How a Dividend Reinvestment Plan Works

One key way investors can grow their portfolios is through compounding returns. By reinvesting dividends earned from their investments, investors can see their portfolio's growth accelerate over time thanks to this compounding effect.

A common way to put compounding into action is through a dividend reinvestment plan, or DRIP. A DRIP automatically reinvests dividends and capital gains distributions to purchase additional shares of the same security—typically at no charge. This reinvestment potentially creates a snowball effect that can accelerate portfolio growth and also saves time. Over years or decades, DRIPs can encourage a disciplined, systematic approach to investing that can make a meaningful difference for investors looking to build wealth.

Important DRIP considerations

Although Schwab doesn't charge fees or commissions in a DRIP, there is still a tax scenario to consider. A security’s dividend income is used in a DRIP to purchase additional shares of that security. Each purchase is then considered a new tax lot (like any other share an investor might purchase) with its own basis and purchase date.

If a DRIP is active in a non-retirement account, the dividend income is a taxable event and will be reported on an investor's 1099-DIV as if it was received in cash. All dividend income is reported on a 1099-DIV for taxable accounts, regardless of whether or not it's reinvested.

If an investor is not dependent on their dividend income, they might consider using it to grow their investment portfolio by enrolling in a DRIP; however, this investing technique may not be suitable for all investors. Investors should consult a financial planner and a qualified tax advisor to determine what makes sense for their situation.

Last, it's important for investors to understand the risks associated with investing in dividend-paying stocks, including but not limited to interest-rate sensitivity and the potential for companies to lower payments or stop paying dividends entirely.

How to enroll in a DRIP

To enroll in a DRIP for a new position, log in to your account at schwab.com. Go to the Trade tab at the top. Then, select Stocks & ETFs.

Below, you'll place an order. First, in the Symbol box, type in the company's name or ticker symbol. Then, from the Action menu, select Buy. Once you've made those two selections, you'll see the Reinvest Dividends checkbox; check the box to enroll in the DRIP.

Schwab.com

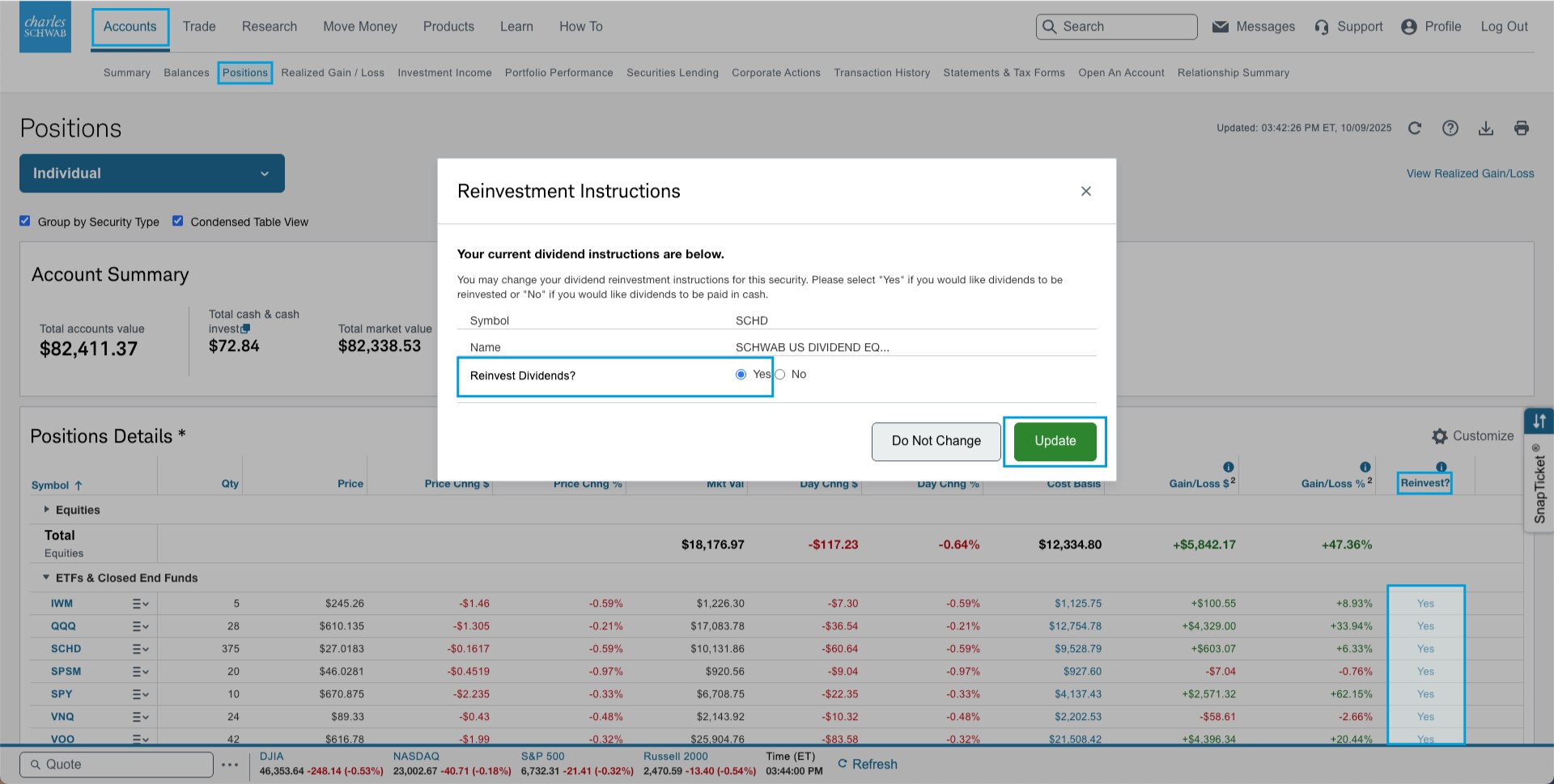

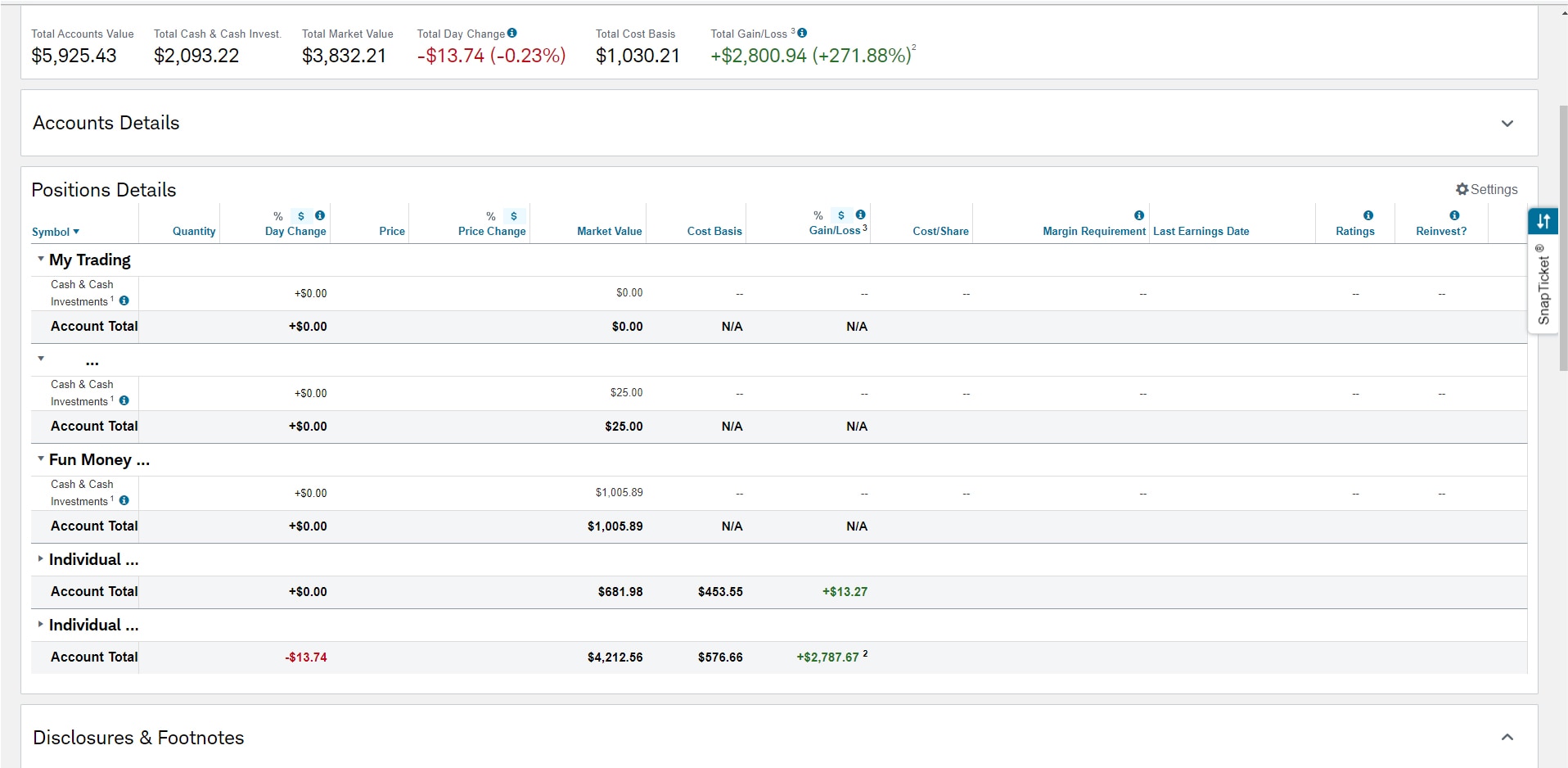

Investors can also set up a DRIP on their current holdings. In the Accounts tab at the top, select Positions. Here, you'll find the Reinvest? column. Find the security you'd like to start a DRIP for and select the link in the Reinvest? column. A pop-up window will appear where you can make your selection. Then, select Update.

Schwab.com