6 Ideas for Trading the Magnificent Seven

Last year, seven market behemoths—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—accounted for nearly two-thirds of the S&P 500® Index's gains.1

That's in part because these stocks constitute an outsize proportion of the index—28% as of year-end 2023. But six of the seven appear also to benefit from a "wide moat," or competitive advantage that's expected to last two decades or more. (Tesla, the outlier, has a "narrow moat," or competitive advantage expected to last 10 years.)2

These mega caps have proved especially tantalizing to traders, who may see profit potential in their higher-than-average volatility. However, moving in and out of the market's most popular stocks isn't without risk. Here are six considerations for trading the so-called Magnificent Seven.

1. Beware overexposure

Many traders limit any single position to a specific percentage of their total trading portfolios (5%, for example). However, given these seven stocks' high prices—which range from $140 to $490 per share3—holding even a handful of shares could mean taking on a larger position than your self-imposed limits. For example, if your total trading portfolio is $50,000 and you buy just 10 shares of Nvidia at $490 per share, that stock alone would account for nearly 10% of your portfolio.

2. Watch for corrections

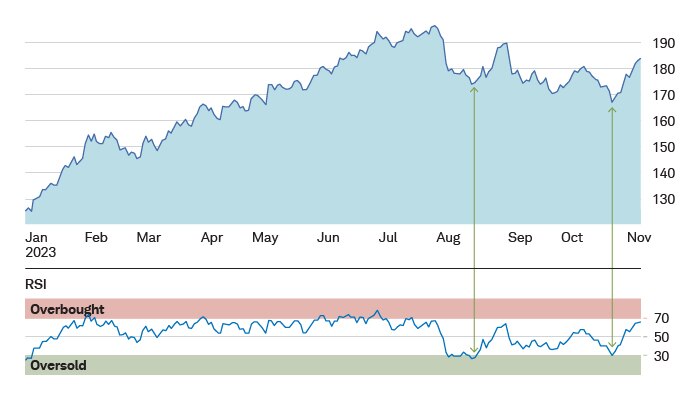

A potentially attractive entry point for any trade is the price at which the stock appears to be technically oversold and due for a rebound. But this can be difficult to gauge with the Magnificent Seven, whose bigger-than-average price swings make it harder to identify a trend reversal.

This is where a stock's relative strength index (RSI)—which tracks the strength of a security's price against its own history—comes in handy. Generally, a stock is considered oversold by technical analysts when its RSI dips below 30, but traders typically research the specific stock's historical trends to find its unique RSI threshold. Also, be careful not to jump in too soon; waiting for the RSI to clearly break back above 30 (or whatever threshold it respects) can help confirm the selling pressure has dissipated and a trend reversal may be underway.

Trading Apple

Traders who bought Apple when its RSI dipped below 30 in mid-August or late October 2023 benefited from steep upswings shortly thereafter.

Source: Schwab.com.

Data from 01/01/2023 through 11/08/2023.

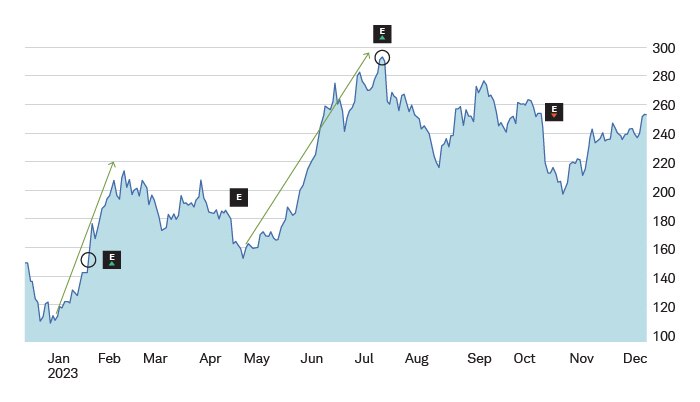

3. Reap the earnings run-up

Due to heightened anticipation in the lead-up to earnings day, some traders may attempt to turn a profit by opening and exiting a position in the days before the numbers hit. Closing a position before the release date also helps avoid the potential negative impact of an earnings miss or disappointing news shared during the earnings call. Before the trade, you may want to check how the stock has performed ahead of earnings announcements over the past year or two; a habit of strong performance before earnings or turbulent reactions after earnings may be worth particular attention.

Trading Tesla

Tesla's stock rallied ahead of two of the company's 2023 earnings reports, creating significant profit potential. Traders who exited just before the January earnings announcement would have missed out on an even steeper post-announcement climb, but those who sold just ahead of the July release could have pocketed tidy profits—as well as avoided the sharp price decline that immediately followed the release.

Source: Schwab.com.

Data from 01/01/2023 through 12/21/2023.

4. Be careful when considering a downtrend

Given how widely held and traded the Magnificent Seven are, it can be difficult to judge when investor sentiment turns negative. Even when the technicals have turned south, investors can still pile in, causing unpredictable jumps in share prices that can undermine a short position, cause you to miss getting in with a low-priced limit order, or trigger a sell order when the stock is still rising—among other disappointments. If you feel that one of the mega caps is due for a dip, you could consider a buy limit order at a lower price that represents the level at which you feel comfortable owning shares, but be prepared to change to a more aggressive price if the stock turns bullish. That way, you'll add positions at a discount if the stock does fall, and if the price rises instead, you can reevaluate and consider if you still want in at a higher price.

5. Pay attention to PEG

After their stellar run in 2023, all seven stocks have been trading at elevated price-to-earnings multiples, perhaps indicating they're overvalued. But for these stocks, in particular, their price/earnings-to-growth (PEG) ratio may be a better measure of valuation because it factors in the company's expected earnings growth. By that metric, four of the stocks—Amazon, Alphabet, Meta, and Nvidia—were trading at discounted valuations as of November 2023, with their average PEG sitting at 0.97, compared with 1.8 for the median S&P 500 stock.4 The PEG ratio shouldn't be used as a valuation metric in isolation, but it can be useful for identifying relative value—that is, how expensive the stock is in an earnings sense but a bit more nuanced than what P/E ratio can provide—particularly after a pullback.

6. Take notes

While these suggestions may be helpful at the start, be sure to pay attention to what's working—and what's not—with your own trades. If you can't seem to find your way forward with one of these mega caps, there are plenty of other candidates to choose from.

1Bloomberg, as of 12/27/2023.

2Morningstar, as of 12/27/2023.

3As of 12/27/2023.

4Bloomberg, as of 11/16/2023. PEG ratio for the median S&P 500 stock was calculated using a forward P/E of 19.3 and an estimated median growth of 11% for 2024.