Back-to-School Stocks for Your Portfolio

September may mark the beginning of school for many students, but it's August when parents are busy buying school supplies.

Back-to-school shopping has historically been a big deal for retailers' bottom lines. Consumer research firm NPD Group reported that in the United States, back-to-school spending on apparel is projected to increase by 11% compared to 2024, representing 35% of the $11.8 billion market for retail school supply spending. This makes back-to-school shopping the second-largest season of the year for retailers and manufacturers after the traditional holidays.

By the numbers

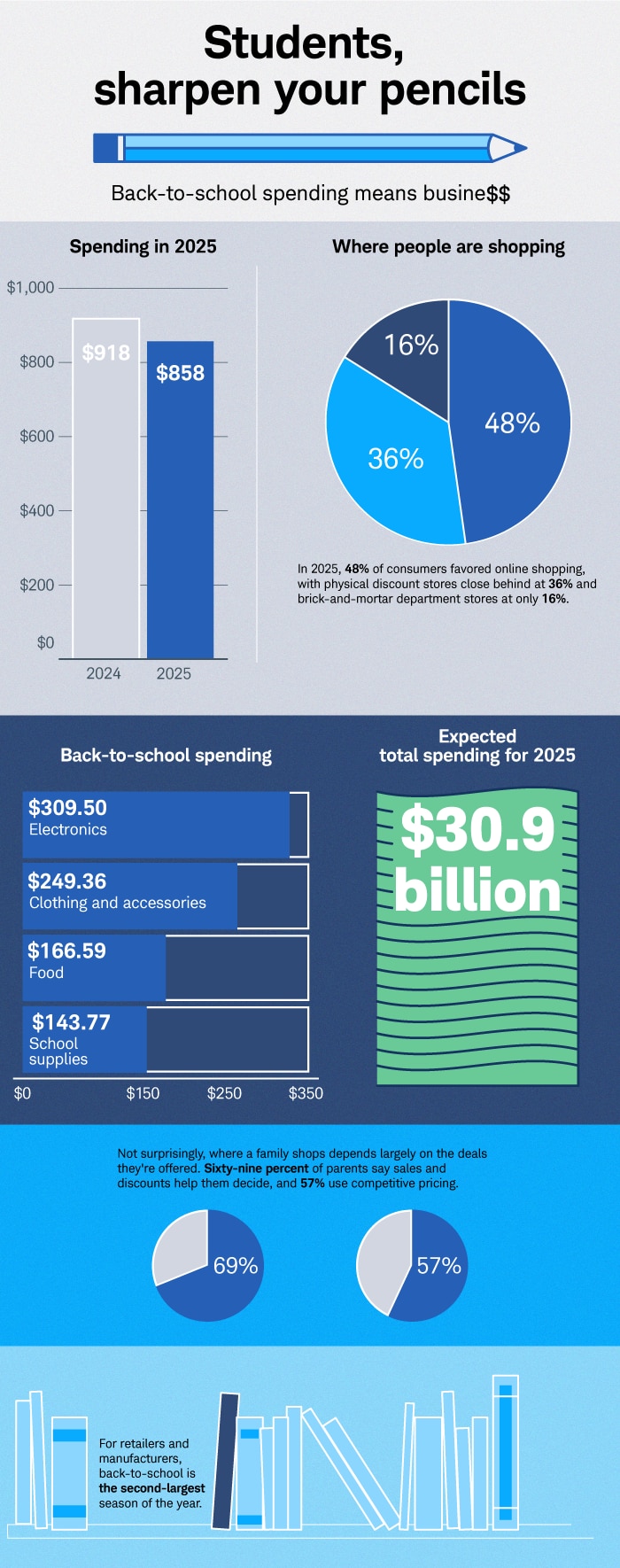

Both Deloitte and the National Retail Federation conducted surveys on how much money parents spend on getting their kids ready to head back to the classroom. Both surveys show total spending for 2025 is expected to fall or remain flat year over year for K-12 students, as parents sharpen their pencils and their budgets.

Deloitte, which surveyed more than 1,200 parents, forecasts parents will spend $570 per student, which is lower than $661 in 2024. Total back-to-school spending this year for K-12 students is expected to be $30.9 billion, down from $41.5 in 2024.

The National Retail Federation, which has conducted its survey since 2003, has substantially larger numbers. The group expects parents to shell out an average of $858, down from $874 in 2024.

The top spending category for parents remains electronics—such as computers, calculators, and phones—at $309.50. Not far behind in the spending categories are clothing and accessories for the K-12 student, with parents expected to drop $249.36 to outfit their progeny. Food comes in third at $166.59, while school supplies like paper notebooks, pencils, backpacks, and lunch boxes has stayed roughly the same at $143.77.

College student spending has decreased slightly as well. This year it's likely they'll spend $1,325.85, down from $1,364.75 in 2024.

Deloitte noted that the top shopping destination remains online, with 48% of spend, followed by discount stores at 36%, and department stores at 16%. They noted that discount store shopping has risen in popularity by five percentage points since last year as shoppers look for value.

Not surprisingly, Deloitte pointed out where a family shops depends largely on the deals they're offered. Sixty-nine percent of parents say sales and discounts help them decide, and 57% use competitive pricing.

Source: Deloitte survey and National Retail Federation survey

The influence of online

NPD Group said Amazon's (AMZN) Prime Week, which took place in early July, seems to continue to pull back-to-school sales earlier in the season. Amazon has extended its summer Prime Day to be a multi-day event since 2023 and other major retailers like Best Buy (BBY) and Walmart (WMT) have followed suit. The full rundown of Prime Week data hasn't been released as of writing, but after the close of the event, Amazon called it the "largest shopping event in Amazon history."

Back-to-school stocks: Where investors may shop

Ben Watson, senior manager of trading education at Schwab, suggested investors can think about back-to-school shopping and back-to-school stocks in a few different ways. To start, consider the mass-market retailers like Dollar Tree (DLTR), Walmart (WMT), and Target (TGT), which offer the gamut of supplies in nearly one stop.

A lot of kids' school supplies include products like pens, lunchboxes, and insulated mugs. Watson remarked Newell Brands (NWL) makes a number of these items, with brands like Elmer's Glue, markers from Mr. Sketch and Sharpie, Paper Mate pens, food storage brands like Rubbermaid and Sistema, and other consumer-focused goods.

For electronics, parents may go to Best Buy to check out tablets, laptops, and smartphones kids need for class, Watson noted. However, many parents may search for online deals after viewing products in stores.

Because clothing is a big part of returning to school, individual apparel retailers, particularly in the athletic-wear segment, can be part of investors' research lists. Upscale brands that appeal to the mass affluent and have significant online presence include Nike (NKE), Lululemon Athletica (LULU), and Abercrombie & Fitch (ANF), Watson pointed out.

There's been much evidence detailing the death of malls as part of the demise of physical retail stores, but Watson remarked that there might be a resurgence. In a report published in late 2024, Retail Merchandiser magazine found that malls were experiencing a seismic shift away from department stores and toward experiential retail, incorporating entertainment, interaction, and mixed-use functions. This shift emphasizes high-end malls, which have remained strong in affluent areas. Lower-tier malls, on the other hand, have been transforming into mixed-use developments, including a much higher component of residential space.

"One trend that is emerging is the re-appearance and expansion of luxury outlets, appealing to value-conscious consumers who are also brand-focused," Watson said.

Late summer—it's a time of ringing: the alarm clock, the tardy bell, and the cash register. Consider ringing in a little back-to-school research for your portfolio as well.

Schwab has multiple ways to research stocks.

Explore the Stock Screener