How to Use Advanced Stock Order Types

If you're an experienced trader, one whose strategies have grown toward the more sophisticated side of things, then your trade entries and exits might require a bit of extra nuance. In many cases, basic stock order types can still cover most trade execution needs for experienced traders. In some cases, though, stock orders might require some fine-tuning. Experienced traders can use advanced stock order types to execute nuanced trades more in line with their goals.

When using advanced order types, it's important to understand them in order to match them to the appropriate context and avoid errors that could be risky or costly. Additionally, some order types straddle the "basic" to "advanced" category, so it's a good idea to become familiar with all of them to better understand when to use them and when not to use them.

Generally, advanced order types fall into two categories: conditional orders and durational orders. Conditional means an order is to be filled under specific conditions or the fill will trigger a condition. Durational means an order must take place within a specific time frame, or "time in force."

One-cancels-other order

A one-cancels-other (OCO) order is a conditional order in which two orders are placed and one order is canceled if the other order is filled. For example: A trader buys shares of a stock at $40 per share. If the profit target is 30%, and the trader doesn't want to lose more than 10% of value in the position, an OCO order consisting of a sell limit ("take profit" order) at $52 and a sell stop at $36 can set the parameters of this conditional order. In this case, if the stock's price reaches $52 and the sell limit order executes, the position will close out at a profit and the sell stop will immediately be canceled, removing the risk of inadvertently opening a short position should the stock decline to $36 or below.

Bracket order

Available in most trading platforms designed for active traders, a bracket order immediately places an OCO "take profit" and a stop order after a position is opened.

If a trader enters a long position, a bracket order immediately places an OCO sell limit (take profit) and sell stop. On the other hand, if a trader enters a short position, a bracket order will place an OCO buy limit (take profit) and buy stop.

Stop-limit order

A stop-limit order allows traders to define a price range for execution, specifying the price at which an order should be triggered and the limit price at which the order should be executed. A stop-limit order essentially lets traders buy (sell) at price X (the stop price) but not any higher (lower) than price Y (the limit price).

For example, a trader might be following a stock that's trading at $120. The trader wants to buy when the price reaches $125, but not if it exceeds $130. The stop-limit order creates the conditions of a buy stop at $125 and a buy limit at $130. As a result, the order can be triggered at the lower (specified) price while preventing an execution beyond the set price limit. If the stock opens at a gap beyond $130, the order isn't filled unless the price falls back to $130 or below. For short sale positions, a trader would do the reverse.

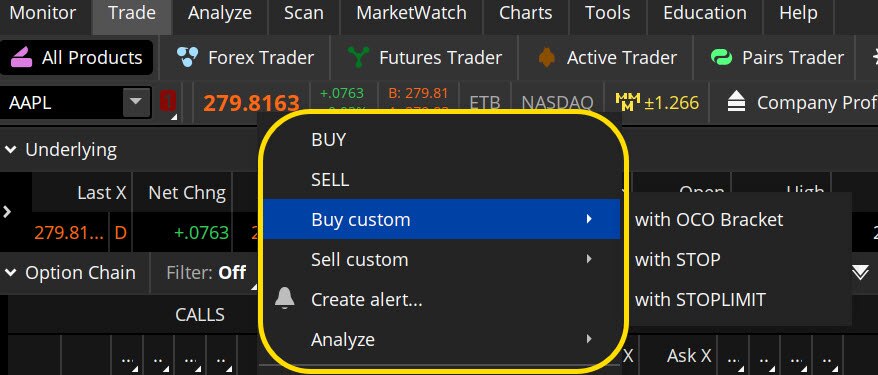

When using the thinkorswim® platform, it's possible to set up brackets with stop and stop-limit orders when placing the initial trade. Under the Trade tab, select a stock, and then select Buy custom (or Sell custom) from the menu (see below).

Bracket orders

Source: thinkorswim platform

For illustrative purposes only.

Good 'til canceled order

Good 'til canceled (GTC) is a durational order that can be used to specify the time in force for other conditional order types. It directs the platform to keep the order active until the trader cancels it. Orders that haven't been filled by the end of the day are usually canceled once the market closes. But a trader can keep a buy order or sell order in place until it's filled or however long the broker will allow it to remain active (typically no more than 90 days) with a GTC order.

Understanding time in force

When placing a conditional order type that involves two or more orders, make sure the time in force (TIF) for each order is identical. For example, an OCO order might not be compatible with a GTC order if that order would be immediately canceled by the OCO.

It's also important to understand TIF in relation to day orders and GTC orders. A day order is canceled at the end of the day, while a GTC order remains active beyond the end of a trading day. Understanding TIF can help reduce the number of positions that counteract each other and that can inadvertently result in negative returns. On the thinkorswim platform, the TIF menu is located to the right of the order type.

Trailing stop order

Trailing stops are not "orders" per se but a means to automatically move or "trail" stops (basic stop orders) that are already in place. Think of the trailing stop as a kind of exit plan.

For example, say a trader purchases stock, sets a stop, and then finds the entire position in the profit zone. The trader has a few choices for modifying the stop:

- Leave it in place.

- Move it up to a "break-even" level to reduce potential losses if the market moves against the trade.

- Set the stop to "trail" a profitable position if it moves higher.

A trailing stop is designed to work as follows:

- Set a trailing stop a specified distance below the current price of the long position.

- If the price of the long position continues to move higher, the trailing stop also moves higher.

- If the price of the long position declines to match the price of the trailing stop, the stop order is triggered, closing your position at the next available market price. Note that the trailing stop price for long positions doesn't adjust lower if the stock price drops.

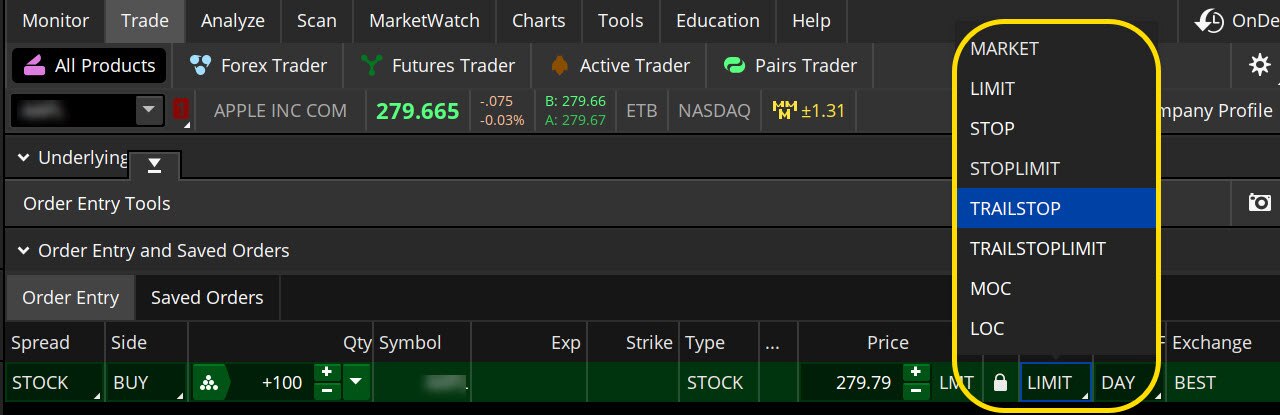

There are many ways to calculate the initial distance used to set a trailing stop. Using the thinkorswim platform, it's possible to pull up an order ticket and select the order type from the menu (see below). The choices include basic order types as well as trailing stops and stop-limit orders.

Order types

Source: thinkorswim platform

For illustrative purposes only.

With a stop-limit order, a trader risks missing the market altogether. In a fast-moving market, it might be possible for the order to trigger at the stop price but then it may not execute at the stop-limit price or better if the stock drops beyond the stop limit price, so a trader might not have the protection they sought. Stop orders and trailing stops will not guarantee an execution at or near the activation price. Once activated, a trailing stop competes with other incoming market orders. Additionally, a limit order doesn't guarantee execution because the position may never reach the set limit price.

Bottom line

Advanced order types can be useful tools for fine-tuning order entries and exits. However, it's important to know what each is designed to accomplish. Consider practicing first in a simulated environment like the paperMoney® stock market simulator on the thinkorswim platform.