Bullish & Bearish Vertical Options Spreads

Depending on its construction, a vertical options spread1 can be either bullish (benefiting from a rise in the underlying's value) or bearish (benefiting from a decrease in the underlying's value). For traders interested in an options strategy that's designed to take advantage of directional moves but with defined risk, a vertical spread could be a strategy to consider.

There are different types of vertical spreads, but their mechanics have some similarities. A call vertical, for example, involves simultaneously buying one call option and selling another call option at a different strike price in the same underlying, with the same expiration. Likewise, a put vertical involves simultaneously buying a put option and selling another put option at a different strike price in the same underlying, with the same expiration.

Among call and put vertical spreads, there are two types: credit and debit. To create a credit spread2, traders sell an option with a higher premium and buy an option with a lower premium. To form a debit spread3, traders purchase a higher premium option and sell an option with a lower premium.

The credit spread

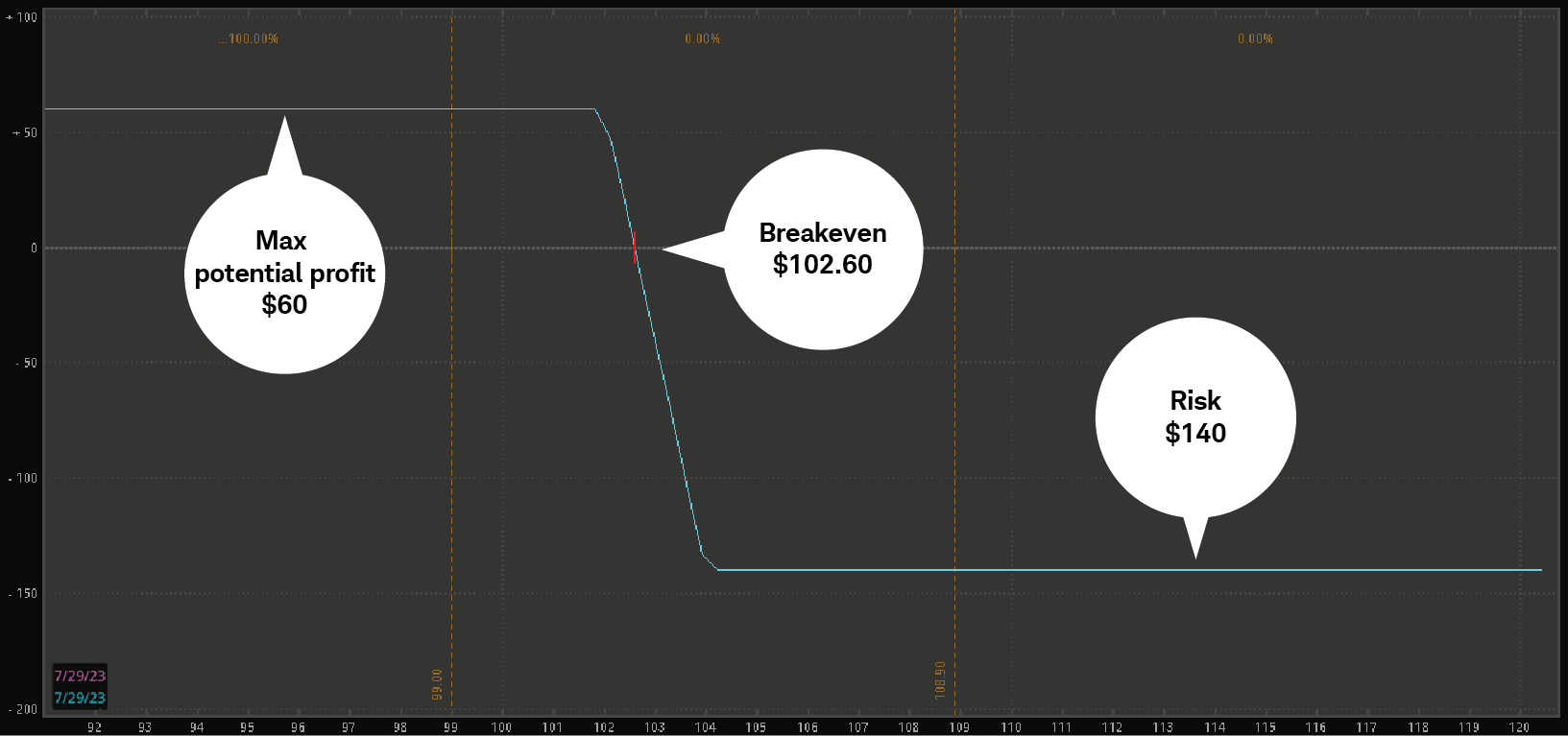

The risk in a vertical credit spread is determined by the difference between its strikes minus the credit received, plus transaction costs. The maximum potential profit for a vertical credit spread is the premium collected when selling the spread minus transaction costs. For example, if a trader sells an XYZ 102/104 call vertical for $0.60, the risk is $140 per contract plus transaction costs and the maximum potential profit is $60 per contract minus transaction costs (see chart below).

Characteristics for a short call credit spread:

- Theoretical risk per contract = (Difference between the strikes – Credit received) x 100 + Transaction costs

- Max potential profit per contract = Credit received x 100 – Transaction costs

For the XYZ example:

- Theoretical risk = $140, or ($2 – $0.60) x 100 + Transaction costs

- Break-even level = $102.60, or $102 (the short strike) + $0.60 (credit received)

- Max potential profit = $60 ($0.60 x 100) – Transaction costs

It's important to keep in mind that the trading examples in this article concerning risk are based on standard calculations. Risks can be much more if there is an unexpected exercise or assignment of the option which could become a long4 or short5 stock position, which could then move against the trader. Additionally, it's important to remember that short options can be assigned at any time up through expiration.

Vertical credit spread profit and loss

Source: thinkorswim® platform

For illustrative purposes only. Past performance does not guarantee future results.

The debit spread

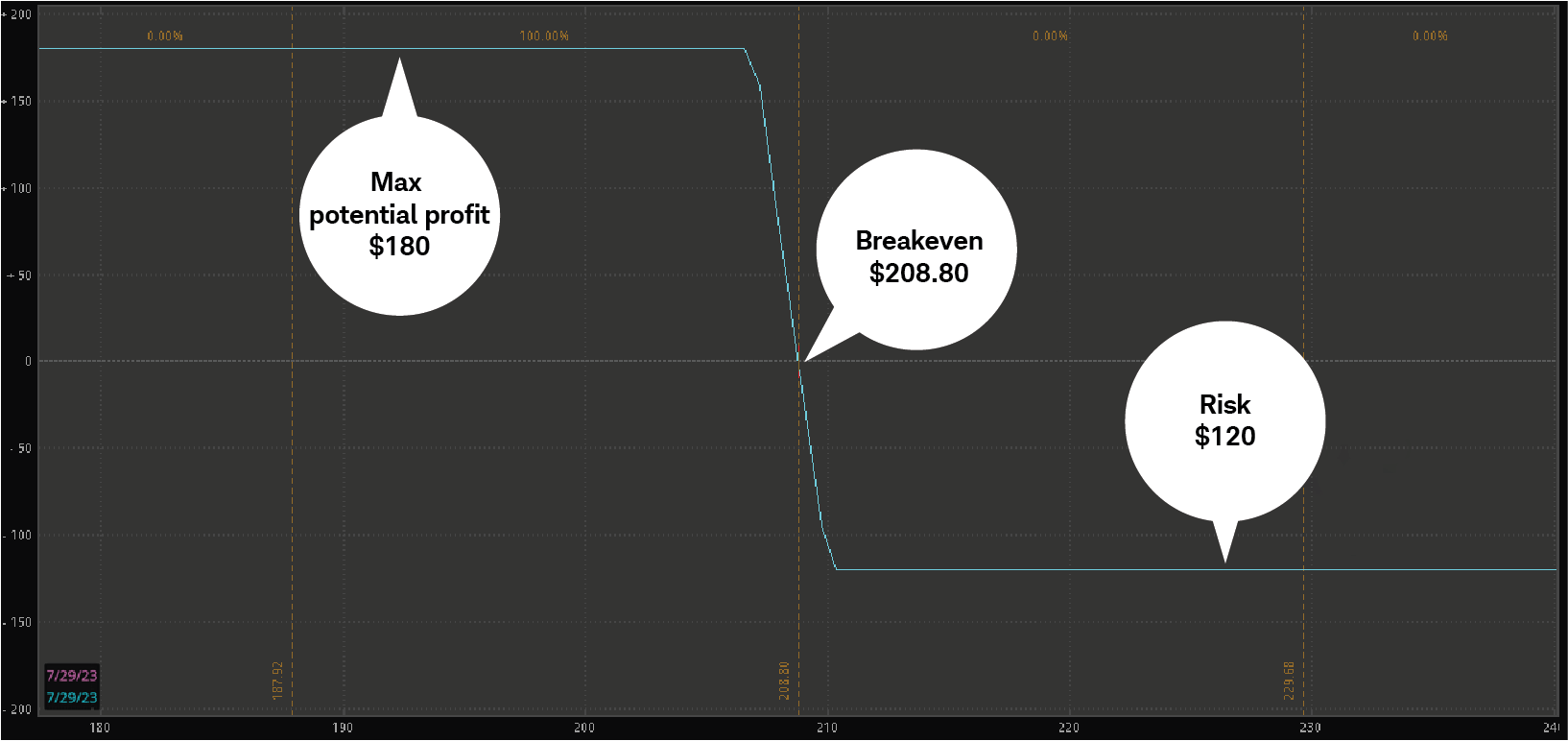

When buying a vertical debit spread, the risk is the premium paid for the spread. The maximum profit is determined by subtracting the premium paid from the spread between strike prices minus transaction costs. For example, if a trader buys a FAHN 210/207 put vertical for $1.20, the risk is $120 per contract plus transaction costs and the maximum potential profit is $180 minus transaction costs (see chart below).

Characteristics for a long put debit spread:

- Theoretical risk per contract = Amount paid for the spread x 100 + Transaction costs

- Max potential profit per contract = (Difference between the strikes – Amount paid for spread) x 100 – Transaction costs

For the FAHN example:

- Theoretical risk = $120 ($1.20 x 100) + transaction costs

- Break-even level = $208.80, $210 (long strike) – $1.20 (the debit paid for the spread)

- Max potential profit = $180, or ($3 – $1.20) x 100 – Transaction costs

Vertical debit spread profit and loss

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

The profit and loss graphs for the call credit spread and the put debit spread examples above are similar. This is because they are both bearish, risk-defined spreads.

Versatile verticals

The vertical spread, which can sometimes be described as versatile, is a directional play that enables an option trader to express a bullish or bearish view. It can also be used to potentially take advantage of relatively high or low volatility levels.

Let's say an option trader thinks a stock is oversold and volatility levels are due to decrease. In this scenario, selling an out-of-the-money6 vertical put credit spread might be worth considering. Selling a vertical put credit spread is a bullish strategy that attempts to profit from a price increase of the underlying as well as a decrease in volatility.

Alternatively, if an option trader believes a stock is overbought, and the implied volatility and premium levels in the options are low, they might consider buying an at-the-money7 vertical put debit spread. This is a bearish strategy that attempts to profit from a fall in the price of the underlying and an increase in volatility.

Depending on the direction a trader believes a stock will go, vertical spreads offer various ways to place directional trades on an underlying stock in a risk-defined manner.

1An options position composed of either all calls or all puts, with long options and short options at two different strikes. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero.

2A spread strategy that increases the account's cash balance when established. A bull spread with puts and a bear spread with calls are examples of credit spreads.

3A spread strategy that decreases the account's cash balance when established. A bull spread with calls and a bear spread with puts are examples of debit spreads.

4Being long a stock means that an investor owns the stock and will profit if the stock rises.

5Being short a stock means that an investor has a negative position in the stock and will profit if the stock falls.

6Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

7An option whose strike is "at" the price of the underlying equity. Like out-of-the-money options, the premium of an at-the-money option is all time value.