Floating-Rate Notes: 4 Key Considerations

Bond yields have fluctuated a lot over the past 12 months, and we expect that volatility to continue. That volatility might catch investors off guard, as bonds are often expected to provide ballast to a portfolio. Bond yields generally have traded in a broad range lately, lacking a clear trend.

In a period of volatility, investment-grade floating-rate notes could be worth considering for investors worried about the prices of their holdings, because prices for floating-rate notes tend to be more stable than their fixed-rate counterparts. Federal Reserve policy can be a key driver of performance, and rate cuts by the Fed likely would result in smaller income payments down the road.

There can be pros and cons to investing in floating-rate notes, so investors should understand the ins and outs before investing.

The basics of floaters

Investment-grade floating-rate notes, commonly referred to as "floaters," are a type of corporate bond investment whose coupon rates are tied to a short-term benchmark rate. A "spread," or additional yield, is usually added to that reference rate to compensate investors for the risk of lending to a corporation, such as the potential that it will default and fail to make timely payments on its debt. Because these are issued by investment-grade-rated corporations, the spread between the reference rate and the floating-rate note yield tends to be relatively low, usually in the 25- to 100-basis-point range (or 0.25% to 1%). Given their investment-grade rating, default risk tends to be relatively low. Bank loans, another type of floating-rate investment, have much higher credit risk.

The underlying reference rates for floaters can vary, but they are usually based on the Secured Overnight Financing Rate (SOFR). SOFR is highly correlated to the federal funds rate, so floater coupon rates are highly dependent on Federal Reserve policy. Floater coupon rates generally rise when the Fed is raising its benchmark interest rate, but they tend to fall when the Fed lowers rates.

Floater coupon rates tend to follow the lead of the federal funds rate

Source: Bloomberg, using weekly data from 1/21/2005 to 3/14/2025.

Bloomberg US Floating Rate Note Index (BFRNTRUU Index) and U.S. Federal Funds Target Rate Mid Point of Range (FDTRMID). Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Schwab does not recommend the use of technical analysis as a sole means of investment research. Past performance is no guarantee of future results.

Four things to consider with floaters

There can be pros and cons to investing in floaters, and performance relative to fixed-rate corporate bonds can vary. Although floaters tend to make the most sense when the Federal Reserve is raising interest rates, they can still offer some benefits today given our expectations of additional rate cuts later this year. Here are four key considerations with floaters today.

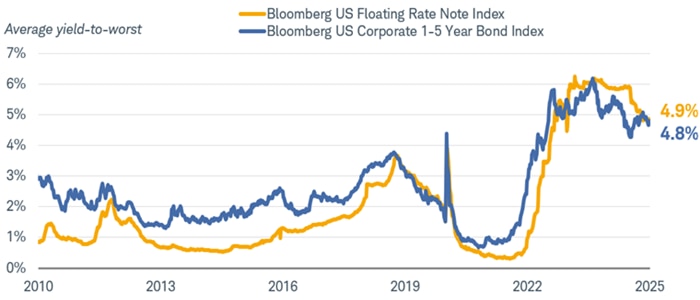

1. They offer similar yields to fixed-rate corporate bonds right now. This normally isn't the case as the chart below highlights. Over the last 15 years, floaters have generally offered lower yields than fixed-rate corporate bonds with similar maturities, mainly due to a positively sloped yield curve.

The yield curve represents the yields that bonds offer at various maturities. When longer-term bonds offer higher yields than short-term bonds, the yield curve is positively sloped. More often than not, the yield curve is positively sloped, but for 2023 and most of 2024 it wasn't, as the fed funds rate was higher than the 10-year Treasury yield.

The gap between the yield on floaters and fixed-rate corporates has shrunk lately given the Federal Reserve rate cuts last year. If the Fed continues to cut rates later this year as we expect, then the yield on floaters would likely drop as well.

Floater yields are slightly higher than short-term, fixed-rate corporate bond yields today

Source: Bloomberg, using weekly data from 3/14/2010 to 3/14/2025.

Bloomberg US Floating Rate Note Index (BFRNTRUU Index) and Bloomberg US Corporate 1-5 Year Bond Index (LDC5TRUU Index). Yield-to-worst is the lower of the yield-to-call or yield-to-maturity. It's the lowest potential rate of return for a bond, absent a default. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

2. Price stability vs. income stability: Do you prefer relatively stable income or relatively stable prices? That's a key consideration when determining if floaters make sense.

Floating coupon rates generally rise and fall with the direction of Fed policy. When the Fed raises or lowers its benchmark interest rate, floater coupon rates adjust very quickly. That's not the case with fixed-rate bonds. Over time, the average coupon rate of an index of fixed-rated corporate bonds does fluctuate, but it's very slow moving. Given this, fixed-rate bonds tend to make more sense for investors looking for more stable income and prefer to lock in a more certain income stream over time.

Average coupon rates for floaters and fixed-rate corporates

Source: Bloomberg, using weekly data from 10/3/2003 to 3/14/2025.

Bloomberg US Floating Rate Note Index (BFRNTRUU Index) and Bloomberg US Corporate 1-5 Year Bond Index (LDC5TRUU Index). Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Floaters do provide more price stability than fixed-rate corporate bonds, however. This is a key benefit for investors, especially for those who are worried about the potential price fluctuations of their bond holdings in the secondary market.

The prices and yields of fixed-rate bonds have an inverse relationship. If a fixed-rate bond's yield rises, its price falls (and vice versa). If market interest rates rise, a bond with a low fixed coupon rate may no longer be attractive—its price will generally fall to make its yield more in line with market interest rates.

That's not the case with floaters. Because their coupons adjust with market interest rates, their prices don't need to. Over time, floater prices tend to be very stable, whether the Fed is raising or lowering interest rates. Keep in mind that floaters can help mitigate interest rate risk, but they still have credit risk, like the risk of default. Floater prices fell sharply during the 2008-2009 global financial crisis, so a recession or extreme market volatility tend to weigh on their prices.

Floater prices tend to be much more stable than fixed-rate bond prices

Source: Bloomberg, using weekly data from 3/15/2005 to 3/14/2025.

Bloomberg US Floating Rate Note Index (BFRNTRUU Index) and Bloomberg US Corporate 1-5 Year Bond Index (LDC5TRUU Index). Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

The benefit of stable prices cuts both ways. It helps when yields are rising, but it can weigh on returns when yields fall. Given the inverse relationship between prices and yields for fixed-rate bonds, traditional bonds can see a boost in value when interest rates fall. Floaters don't offer that same benefit.

3. Balance of risk vs return: When considering any type of fixed income investments, investors must decide how much interest rate risk and credit risk to assume.

Both of those risks are low for Treasury bills. They are backed by the full faith and credit of the U.S. government (so there's low credit risk) and have very little interest rate risk given their short-term maturities. That's highlighted by the very low annualized standard deviation for an index of Treasury bills.

Fixed-rate, investment-grade corporate bonds have low to modest credit risk, and the interest rate risk varies based on the underlying maturities. The longer the maturity, the higher the interest rate risk, all else equal. Meanwhile, lower-rated bonds like high-yield bonds and bank loans have credit risk. They generally have higher total returns over time, but those higher returns come with a lot of volatility.

Floaters have very little interest rate risk given their floating coupon rates, and low to modest credit risk given their investment-grade ratings. Over time they have generated higher average total returns than Treasury bills, with more volatility, and lower average returns than fixed-rate corporates, but with less volatility. The chart below calculates returns and volatility over the past 20 years, many of which were during the Fed's zero-interest-rate policy regime, which pulled down floater yields (and therefore returns).

Returns and volatility for various fixed income investments

Source: Bloomberg. Monthly data from 2/28/2005 to 2/28/2025.

Treasury Bills = Bloomberg US Treasury Bills TR Index (LD20TRUU Index); Floaters = Bloomberg US Floating Rate Notes TR Index (BFRNTRUU Index); 1-5 Year Corps = Bloomberg US Corporate 1-5 years TR Index (LDC5TRUU Index); 5-10 Year Corps = Bloomberg US Credit Corp 5-10Y TR Index (BCR5TRUU Index); Bank Loans = Morningstar LSTA US Leverage Loan 100 TR USD (SPBDLL Index); High-Yield = Bloomberg US Corporate High-Yield TR Index (LF98TRUU Index). TR, or total return, includes both interest payments and changes in the market value of the bonds. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Standard deviation, commonly used as a measurement of risk, is a statistical measure that calculates the degree to which returns have fluctuated over a given time period. A higher standard deviation indicates a higher level of variability in returns. Past performance is no guarantee of future results.

4. The outlook for Federal Reserve policy. Since floater coupon rates are strongly influenced by the federal funds rate, the path of the fed funds rate matters.

The Fed has suggested that policy may remain on hold for the time being, but we still expect rate cuts later this year. The timing and magnitude of potential cuts will depend on the inflation outlook and, perhaps more importantly, the economic growth outlook. Despite growth concerns driven by uncertainty from Washington lately, there's still a risk to higher long-term yields down the road should inflation remain sticky or perhaps even reaccelerate.

If the growth concerns morph into an actual growth slowdown, then fixed-rate bonds would likely make more sense, as intermediate- and long-term yields could fall. But with so much uncertainty, floaters can make sense given their relative price stability in case the growth concerns abate and inflation remains sticky, potentially pulling up long-term yields and pulling down long-term bond prices.

What to consider now

Investment-grade floaters can make sense for investors given their relative price stability, but their coupon rates will likely decline when/if the Fed cuts rates down the road. The depth of the rate cut matters. If the Fed only cuts rates one or two more times, floater coupon rates wouldn't fall much further, and, for some investors, the relative price stability may outweigh the potential decline in income. However, if growth concerns persist and the economy does begin to slow, the Fed would likely cut rates more than currently expected. In that scenario, it would make more sense for investors to consider intermediate- or long-term fixed-rate bonds to lock in higher yields now with more certainty. Given so many unknowns today, a small allocation to floaters can make sense.

The floater market is much smaller than the fixed-rate corporate bond market, so it can be difficult to invest in individual securities. One way to get direct exposure, however, is through an exchange-traded fund (ETF) that tracks a floater index. Unfortunately there isn't a specific Morningstar category for investment-grade floating rate notes, but there is a way for Schwab clients to screen for funds using the ETF screener: log in to their account, click the "Research" tab, then "ETFs" and "ETF Screener." At left, under "Choose Criteria," open the "Basic" dropdown and click "Fund Name." Then, in the "Fund Name" popup, enter "float" as the search term. Using those criteria should provide a starting point for an investor to explore some ETFs that focus on investment-grade floaters, but keep in mind that might not be the comprehensive list, and some of the funds might have exposure to other sorts of floating-rate investments.