Basic Call and Put Options Strategies

For options-approved traders, trading options can be useful in a variety of circumstances and in different market scenarios. Some options strategies can be complex, but for options beginners, it might make sense to start with fundamental strategies like basic call and put options.

Like all our strategy discussions, the following is strictly for educational purposes. It is not, and should not be considered, individualized advice or a recommendation.

Key characteristics of call and put options

A call option gives its owner the right, but not the obligation, to buy the underlying security at a specific price (the strike or exercise price) on or before a specific date (the expiration). A put option gives its owner the right, but not the obligation, to sell the underlying security, again, at a specific price on or before a specific date.

For standard, American-style equity options, each contract represents 100 shares of stock and may be exercised or assigned at any time up to and including the expiration date. (Non-standard and index options may have different deliverable specifications, so it's important to understand the terms before trading.) Contracts are priced per share, so traders need to multiply an options contract's quoted price by 100 to determine the price of a single contract. For example, a call priced at $3.50 would cost the option buyer $350, but the premium paid for an option is typically a fraction of the underlying asset's price.

Call options strategies

Buying calls as a stock alternative

Buying a call option is often considered a bullish strategy because the price of the call option typically rises along with the price of the underlying security. Similarly, call prices typically fall when the underlying security falls. Traders or investors who have a directional view might consider buying a call option as a lower-cost alternative to buying a stock outright.

It's important to remember that unlike stocks, options have an expiration date. If a trader buys an option and it expires worthless, they lose their entire investment and don't have unlimited time to hope for a recovery. Additionally, options don't carry voting rights, and they don't pay dividends.

For example, a trader who is bullish on a stock could buy shares or an option. Shares are $188 each. The trader could also buy call options at a strike price of $200 for $2.69 per option. Because options trade in units of $100, the options position costs $269 versus $18,800 to buy 100 shares.

If the stock price declines, the option price will also typically decline. If held until expiration, they'll expire worthless. If the stock increases, the option price will also increase, at which point the trader could sell it at a profit or hold it to see if it goes in the money (ITM), meaning the stock moves above the strike price of $200.

If the share price exceeds $202.69 ($200 exercise price plus the $2.69 options premium), then the options trade is profitable. At this point, the trader could close the options trade and collect a profit or exercise their right to purchase the shares at $200 each, which at this point would be a discount to the market price. Because options require less upfront capital but still participate in the underlying's price activity, they are often used by speculators who have no real interest in owning shares of the stock itself.

Selling covered calls for potential income

Some option traders turn to call options when they already own the stock. Instead of using calls as a lower-cost substitute for stock, they use calls to potentially generate income on shares they already hold. This strategy is called a covered call and involves selling the option rather than buying it.

When a trader sells a covered call, instead of paying a premium, they receive the premium. However, the call can be exercised at the will of its owner (buyer) at any time up until expiration. If the call is ITM—below the stock's current price—on or before expiration, the likelihood that the option buyer will exercise their right to buy the underlying at the strike price increases. If this happens, the covered call seller is required to deliver the stock—100 shares for each options contract sold.

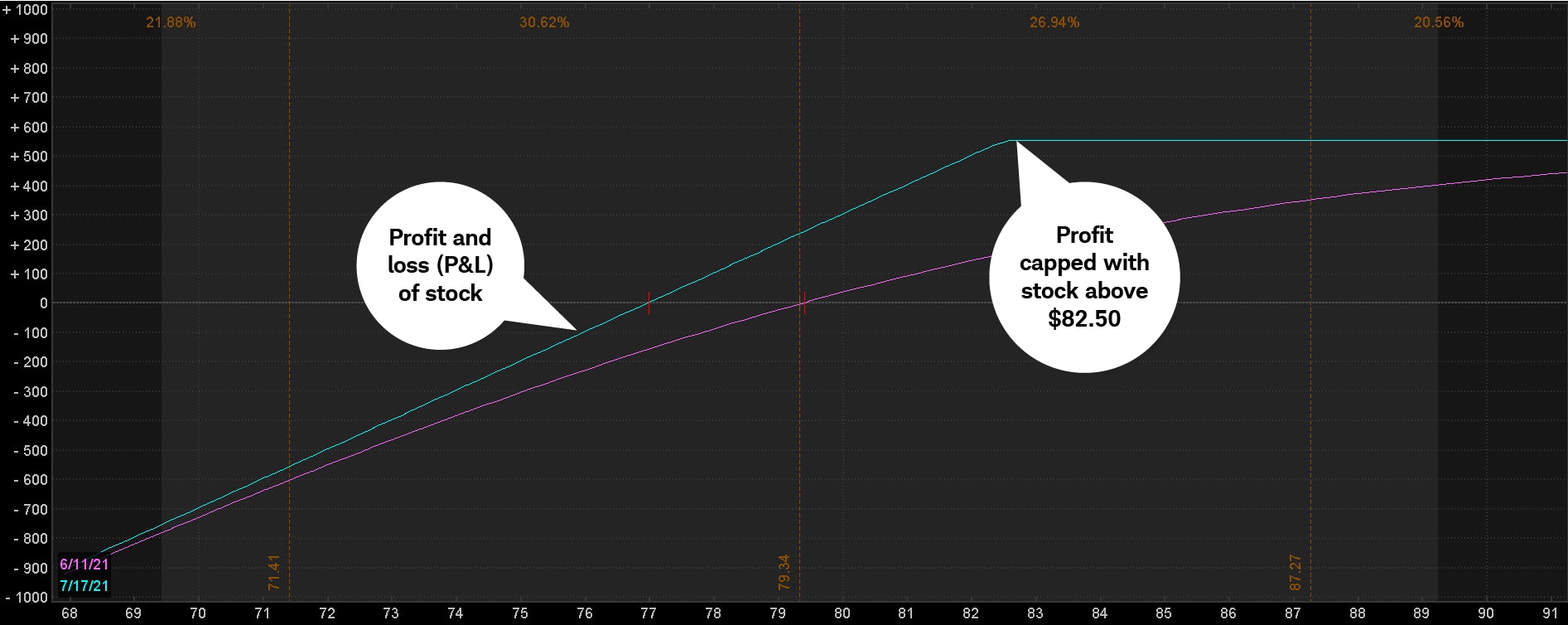

Let's look at an example. Suppose a trader owns 100 shares of a stock that's trading at $79.34. They're long-term bullish on the stock but don't think the stock will move much in the next several weeks. The trader opens a covered call by selling an out-of-the-money (OTM) 82.5-strike call and collecting $2.37, or $237, in premium.

If the stock stays below $82.50 between the time the trader sells the call and expiration, the option will likely expire worthless. If the call buyer does not exercise the option, the trader would keep the stock as well as the premium. Some traders refer to this as an "income enhancement" to the stock the trader owned.

On the other hand, if the stock rallies above $82.50, the trader might be required to deliver the stock at $82.50 per share. Because the stock was at $79.34 when the trader sold the call, if the stock rallies above $82.50 by expiration, the trade's total return is capped at $553—$237 options premium plus a stock gain of $316—minus transaction costs.

Risk profile of a covered call

- Stock price= $79.34

- Call bid

- Call ask

- Strike

- Put bid

- Put ask

-

Stock price= $79.3435 days until expirationCall bid6.05Call ask6.20Strike75Put bid1.73Put ask1.78

-

Stock price= $79.34Call bid4.50Call ask4.65Strike77.5Put bid2.68Put ask2.76

-

Stock price= $79.34Call bid3.35Call ask3.40Strike80Put bid3.95Put ask4.05

-

Stock price= $79.34Call bid2.37Call ask2.42Strike82.5Put bid5.45Put ask5.55

-

Stock price= $79.34Call bid1.65Call ask1.68Strike85Put bid7.25Put ask7.35

Looking at the above table, suppose a trader sells the 82.5 strike call at the bid price of $2.37. The trader would collect $237 of premium ($2.37 x 100) minus transaction costs. If the stock stays below $82.50 between the time the trader buys it and expiration, the call would likely expire worthless. If the call option buyer does not exercise the option, the trader would keep the stock as well as the premium. Some traders refer to this as an "income enhancement" to the stock the trader owned.

On the other hand, if the stock rallies above $82.50, the trader might be required to deliver the stock at $82.50 per share. Because the stock was at $79.34 when the trader sold the call option, if the stock rallies above $82.50 by expiration, the return is capped at $553 ($237 premium + $316 stock gain) minus transaction costs. The total return is capped because the trader is required to sell the 100 shares owned, so if they only had 100 shares to begin with, they don't own additional shares of that stock.

Risk profile of a covered call

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Buying puts for protection

Buying a put option is usually considered a bearish strategy because the price of a put tends to rise as a stock price falls. If a trader is bearish on a stock, they might consider buying a put instead of shorting the stock. Shorting stock is very risky because there's no cap on potential losses, while the maximum loss for a put option is the premium paid.

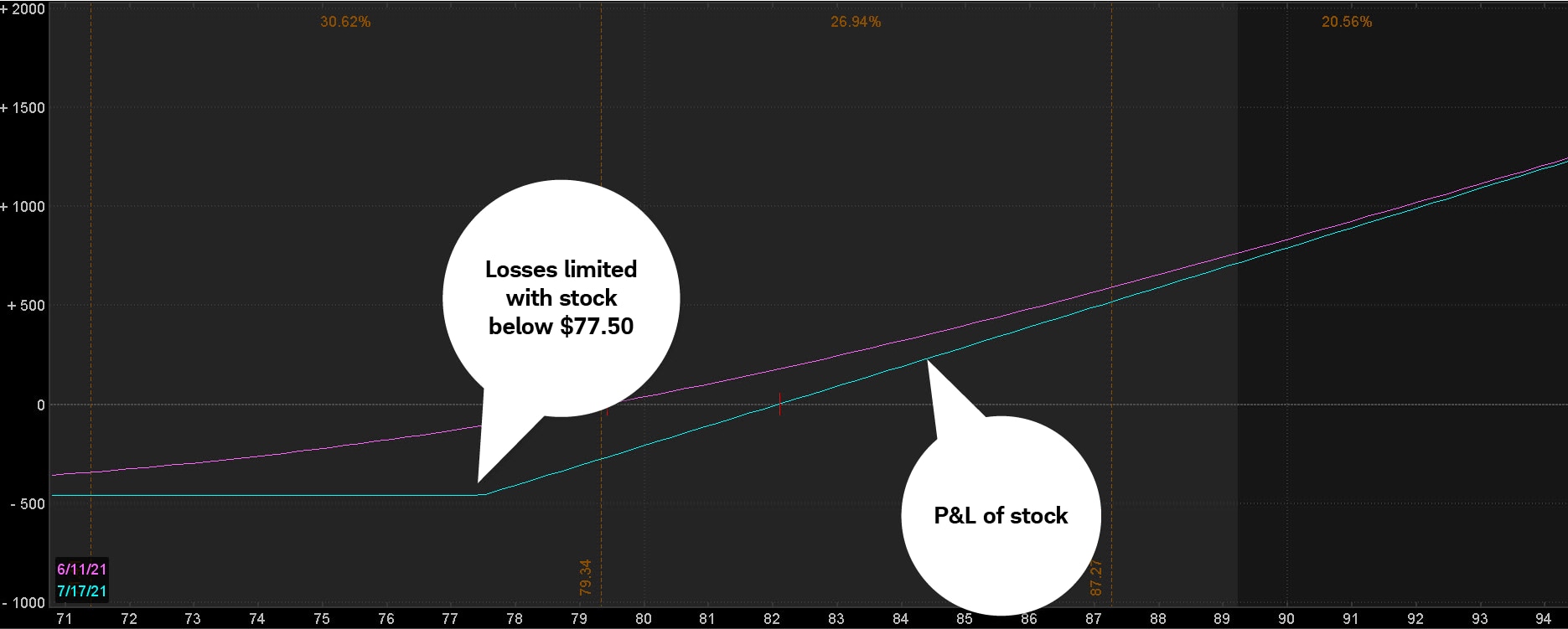

The protective put is a basic options strategy that can potentially help limit losses on a stock a trader already owns. The theory behind the strategy is that a trader buys the put option on a stock in their portfolio as a hedge in case the stock drops.

Suppose a trader owns the stock in the example above, currently trading at $79.34. The trader still has a long-term bullish outlook but isn't comfortable with the shares dropping below $77.50 in the near term. Paying $2.76 ($276 per contract) for the OTM 77.5-strike put means the trader caps their losses at $4.60 if the stock falls below $77.50 on or before the options contract's expiration date. This is the difference between the current stock price and the strike price of the option ($79.34 – $77.50 = $1.84) plus the premium for the put ($2.76) in addition to transaction costs.

In this example, the trader has limited their downside risk to $77.50, but it's still possible to profit if the stock continues to rise. And if it does move higher, against the trader's suspicions, they've spent $276 for the downside protection, which is deducted from any additional profit in the stock position itself.

Risk profile for a protective put

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Call and put options give traders diverse opportunities to generate income, protect against losses, and speculate on the market across all types of market conditions. With this flexibility comes some complications, so it's important to learn how options work before jumping in. Knowing how to use options effectively separates smart strategy from expensive speculation.

First, the basics. Call options give holders (buyers) the right, but not the obligation, to buy a stock in the future at a price set today. Puts, on the other hand, give holders the right to sell a stock in the future at a price set today. Buying calls is one way to speculate on stock prices appreciating, and buying puts is a way to speculate on prices falling. Both strategies can also be used to hedge against unwanted price movements.

Options strategies range from simple to complex and from relatively low risk to very high (or unlimited) risk. Understanding the three basic options strategies below may help traders regardless of their risk tolerance and temperament to speculate on volatility, generate income, and manage risk.

1A limited-return strategy constructed of a long stock and a short call. Ideally, you want the stock to finish at or below the call strike at expiration. If the stock price settles above the strike price, you'd likely have your stock called away at the short call strike. You'd keep your original credit from the sale of the call as well as any gain in the stock up to the strike. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs.

2Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

3Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.