, monthly paycheck from your investments.

Deciding which accounts to draw from, harvesting your losses, and prioritizing RMDs to generate tax-smart income from your portfolio can be complicated. Schwab Intelligent Income handles that complexity, using sophisticated algorithms to consider enrolled assets across your taxable, tax-deferred, and tax-free retirement accounts and making tax-efficient withdrawals for you.

Learn more or get started.