What Is Probate? Keeping Your Estate Out of Court

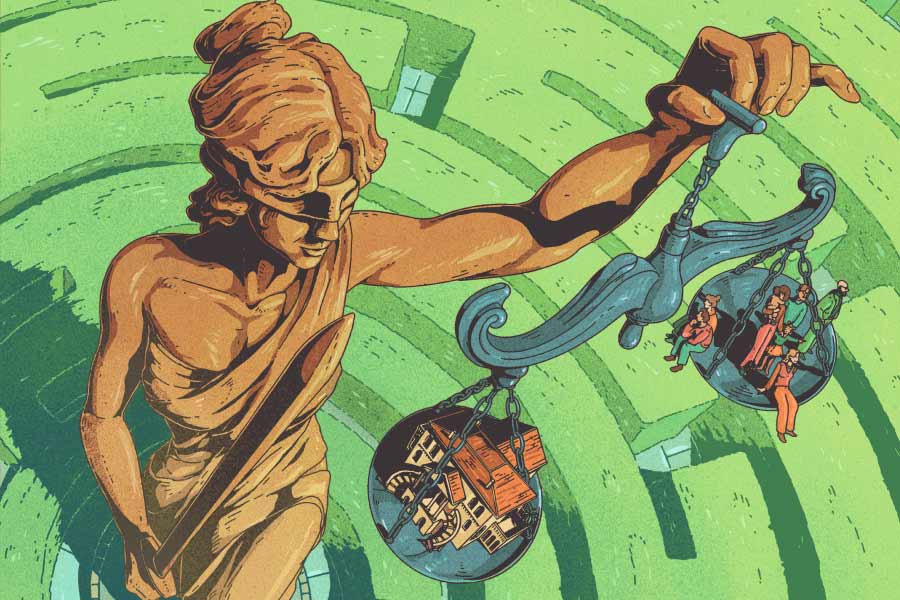

A good estate plan should smoothly settle your affairs and quickly transfer assets to heirs after you've passed. Yet even simple mistakes—like neglecting to add a beneficiary on a new retirement account or forgetting to place a particular asset in a trust—could subject those holdings to probate, the court-supervised legal process of validating and distributing your estate.

"Navigating the probate court process can be onerous under the best of circumstances, but especially so when you've just lost a loved one," says Kim Frank, a Schwab director of tax, trust, and estate based in Orlando, Florida. "Minimizing your estate's exposure to probate can not only keep costs down but also help your family focus on what matters most: themselves and those around them."

Here's how probate works—and what you can do today to reduce its impact on your heirs.

The process

There's a lot you can do to circumvent much of the probate process (see "The potential solutions"). However, if your estate does end up in probate court, the process differs depending on whether you have a last will and testament:

- If you do, the court will authenticate your will's legality, approve your chosen executor, assess the estate's assets and liabilities, and resolve any disputes among creditors and family members. The executor must then pay any outstanding bills, file final tax returns, and distribute the estate to beneficiaries according to the will. The court will also affirm any intended guardians of minors after conducting background checks and appointing an attorney to act in the best interests of the children.

- If you don't, the court will appoint an administrator to settle your affairs, who must then identify your heirs and assets, as well as assign a guardian for any minor children. The state's intestacy statutes will then determine who inherits your assets and in what proportions. "Think about it: Without a will or prior planning, you're handing over your biggest estate decisions to state law, which may not work best for your circumstances," says Austin Jarvis, director of estate, trust, and high-net-worth tax at the Schwab Center for Financial Research.

The pitfalls

Probate laws vary by state, but there are some commonalities:

- Cost: "Although fees and rules can vary widely, most large estates pay from 0.5% to 4% in probate costs," Austin says. Although 19 states have adopted the Uniform Probate Code, which mandates that lawyers charge only a "reasonable fee" for probate services,1 seven states (Arkansas, California, Florida, Iowa, Missouri, Montana, and Wyoming) have statutory probate fees based on an estate's size. In California, for instance, attorneys charge 4% of the first $100,000 of an estate, 3% of the next $100,000, 2% of the next $800,000, 1% for the next $9 million, and 0.5% for any remainder up to $25 million, with the court determining an appropriate fee for estates over that amount.

- Duration: Most large estates can take a minimum of six months to clear the probate process, but it's not uncommon for it to take two years or longer. "If heirs require assets from the estate in the near term, the probate process can delay those distributions at a critical time," Austin says.

Tick, tick, tick

Gaining access to assets that must pass through probate could take a disruptively long time.

- Executor task

- Typical duration

-

Executor taskPrepare and file petition for probate with courtTypical duration1–4 months

-

Executor taskGive notice to creditorsTypical duration3–6 months

-

Executor taskPay debts, fees, and taxesTypical duration6–12 months

-

Executor taskInventory and value relevant assetsTypical duration6–12 months

-

Executor taskDistribute assets to beneficiariesTypical duration9–18 months

-

Executor taskClose the estate with the courtTypical duration9–24 months

- Loss of privacy: An estate's assets and beneficiaries become a matter of public record as part of the probate process. "Unless your probate documents are sealed—which is rare—virtually anyone can look up your estate details," Austin says. "As a result, heirs and beneficiaries may be targeted by fraudsters or subjected to unwanted solicitations."

"The good news," Kim says, "is there are plenty of things you can do to influence whether and how much of your estate is subject to probate."

The potential solutions

1. Beneficiary designations

Assigning primary and contingent beneficiaries to your financial accounts bypasses probate, helping to ensure their timely distribution. Such instructions—which are easy to implement and supersede any directives in your will—are referred to in a number of ways, depending on account type: beneficiary designations (retirement accounts), pay-on-death designations (bank accounts), and transfer-on-death designations (brokerage accounts).

It's important to review your beneficiaries from time to time, and especially after major life events. "Many people accidentally leave entire 401(k) accounts to ex-spouses because they forgot to update their beneficiary designations," Austin says.

Managing your beneficiaries

Review and update the beneficiaries on your Schwab accounts.

2. Titling

Married couples typically hold property as joint tenants with rights of survivorship, making it easy for the surviving spouse to directly inherit the property outside of probate. However, joint tenants needn't be spouses. For example, an elderly parent may choose to name an adult child as a joint tenant on their house, especially if the child has moved in to serve as a primary caregiver.

That said, be aware that adding a nonspousal heir as a joint titleholder could have tax consequences in some situations. The recipient will share your original cost basis, but upon your death only your half of the property may receive a step-up to fair market value—meaning your heir's half could be subject to capital gains taxes should they decide to sell. (Adding a joint account owner who later encounters creditor issues, such as through a car accident or divorce, could also cause problems for the original owner during their lifetime.)

To avoid such scenarios, you could instead:

- Create a transfer-on-death (TOD) deed: If available in your state, you may be able to name a nonowner beneficiary, such as an adult child, who will automatically inherit the property when you die. This kind of title also avoids probate, yet the heir benefits from a full step-up in the original cost basis for tax purposes.

- Place the property in a revocable trust: Assets within a revocable trust remain entirely under your control during your lifetime (see Trusts), and ownership is transferred to your named beneficiaries with a full step-up in cost basis.

3. Trusts

Although establishing a revocable living trust requires up-front time and expense, its assets typically bypass the probate process, stay out of the public eye, and become almost immediately available to the trust's beneficiaries.

"The appeal of a revocable trust is that you remain in control of the assets during your lifetime, meaning you can amend the terms, terminate the trust, or change beneficiaries at any time," says Matt McColl, a Schwab director of tax, trust, and estate based in Westlake, Texas.

You can also name a successor trustee to manage the assets should you or your spouse become incapacitated. (According to a National Health Interview Survey, 5.7% of U.S. adults ages 75 through 84 experienced dementia in 2022; for those 85 and older, that number more than doubled to 13.1%.2) Additionally, this person (or someone else of your choosing) can continue overseeing trust assets after you pass, ensuring your beneficiaries are provided for according to the trust's provisions.

Finally, a trust makes it easier to pay bills on behalf of your estate. For example, if your house requires repairs before it can be sold, an executor could conceivably have to wait until the necessary funds go through probate, whereas a trustee can authorize and distribute funds to cover these and other outstanding costs immediately upon your passing.

Keep in mind, however, that establishing a trust is a two-step process:

- Setup: "First you need to create the legal entity, which is best done with the assistance of an estate-planning attorney," Matt says. "While there are online services that let you create a living trust yourself, an attorney can help ensure the trust complies with state laws, is structured to withstand legal challenges, and aligns with your specific estate-planning goals."

- Retitling: "Qualifying assets must be retitled in the name of the trust, otherwise they will wind up in probate, defeating the purpose and effort of establishing the trust," Matt notes. Assets that may be placed in a trust include life insurance policies, nonretirement brokerage and mutual fund accounts, personal property, and real estate. Nonqualifying assets generally include retirement accounts and bank accounts that are used to pay ongoing expenses. Additionally, if you own a business, your ownership agreement may prohibit you from placing your share in a trust.

Note that living trusts are typically paired with a pour-over will, which transfers any remaining assets to the trust upon your death, acting as a fail-safe for things you may have overlooked during the trust's creation. However, such assets are subject to probate.

4. Communication

As a final piece of advice for avoiding probate and other delays in distributing your estate, set aside some time now to make sure your family members and other beneficiaries know what to expect.

"Let's say you have a second marriage and your primary residence is going to your current spouse, while you plan to leave everything else to your kids from the first marriage," Matt notes. "It's a good idea to communicate those plans to avoid any unpleasant surprises—especially if they could result in litigation."

1"Uniform Probate Code," law.cornell.edu.

2Ellen A. Kramarow, Diagnosed Dementia in Adults Age 65 and Older: United States, 2022, cdc.gov, 06/13/2024.

Discover more from Onward

Keep reading the latest issue online or view the print edition.