Countdown for Gift and Estate Tax Exemptions

The clock is ticking down on a temporary increase to federal lifetime gift and estate tax exemptions. The Tax Cuts and Jobs Act (TCJA) of 2017 roughly doubled the amount of these exemptions, which in 2023 allowed individuals to shield $12.92 million and couples up to $25.84 million from estate tax liability.

Unless Congress makes the change permanent, this provision will "sunset" on January 1, 2026, and the exemptions will revert to 2017 levels, adjusted for inflation—about half of what they are now. That might be around $7 million for individuals and $14 million for married couples. Estates valued above exemption levels may be taxed at a rate as high as 40%.

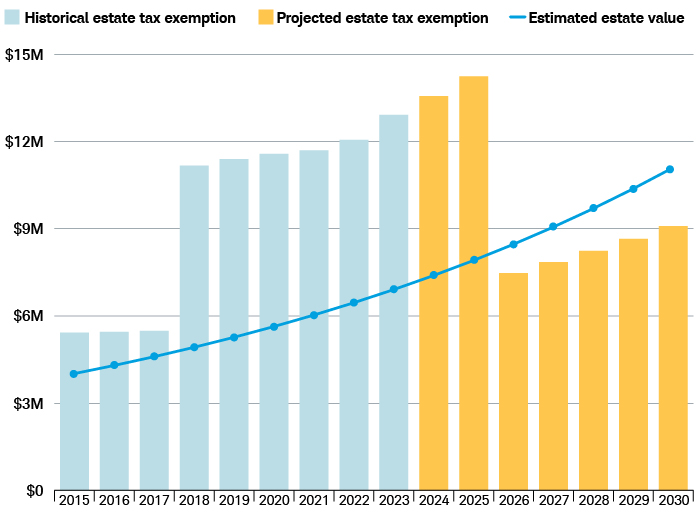

Growing out of proportion

An estate valued at $4 million in 2015 may approximately double over a decade and be subject to federal estate taxes starting in 2026.

Source: Schwab Center for Financial Research.

The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of taxes or fees. Assumes an individual estate value of $4 million, 7% estimated annual return, 5% inflation rate, and reduction of the estate tax exemption to $7.48 million in 2026.

"Anyone with projected estate tax liabilities has a two-year window that could close pretty quickly," says Austin Jarvis, director of estate, trust, and high-net-worth tax at the Schwab Center for Financial Research. "Some people could go to bed on December 31, 2025, not having thought about the value of their estate and wake up in 2026 and with millions of potential tax liability."

Fortunately, there's still time to plan accordingly. Here are three common strategies to consider depending on your situation.

For married couples: dual spousal trusts

Married couples who want to lock in the current exemption limit might consider a spousal lifetime access trust (SLAT), a type of irrevocable trust that can exclude assets from your estate while granting the beneficiary spouse limited access to them. To maximize this strategy, each spouse can create a SLAT in their own name, thereby potentially preserving their respective maximum current combined estate and gift tax exemption.

For example, if you and your spouse have separate assets totaling $27 million, you could both transfer $12.92 million into two SLATs benefiting each other and exclude the full $25.84 million from your taxable estates—plus any future appreciation and income from those assets. This strategy, however, is complex and comes with a major caveat: The court-established "reciprocal trust doctrine," which mandates that if SLATs between two spouses are too similar, it would invalidate them for estate and gift tax purposes. It's important to work with an estate planning specialist and attorney when considering this strategy.

A SLAT may also be a good option for married couples aiming to preserve the higher generation-skipping transfer (GST) tax. This tax applies, either during life or at death, to gifts for individuals who are more than one generation or at least 37½ years younger than the donor. (The GST tax exemption is currently the same as the lifetime estate and gift tax exemption.)

How your Schwab Wealth Advisor can help

Your Schwab Wealth Advisor can discuss how potential changes in estate and gift tax exemptions may affect you and help connect you with estate planning specialists.

For family businesses: a change of entity

An estate that includes a family business can introduce many complexities. "Estate planning is a balancing act between how much of your assets to give away and how much to maintain in your control," Austin says. "If you own a business, you can give away a lot in terms of actual ownership while retaining a large amount of control."

To do so, many wealthy family businesses form as family limited partnerships (FLPs) or family limited liability companies (FLLCs). Both corporate entities can allow the transfer of wealth between generations and give limited liability protection to partnership assets from the claims of creditors and divorcing spouses.

- In a Family Limited Partnership, family members serve as general and limited partners. A married couple, for instance, can each maintain 1% control of their business as a managing partner while granting 49% limited partnership interests to each of their two children. Limited partnership interests offer a level of personal asset protection for those who own them.

- A Family Limited Liability Company can work similarly. After creating an FLLC, individuals can transfer business assets to their intended beneficiaries, in the form of limited interests in the FLLC, typically at a discounted gift tax value, while retaining control of management decisions and the timing and amount of distributions to the members—typically children and grandchildren.

Both FLPs and FLLCs employ discounts that reduce the amount of a reportable gift. For example, if 98% of a $20 million business ($19,600,000) were transferred by a married couple to the next generation, a 20% discount could apply to the gift (the actual percentage may vary and is determined by valuation experts). In this example, that translates to a reportable gift of $15,680,000.

With the current exemption levels, this allows more room to give away larger, "supercharged" gifts, especially with discounting. "But intrafamily discounts have been targets of tax reform advocates in recent years," Austin cautions, "so the clock may be ticking down on this tax option as well."

For everyone: strategic gifting

Another way to take advantage of current exemption levels is a simple gifting strategy. Generally, it's better to give assets to loved ones while you're still alive and allow them to benefit right away. Additionally, such gifts can grow in value under someone else's ownership, helping to lower your taxable estate.

For example, an individual holds an estate valued at $15 million and wants to give $10 million to heirs today. Under current law, they can use the $12.92 million exemption to make a $10 million tax-free gift. If they wait until 2026, the exemption may sunset to around $7 million, meaning $3 million of the $10 million gift would be subject to a 40% gift tax—a tax payment of $1.2 million.

Know what you have

Because an estate's value could grow differently than expected, it's good to check its current and potential worth to help determine whether you might breach certain limits that would trigger tax liability. A good rule of thumb is to review your estate plan every three years if nothing changes; however, those with more sizable assets might want to review annually prior to 2025. Working with your wealth advisor, you can address any potential tax exposure should your estate grow more than anticipated.

"Some people don't think they're wealthy, but when they add up everything, they have a much more valuable estate than they thought," Austin says. "There's opportunity now to prepare."