The Hidden Risks of Serving as Executor or Trustee

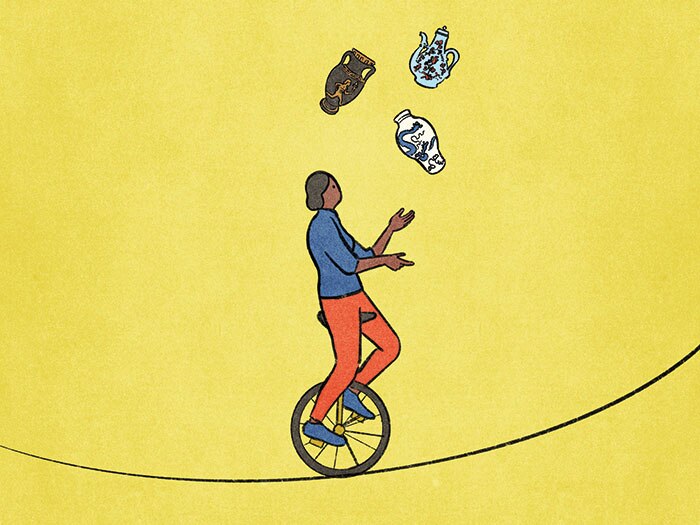

Being named the trustee or executor of an estate can feel like an honor, but it's important to recognize the accompanying obligations—and legal repercussions—of serving as a fiduciary who must act on behalf of others.

"What many people don't realize is that as executor or trustee, you're taking personal legal responsibility," says Austin Jarvis, director of estate, trust, and high-net-worth tax at the Schwab Center for Financial Research. "In fact, some states require you to be bonded to serve as an executor in order to protect the estate against fraud."

Before you accept the role, be sure you understand exactly what it requires—namely, that you:

- Follow the rules of the document: You must implement the terms of the trust or will exactly as written. "This is true even if you disagree with them now or at any point in the future," Austin says.

- Act in the best interest of all beneficiaries: "Particularly when it comes to trusts and balancing the interests of multiple beneficiaries, it can be difficult to satisfy everyone," Austin says.

- Make prudent investment decisions: "You should have an airtight rationale for every investment decision you make," Austin says. "If a beneficiary feels you're mismanaging the trust assets, they could take you to court." To protect yourself, ask the beneficiaries for written approval of any investment changes beyond normal portfolio rebalancing.

- Keep accurate records: If someone asks a question and you don't have a record of the answer, you could be in breach of your fiduciary duty. "At a minimum, you should keep annual accountings containing all the financial details and events that occurred over the past year," Austin adds.

If a beneficiary takes you to court for malfeasance or negligence, a ruling in their favor could result in your removal as executor or trustee, as well as require you to pay personal restitution for any mistakes—and even punitive damages for actions determined to be self-dealing. "You'd be surprised how often these kinds of cases go to court," Austin says.

Thus, those who are asked to serve as executor or trustee should think long and hard before accepting the role. "It's perfectly acceptable to decline," Austin says. "And if you've already agreed and change your mind, you should tell the estate owner right away so they can update their will or trust documents. Otherwise, you may need to petition the court to be removed."

For estate owners, you might even consider pairing your chosen executor or trustee with a professional fiduciary. "That way, you can have someone who personally knows your beneficiaries and can help implement your wishes and a professional who can help them navigate any legal burdens that might arise," Austin says.

Schwab Personal Trust Services

Offered through Charles Schwab Trust Company (CSTC), Schwab Personal Trust Services can help impartially manage your financial assets, with all the accompanying administrative duties and legal complexities, for the full term of the trust. Depending on your needs, CSTC can serve in three separate trustee capacities:

- Sole trustee. CSTC assumes all the administrative, fiduciary, and investment responsibilities of managing your trust according to the terms defined in your trust document.

- Co-trustee. CSTC acts as a co-trustee with the individual(s) you designate. In that role, CSTC assumes full investment management and administrative responsibilities for the trust but may share discretionary disbursement decisions with the co-trustee(s) according to the trust provisions.

- Successor trustee. CSTC steps in once you or the individual you name as sole trustee or co-trustee is no longer willing or able to serve.

To learn more, visit Schwab Personal Trust Services or contact your Schwab consultant.

Discover more from Onward

Keep reading the latest issue online or view the print edition.