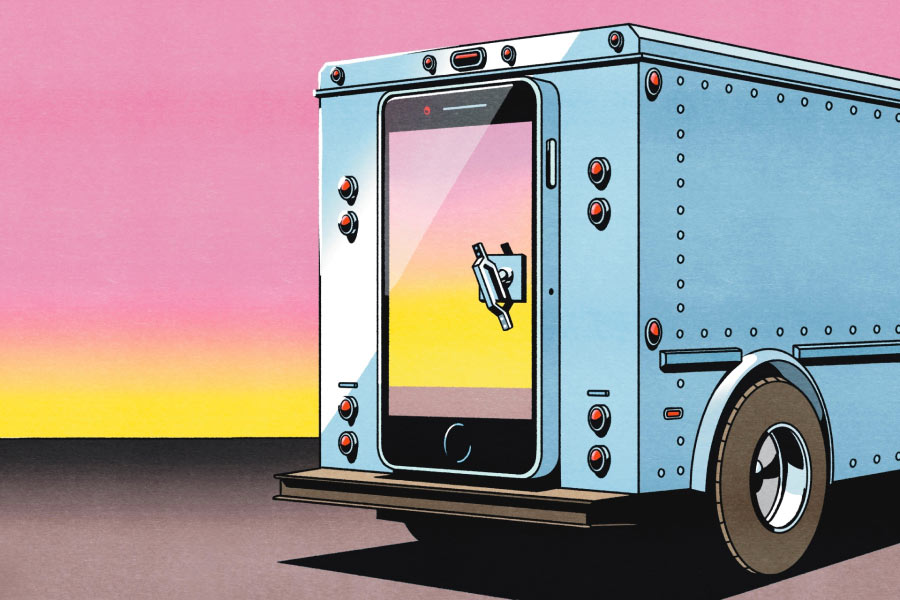

Are Digital Payments a Safer Way to Pay?

The convenience of electronic payments is one reason 55% of high earners use digital wallets, which store payment information on mobile phones or online, according to a 2024 survey by pymnts.com. Yet older consumers have been relatively slow to adopt electronic payment options, citing privacy and security concerns as reasons for sticking with cash, checks, or physical cards.1

"Ironically, electronic payments are now considered the safer option," says Lisa Lang, a senior manager with Schwab's Financial Crimes Awareness team—especially given that check fraud, in particular, has nearly quadrupled since the pandemic.2

What's more, many digital payment services offer a bevy of safety features on top of what your bank or credit card company provides, including:

- Authentication, including both two-factor authentication—which requires a one-time code in addition to your password—and biometric authentication, such as scanning your face or fingerprint.

- End-to-end encryption, which masks your card and transaction information until it's decrypted at its intended destination.

- Tokenization, which provides a merchant with a one-time token rather than your actual card information.

"For many people, it's a question of when, not if, they'll be impacted by financial fraud," Lisa says. "It can take a minute to get up to speed on some of the newer payment technologies, but their security and convenience are hard to beat."

Wallet 2.0

Here are some of the more common electronic payment options and how they work.

- Type

- Features

- Caveat emptor

- Getting started

-

TypeDigital/Mobile wallets—including Apple Pay, Google Pay, PayPal, and Samsung Pay.Features- Credit and debit card information is kept in a virtual wallet that can be used in-store, online, and even to exchange funds among other users.

- Boarding passes, e-tickets, membership cards, and other digital documents can often be securely stored (though PayPal doesn't allow this).Caveat emptor- If you lose access to your phone or smartwatch, you'll need your physical card to make in-store purchases.

- Most devices support only their own wallets.

- Few in-store terminals accept PayPal.Getting started- Mobile wallets come preinstalled with most smartphones. You'll be prompted to sign in, set up additional authentication, and add your cards.

- For PayPal, you can go online or download the app to create an account and security passkey and add your cards.-

TypeOnline payment processors—including Amazon Pay and Shop Pay.Features- Payment, shipping, and other information can be saved for seamless online checkout.Caveat emptor- Security involves two-factor but not biometric authentication.

- Shop Pay is available only at outlets that use the Shopify platform.Getting started- Log in to Amazon Pay using your Amazon credentials to use payment and address information already stored there.

- Sign up for Shop Pay with your email and phone number, then save your address and cards for easy checkout.-

TypePeer-to-peer payment apps—including Cash App, Venmo, and Zelle®.Features- Money can be securely transferred between individual bank accounts—and, in the case of Cash App and Venmo, those of participating vendors.Caveat emptor- You may not be able to recover funds sent in error.

- Each app has limits on the dollar amount you can send within a given time frame.Getting started- Download the Cash App or Venmo apps, create an account, then link your checking account.

- Sign up for Zelle through your participating bank's app.Learn more about using Zelle® through the Schwab Mobile app.

1"Got Leather? Almost a Third of Consumers Prefer Carrying Physical Wallet," pymnts.com, 04/03/2024.

2"Treasury Announces Enhanced Fraud Detection Process Using AI Recovers $375M in Fiscal Year 2023," U.S. Department of the Treasury, 02/28/2024.

Discover more from Onward

Keep reading the latest issue online or view the print edition.