The Case for Investing in the International Market

Many investors have underinvested in international securities over the past 15 years, preferring U.S. stocks instead. And who can blame them? Over that span, domestic equities returned about 13.5% annually, compared with 4.8% for international stocks, according to Morningstar Direct.1

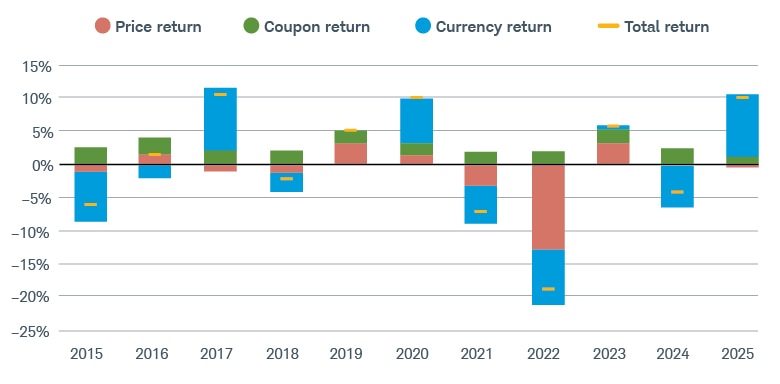

But lately the tables have turned: In the first six months of this year, non-U.S. stocks returned 18.2%—well ahead of the 5.6% for U.S. issues.2 International bonds have enjoyed a similar about-face, in large part due to the dollar's decline. After posting negative total returns in three of the past four years, they surpassed 10% in the first half of 2025.3

"U.S. investors are naturally biased toward domestic stocks and bonds, and that's especially true when U.S. markets are dominating," says Michelle Gibley, CFA®, director of international research at the Schwab Center for Financial Research. "However, most investors should have at least some international exposure, and with so much domestic uncertainty that's especially true today."

Indeed, a recent Schwab survey of more than 700 investors and traders showed that 21% of them have larger allocations to international investments than they did a year ago.4 As William B., a Florida-based client, puts it, "There are many opportunities in foreign markets that can increase the value of my portfolio while adding stability when U.S. markets experience volatility."

Whatever the current conditions at home, international investments can offer compelling diversification advantages—across currencies, economies, and sectors.

Currency exposure

When you buy a foreign security, you convert your dollars into the currency of that security. If the foreign currency appreciates against the U.S. dollar, it exchanges into more dollars when translated back, adding to your total return; if it depreciates against the dollar, it reduces your total return.

When the dollar was riding high, the currency conversion depressed the total return for many foreign assets. The dollar's recent weakness, however, has turned that drawback into a benefit—and investors are taking notice. To illustrate, say you purchase €10,000 worth of European stock at an exchange rate of €1 to $1, paying $10,000 for the shares. One year later, the stock's value is unchanged at €10,000, but the exchange rate has moved to €1 to $1.15. With the dollar falling in value relative to the euro, your investment is now worth $11,500 ($10,000 × 1.15) just from currency changes.

According to The Wall Street Journal, when the dollar has strengthened, international stocks rose only 0.16%. When the dollar has weakened, on the other hand, international stocks have risen 2.57% on average in a given month—a difference of 2.41 percentage points in bottom-line returns.5

In fact, U.S. investors can sometimes earn positive returns even when the asset itself is down. For example, the prices of many foreign government bonds have declined this year, yet the weakening dollar has nevertheless generated positive returns for bond funds that hold such issues.

Gained in translation

In the first half of 2025, the 10.0% total return for the Bloomberg Global Aggregate ex-USD Index of international bonds was due almost entirely to positive currency translations.

Source: Charles Schwab and Bloomberg. Data from 01/01/2015 through 06/30/2025.

For illustrative purposes only. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. For more information on indexes, please see schwab.com/indexdefinitions.

Access to economic growth

"Because markets are forward-looking, it's not so much the degree of growth as the direction of growth that drives investing decisions," Michelle says. "Are things getting better or worse? The answer to that question is what's drawing more investors to stock markets like Europe this year."

"The U.S. [economy], while the world's largest, is increasingly becoming the least predictable," suggests Mark P., a Schwab investor from Wisconsin who feels that diversifying to other countries "can be a hedge against the U.S. market."

Even minor changes in investor sentiment can have major effects on foreign markets. "Given the small size of most international markets relative to the U.S., investors reallocating even just a fraction of their domestic dollars into foreign assets could lead to outsize growth abroad," Michelle says.

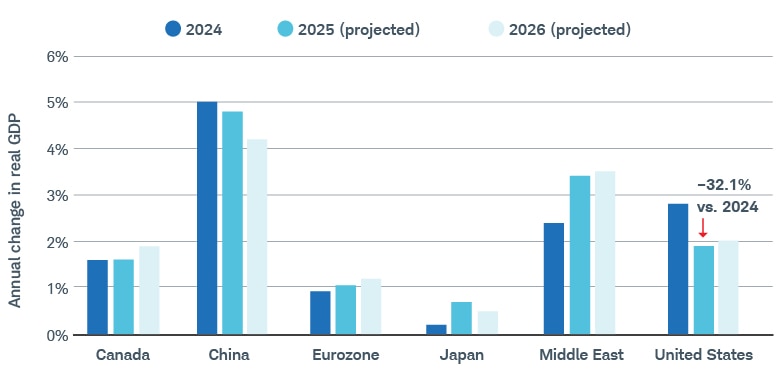

While trade tensions have caused many economists to lower their estimates of global growth this year, the U.S.—and China, to a lesser degree—is likely to suffer most, according to estimates from the International Monetary Fund based on data through July.6 Meanwhile, growth in Canada, Japan, the Middle East, and the eurozone is expected to remain stable or even increase compared with 2024.

The bigger they are, the farther they fall

The U.S. is projected to bear the brunt of the fallout from trade tensions.

Source: "World Economic Outlook," International Monetary Fund, 07/2025.

For illustrative purposes only. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research, and are developed through analysis of historical public data.

Of course, government policy can either dampen a country's economic prospects or boost them. Germany, for instance, historically has avoided running a fiscal deficit, but legislators there recently approved €1 trillion in spending on defense and infrastructure due to increased security concerns. "That's a watershed event," says Michelle, who estimates the move could add 1.5 percentage points to Germany's gross domestic product every year for each of the next 10 years.

Differences or lags in monetary policy, in particular, can influence investor sentiment. For example, since June 2024, the European Central Bank has lowered key interest rates to around 2% as of September 2025. The Fed, by comparison, has implemented slower cuts to target a rate of 4.0%–4.25% by the same end point. This divergence could make European securities more appealing to investors.

"Lower rates make borrowing more accessible, fueling consumer spending and corporate investment—tail winds that can stimulate growth and lift international asset prices," says Kathy Jones, Schwab's chief fixed income strategist. "When one central bank starts cutting further and faster than another, it could make financial assets in its country relatively more attractive."

Sector diversification

The shift in the makeup of U.S. stock indexes over recent years has further eroded the level of diversification in many investors' portfolios. Most notably, the technology sector's share of the S&P 500® has nearly doubled over the past decade, 7 rising from around 18% in 2014 to about 35% today.8

That worked out great for many investors during much of that period, but the first quarter of 2025 revealed the downside, as technology stocks plunged 12.8%, dragging down the S&P 500 as a whole by 4.6%. "You could argue that the U.S. stock market is now too beholden to the tech sector," Michelle says. "International stock markets, at least from that perspective, remain much more diverse."

Take the MSCI EAFE Index, which tracks large- and mid-cap companies across 21 developed markets, excluding the U.S. and Canada. The index is allocated most heavily to financials and industrials, which together account for about 43% of the index; information technology is less than 10%.

"Tech dominance is one reason investors have been willing to pay a premium for U.S. stocks versus their counterparts overseas," Michelle says. "But as returns earlier this year showed, tech doesn't always outperform."

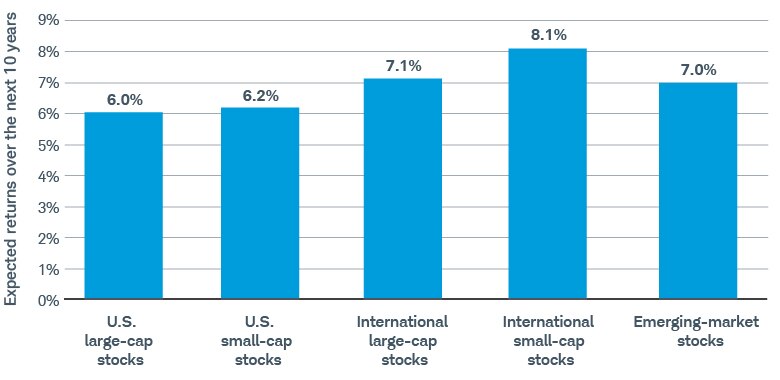

How to allocate to international

U.S. stocks' stellar run over the past decade has pushed many investors' portfolios out of whack from their own target allocations. And with the potential for international stocks to outperform their U.S. peers over the coming decade, "now is a great time for investors to consider shifting their allocations back to their long-term international targets," Michelle says.

Growth goes global

Schwab Asset Management's expectations for returns over the next 10 years have international equity asset classes exceeding the returns of both U.S. large- and small-cap stocks.

Source: Schwab Asset Management. Data as of 10/31/2024.

Each bar represents Schwab Asset Management's annualized nominal geometric return expectation for a given asset class. Geometric returns account for the compounding nature of investment returns. All indexes specified utilize a total return version of the named index. Total return = price growth + dividend and interest income. The example does not reflect the effects of taxes or fees, unless specified. Where specified, "net return" denotes a version of the index that reflects foreign taxes have been subtracted from dividends. Numbers rounded to the nearest tenth of a percentage point. Benchmark indexes: S&P 500® Total Return Index (U.S. large-cap stocks), Russell 2000® Total Return Index (U.S. small-cap stocks), MSCI EAFE Net Return Index® (international large-cap stocks), MSCI EAFE Small Cap Net Return Index (international small-cap stocks), and MSCI Emerging Markets Net Return Index (emerging-market stocks). Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research, and are developed through analysis of historical public data.

For most long-term investors, the allocation of international stocks should comprise at least 5% and as much as 40% of their stock portfolio, depending on their risk-and-return objectives. "The lion's share of that allocation should go to developed markets, but some exposure to emerging markets, which have higher growth potential but also higher risks, may be warranted for those with a longer-term investing horizon," Michelle says.

On the bond side, investors should consider adding international bond exposure primarily in the form of bond funds, and even then the category generally shouldn't exceed 10% of a fixed income allocation, Kathy suggests.

Whatever your ideal stock and bond allocation, exchange-traded funds (ETFs) and mutual funds are simple and sensible ways to access international markets due to their generally low cost and diversified exposure.

That said, not all international funds are created equal. Passive index funds aim to faithfully track a broad market index, so they may be more vulnerable to political instability, a rebound in the U.S. dollar, regulatory and trade uncertainty, and other developments. Actively managed funds, on the other hand, monitor global markets and can make adjustments in real time.

"In volatile environments like this, a more hands-on approach might be warranted," Kathy says. "After all, if this year has shown us anything, it's how quickly things can change."

See which international stock and bond funds are included in Schwab's Mutual Fund OneSource Select List® and ETF Select List®.

1,2Randall Smith, "How Much of Your Portfolio Should Be in International Stocks?" wsj.com, 07/04/2025.

3Charles Schwab and Bloomberg. Data from 01/01/2015 through 06/30/2025.

4The "Your Take on International Investing" survey was fielded from 07/11/2025 through 07/15/2025 and collected responses from 723 Schwab clients and prospects. Quotes have been edited for clarity.

5Derek Horstmeyer, "What Stocks Do Best When the Dollar Weakens or Strengthens," wsj.com, 06/06/2025.

6World Economic Outlook, International Monetary Fund, 07/2025.

7Michael Clarfeld, "Tech Is Taking Over the Stock Market. Passive Investors, Beware," barrons.com, 07/31/2024.

8S&P Dow Jones Indices, as of 09/30/2025.

Discover more from Onward

Keep reading the latest issue online or view the print edition.