How Well Do You Know Market Cap?

Before an investor buys any shares in a company, they should know whether they'd be investing in a giant or a lightweight. Market capitalization provides the answer.

Market capitalization, or market cap, is shorthand for a company's value as measured by the stock market. It matters because investors and the companies who create stock indexes (like S&P Global and CME Group) group companies according to market cap and use it to frame their analyses.

Calculating market capitalization

Market cap represents the value of a publicly traded firm based on the number of stock shares an investor could buy right now on the open market (calculated by multiplying the "free float" by the stock's current price). Here's the formula.

The Financial Industry Regulatory Authority (FINRA), the U.S. financial industry's self-regulatory body overseeing investment broker-dealers, currently categorizes market cap as follows:

- Mega-cap companies have a market value above $200 billion. Think Nvida, Apple, and Tesla—undisputed heavyweights.

- Large-cap companies have a market value between $10 billion and $200 billion. Boeing, Citigroup, and Intel fall into this bucket.

- Mid-cap companies have a market value between $2 billion and $10 billion. Sweetgreen and Warby Parker are two well-known mid-cap companies.

- Small-cap companies have a market value between $250 million and $2 billion. Jet Blue and Kohl's are in this category.

- Micro-cap companies have a market value below $250 million.

"Both professional and individual investors can build their portfolios with market capitalization as a consideration for the goals they want to reach," said Viraj Desai, director of Charles Schwab Investment Management. "Market cap can introduce you to choices that fit your risk appetite, investing time horizon, and market outlook."

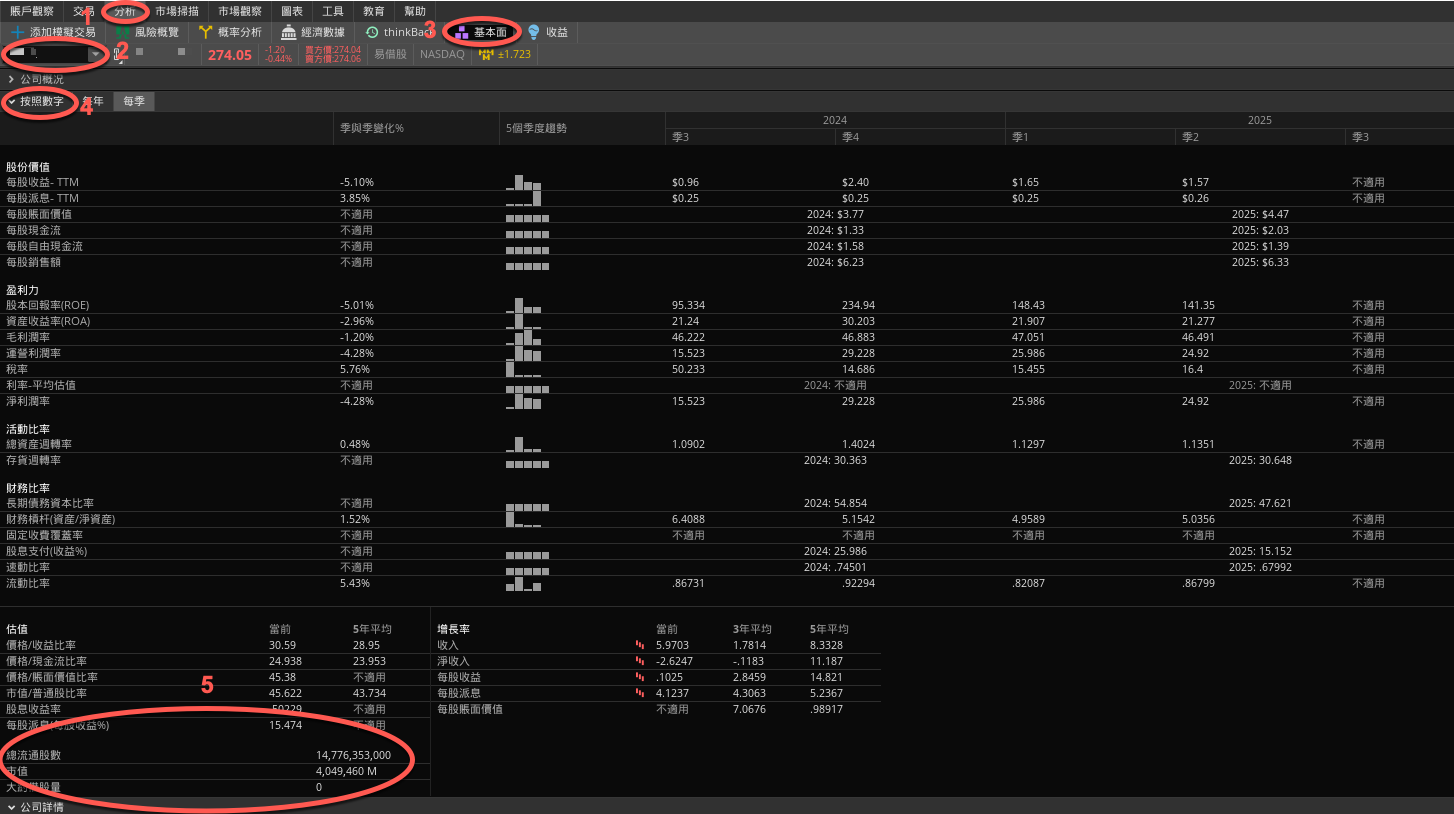

How to find market cap on thinkorswim

The thinkorswim® platform provides a deep dive into company fundamentals. Here are five steps to easily find any stock's real-time market cap:

Step 1: Log in to thinkorswim and select the Analyze tab.

Step 2: Enter a stock symbol.

Step 3: Select Fundamentals.

Step 4: Scroll down to By the Numbers and choose either Annual or Quarterly data.

Step 5: Scroll to Valuation to view Total Shares Outstanding and Market Cap.

來源:thinkorswim 平台

僅用於教育目的。過往表現不保證將來結果。

Using market cap for investment decisions

Any investor—professional or individual—can use market cap to guide broad asset allocation, and diversifying across market caps helps balance risk and growth. Bigger companies' earnings are generally less volatile than those of smaller companies, whose earnings can grow much faster but are also more exposed to economic downturns, often resulting in painful share-price declines. "Small-cap or micro-cap stocks are generally younger firms with relatively short track records that require deeper due diligence to determine their prospects," Desai said.

One approach is the "total market" mutual fund, which contains a mix of small-, medium- and large-cap companies. Other investors may opt to self-select a mix of investments according to personal risk tolerance—for example, focusing mostly on big companies with a small percentage of small caps.

Many active investors shift their allocations according to different economic and market cycles. For example, smaller-cap stocks often "pop" first coming out of a recession, while larger-cap companies tend to perform better late in a bull market as growth slows and costs rise.

"Big moves in market cap get attention, but if you're investing in companies, market cap is just a starting point for what you'll need to know," Desai said. "For example, larger-cap companies generally have a track record of long-term success and stability, so you'd want to watch how companies within that size range are performing as a group and why."

When looking at individual companies, market cap provides a shorthand for evaluating them, with smaller-cap firms typically carrying more risk, he said.

Market cap can often reveal other insights. "If you see a particular manager with a few small-cap holdings in what's supposed to be a large-cap fund, that's what's called 'style drift,' and it is frequently used to generate excess returns," Desai said. "The problem is that too much style drift can violate the fund's objective."

That's why market cap should just be "a starting point" for stock analysis—among the first filters that narrow the universe of assets.

Market cap shapes stock indexes too

Most major stock indexes, such as the S&P 500® index (SPX) or Nasdaq-100® (NDX), require a certain market cap for inclusion and are weighted by float-adjusted market cap. To be included in such an index, a company needs to maintain a market cap that exceeds the index's minimum value and meet other criteria. For example, the minimum market cap for inclusion in the SPX is currently $22.7 billion, according to S&P Global.

However, market-cap-weighted indexes are not the only game in town.

One drawback of market-cap-weighted indexes is that they can be prone to concentration risk, which means an index's performance may be overly influenced by a few large companies. For example, as of September 2025, the so-called Magnificent 7 stocks accounted for about 34% of the total index.

Some investors prefer equal-weight indexes, where each stock is weighted by an equal percentage, so a handful of stocks can't dominate an index's performance. For example, in the S&P 500 Equal Weight Index (SPXEW) each stock, regardless of size, accounts for 0.2% of the index. Given the high concentration in the market-cap-weighted SPX, an allocation to an equal-weighted index can diminish the risk of overconcentration, while allowing investors to still access the companies in the index.

Why investors can't live by market cap alone

Learning new investment tools is important, but all have their limitations. Here are a few to consider when evaluating market cap:

- Market cap reflects only one side of the balance sheet. Market cap tracks equity movements only. Investors also need to understand a range of fundamental metrics, including earnings, earnings growth, and how a firm's outstanding debt and other liabilities affect its prospects.

- Market-cap dominance can foil diversification. We brought up concentration risk earlier—the potential for the largest stocks in any market-cap category to hurt their peers if their news turns bad. When investing in individual companies or funds, it's important to understand market-cap weighting and the impact market-cap leaders could have on a total portfolio. After checking a company's profile information on thinkorswim, consider bookmarking the SEC's EDGAR database to search for the latest company financial information filings.

- Market cap challenges professional investors. Recall that style drift occurs when a fund manager invests in securities that are beyond the manager's mandate, such as adding large-cap investments to a mutual fund or ETF made up primarily of mid-cap stocks. Individual investors run the same risk of being susceptible to style drift. If an investor has laid out a stock allocation plan that incorporates market cap, they need to ensure the percentage of assets allocated doesn't stray too far from the target asset allocation. This may require occasional rebalancing. Also, get to know the concept of tracking error—a measure of difference in returns between a stock or mutual fund and its benchmark. It's a potential indicator of style drift too.

Bottom line

Market cap is a solid starting point for evaluating a potential investment in terms of risk tolerance and growth target objectives. But it's important to dig deeper to get the full picture of a stock's or fund's performance. The thinkorswim platform provides hundreds of studies and data points to help investors and traders do just that.