Getting Started with Equity Research Reports

For good reason, investors often use equity research reports to assess a stock's investment characteristics. Some are written by brokerage firms; others by independent research firms. And some lean heavily on qualitative or quantitative models. Given the diverse methods by which these reports are generated, they can cover a broad spectrum of formats and meet a range of investor needs. Some are only a grade or rating, while others include information about past events, business line evaluations, or commentary and analysis on the company's prospects.

However, keep in mind, research reports can be hard to navigate because they may contain jargon and inconsistencies. They are also not the final word on a company's prospects. No one, no matter how skilled, can predict the future, and the success of all report findings is limited to what the analyst prioritizes when compiling their research. These reports should be considered just one tool in an arsenal of investment research.

How reports are prepared

Analysts take a variety of research approaches. Some focus on financial data. Others look at the fundamental factors of the company's business, while some focus on technical indicators. A number of firms leverage a proprietary analytical process or financial modeling. All of this means it's difficult to offer a general description of all the various research reports an investor might encounter, but there are some commonalities.

Many investment analysts compile research reports from publicly available information and from non-public information they uncover in their research. They typically start by collecting all the information they can about a company and its industry, then distilling it into factors that are most relevant to the current investment case. Reports might include SEC filings, company announcements and presentations, industry news, and interviews with company management.

Typically, research reports can be based on a mix of public information—both material and immaterial—as well as non-public information that is very unlikely to have an impact on the company stock. This method of information gathering is known as the "mosaic theory" due to the different sources involved. Examples of immaterial data include results of an employee satisfaction survey or social media metrics. If an analyst uncovers materially significant inside (non-public) information, they cannot act on it and may not be able to publish their report until that information has been made public.

Analysts may then use the information gathered to create a financial model, which forecasts a company's financial statements several years into the future. This model generates earnings estimates and shows how future expectations might play out by the numbers. For example, a company may have plans to open new locations and raise prices in step with inflation. Such a model might incorporate inflation into the revenue line—and into expenses—and increase expenses accordingly for the new locations before folding in additional revenue. This forms a "reality check" on the company's plans. Then, it's common for analysts to assign their buy, sell, or hold ratings to the stock based on the results of the research and the analyst's outlook for the company relative to the overall market.

What readers should look for

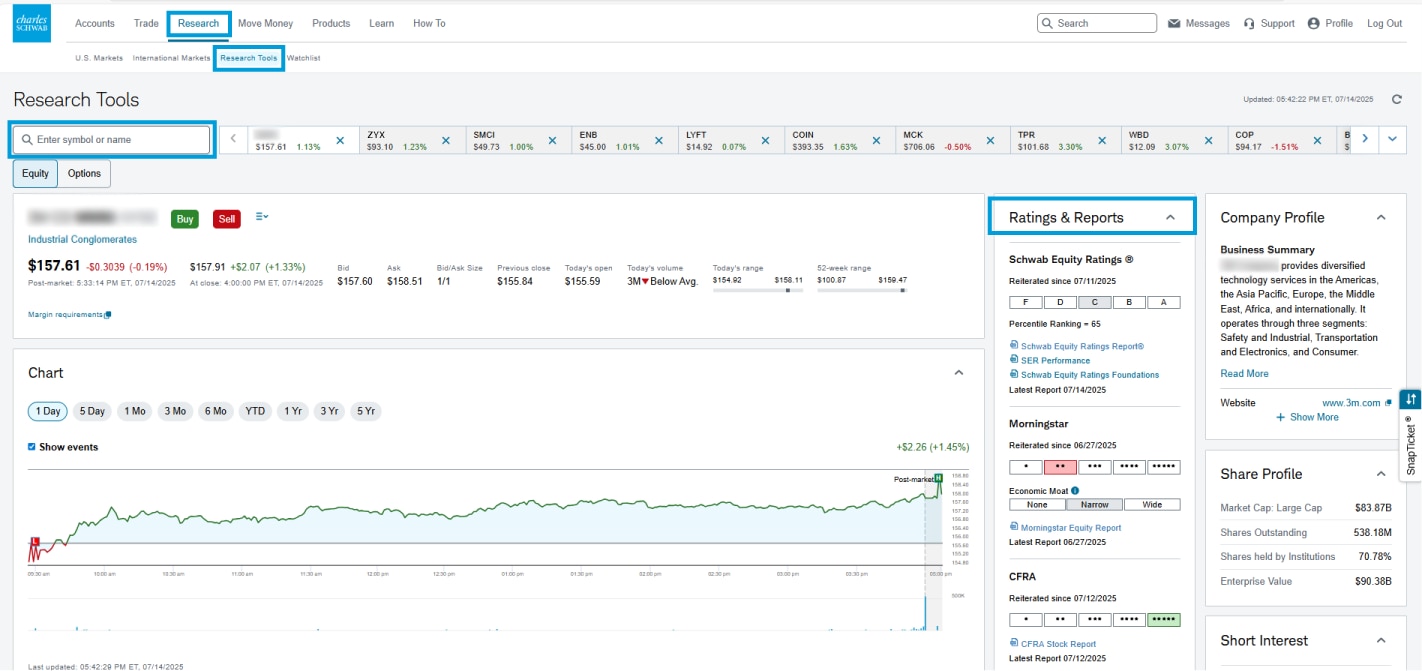

Schwab clients can find Schwab Equity Ratings Reports as well as research from independent third parties by logging in to their Schwab account, selecting Research > Research Tools, and then entering the ticker symbol. The company's Ratings & Reports will appear to the right of the price chart. From here, clients can access research reports from several different services.

Source: Schwab.com

For illustrative purposes only. Screenshots are historical in nature.

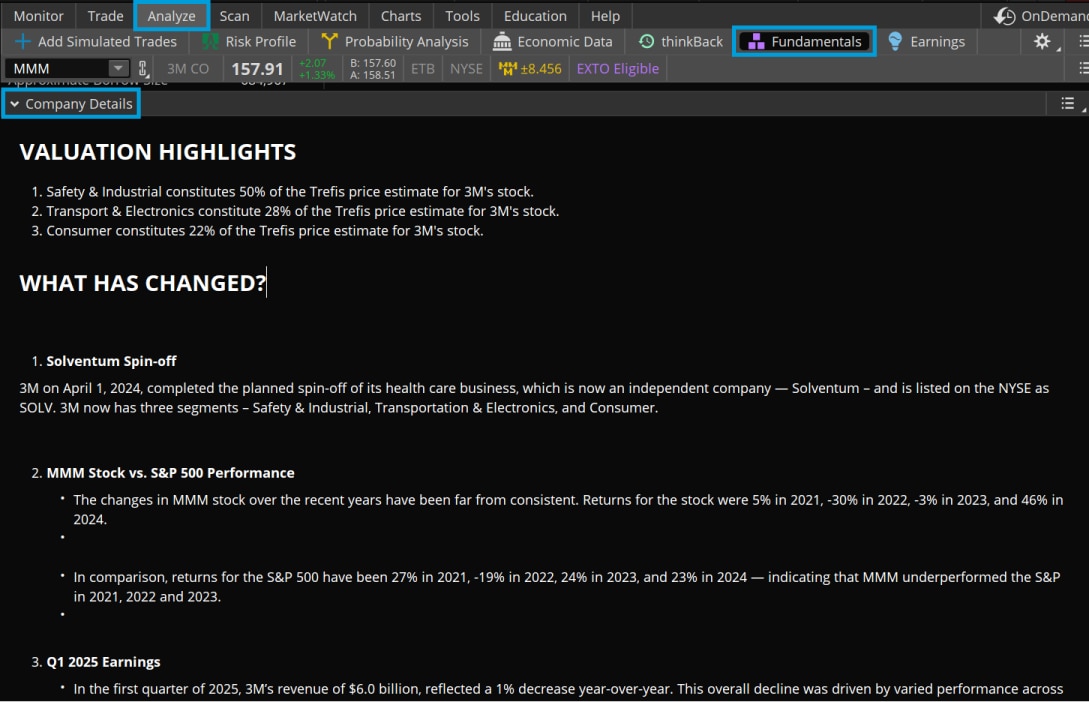

On the thinkorswim® platform, research and analysis is available from Trefis Insight Guru, a separate and unaffiliated company. Under the Analyze tab, enter the ticker symbol, select Fundamentals, and scroll down to Company Details. From here, clients can access research that offers information about the company, its valuation, and changes in company performance.

Source: thinkorswim

For illustrative purposes only. Screenshots are historical in nature. Information/estimates provided by Insight Guru, a separate and unaffiliated firm. Stock prices are impacted by numerous factors and estimates of prices in the future are not guaranteed.

Bottom line

Research reports can introduce investors to a company, explain the factors that drive its financial results, and list different risks that the company may face. Readers can use them to learn more about a company and compare different analysts' perspectives on estimates and outlooks. In most cases, the information in research reports has already informed the current stock price, so investors are unlikely to uncover anything surprising. But these reports are especially useful when a trader is beginning to research a stock for the first time.